Introduction

Two very important areas for trustees of not-for-profits (NPOs) to consider thoughtfully are investment policy [on adopting an investment policy, see Kelly Rodgers in (1995), 12 Philanthrop., No. 3, p. 9-12] and the spending rate. The spending rate is a measure that is applied annually to the capital base of the NPO to determine how much money will flow from the capital base to the operating budget of the organization. Two issues must be addressed: how much and how to measure it. A prudent approach will ensure that trustees are not tempted to make short-term decisions during times of financial stress which might have negative long-term repercussions.

This article will discuss different ways to calculate how much “return” should be transferred to the operating budget. Each approach has its benefits and drawbacks and each NPO will probably have a set of circumstances which will suggest one method over another. In the end, however, it is important for trustees to be aware of the alternatives so they can make an informed choice.

Background

A pool of capital invested in marketable securities, the usual situation of an NPO in Canada, produces interest and dividend income as well as capital gains and losses. The capital gains and losses can be either realized through the sale of securities or unrealized. How an NPO views each of these components of return will affect the type of spending rate and its measurement. Further, capital gains and losses are always changing in response to the external financial markets. In the long run, NPOs assume that capital gains will compensate for market variability.

This issue becomes important when, after great deliberation, trustees of an NPO decide to move to a higher-growth investment strategy, by means of equity securities which generate a large portion of their return from capital appreciation. The question then is how to ensure that the NPO operating budget receives the benefits from the higher rate of return which the equities will generate.

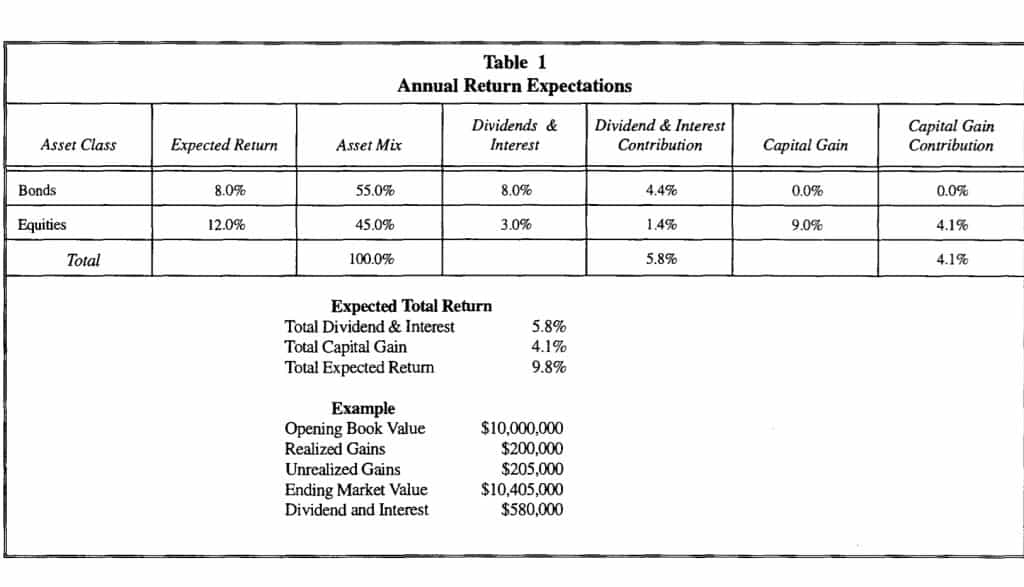

Table I (page 58) illustrates an NPO whose investment policy is 55 per cent bonds and 45 per cent equities. The table shows the expected components of investment return. Interest and dividend return are usually quite predictable and are stable from year-to-year. The variable we are most concerned with is the return coming from capital gains whose timing and magnitude are unpredictable in the short run.

Table I indicates a total return expectation in a reasonable investment environment of 9.8 per cent. Any spending policy should take this into account and, where applicable, factor in cost-of-living adjustments.

A final consideration trustees have is the 4.5 per cent spending rate imposed by the Government of Canada which is necessary for foundations to maintain their non-taxed status. The high threshold this represents today, when five-year bonds are yielding 5.5 per cent, must be the subject for a different article. It is relevant, though, to note that the 4.5 per cent measure is based on market value and is conceptually consistent with calculating a spending rate based on total return vis-a-vis the market value of the fund.

What then are the options for an NPO to plan for, and pay out, this expected return?

Methods

Per Cent of Book Value

One approach is to pay out a percentage of book value, such as eight per cent per annum, or $800,000 per annum in our example. The advantage of this is the transfer of realized gains (and losses), when incurred, into the book value when the proceeds of the realized gains are reinvested in a new security. This in turn systematically increases (or decreases) the annual payout because the eight per cent will be calculated on a rising (or declining) book value. This process eliminates radical swings in the payout to the NPO but still ensures some transfer of the realized capital appreciation to the operating budget.

This calculation does not reflect unrealized gains or losses which are only expressed within the market value of the fund. As well, choosing the payout rate is difficult. If it is too low, the NPO stakeholders may feel penalized, especially if they have pursued a policy with equities which promise higher returns. If the payout is too high, then the NPO may be unwittingly encroaching on capital and at some future time may have to reduce the payout.

Per Cent of Market Value

Another option is to pay out a percentage of market value, e.g., seven per cent per annum. In our example this would equal $700,000 in the first year but $730,000 in the next. This has the advantage of taking unrealized gains and losses into the calculation. Choosing the payout rate is still difficult and it is important that a sufficient margin be maintained between expected returns and the targeted payout.

Both of the foregoing approaches base the spending rate on expected market returns and rates of inflation. These approaches are compatible with a growthoriented investment and asset mix because the spending rate is based on total return and not simply interest and dividend income. Neither approach solves the problem of dealing with those years, although infrequent, when markets produce negative returns and realized or unrealized losses inevitably have an impact on the portfolio.

The Per Cent of Market Value approach is consistent with the Government of Canada’s approach insofar as it has chosen 4.5 per cent of market value as the minimum spending threshold for a foundation which wishes to maintain its non-taxed status.

Cash Returns

The most common approach is that of distributing the interest and dividend income ($580,000 in our example) and, in accordance with Generally Accepted Accounting Principles (GAAP), including realized gains or losses ($200,000 in our example). The total made available for spending would be $780,000. Needless to say, there is great enthusiasm for this approach when there are ample capital gains. In those few years when there are bear markets, the appeal diminishes.

Interest and Dividends Only

This approach is very conservative and, in our example, would provide only $580,000 for spending in the first year. It is attractive in that it leaves both realized and unrealized capital gains in the portfolio. Longer term, by leaving the capital changes within the portfolio, growth is significantly enhanced. This system works well when there is a clear investment and asset mix policy which encourages the investment manager to rebalance out of successful and higher return equities back into higher-income-producing bonds. This process will produce a growing and stable level of income to the NPO, meeting both the current need for income and a stable and growing need for income in years to come. Another benefit of this approach is in those years when returns are negative: there is no material impact on the amount which is transferred to the operating account.

Summary

The least attractive of these methods is the Cash Return as it imposes no discipline on the NPO. Over time there can be a subtle bias towards selling secuntles with gains and retaining those with losses. There can also be a tendency to “take gains” simply to provide operating funds without careful thought given to the long-term repercussions. In time, this approach can significantly weaken the capital base of the NPO.

Current thinking would suggest that the Per Cent of Market Value is the most defensible approach. This approach forces trustees to evaluate potential returns and inflation in light of their spending needs and desire for capital growth. It also means the investment manager is less constrained when making investment decisions.

Each NPO has a unique set of circumstances which dictate investment and spending policies. A thoughtful examination of both investment policy and spending rules will add immeasurable value to an NPO over its lifetime, ensuring complete fulfilment of its social mandate, both now and in the future.

NANCY J. GRANT

Bissett & Associates Investment Management Ltd., Calgary, Alberta