Tim Draimin is fond of saying that while necessity is the mother of innovation, austerity is the mother of necessity. So how is the grandchild, innovation, faring?

Two years ago the Philanthropist published an article entitled On Not Letting a Crisis Go To Waste: An Innovation Agenda for Canada’s Community Sector (Brodhead, 2010). Its central thesis was that the 2008 financial crisis precipitated but was not the cause of the wide-ranging changes buffeting Canada’s charitable or “community” sector. It argued it would therefore be a mistake to adopt a short-term response and hunker down until things returned to “normal,” as many organizations did when faced by federal government cuts in the 1990s. Rather, organizations and the sector as a whole should seize this opportunity to re-think their structures, business models, and goals to confront a new, emerging reality.

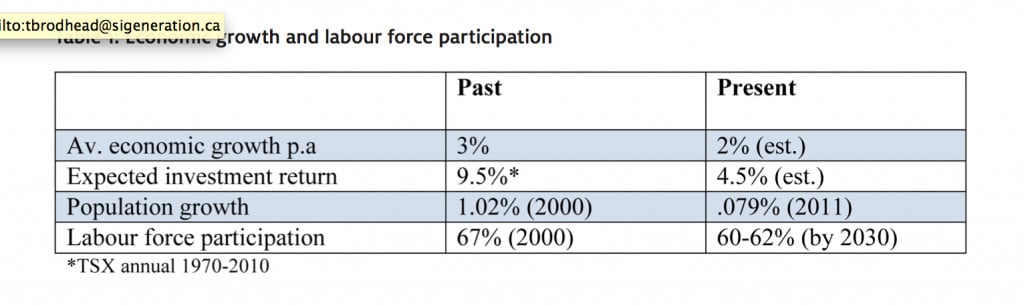

In retrospect it is easier to see that 2008 highlighted a change that was already underway in the global economy as power and wealth shifted from the industrialized world toward emerging economies. This is an inevitable consequence of globalization and heightened competition, compounded by the aging populations and indebtedness of rich countries. The global financial crisis has forced governments to address their recurrent deficits and the growing level of public and private debt. For Canada, which emerged relatively less affected than many OECD countries, the present situation can be summed up in Table 1.

Table 1: Economic growth and labour force participation

Slower economic growth and fewer active workers relative to the overall population produce less tax revenue, while an aging population relies more on public services. A federal policy to shrink government, along with perceived public resistance to tax increases and lower returns on endowments, means reduced revenue, and, particularly for Canadian charities and community organizations that have depended heavily on government, deep cuts in grants and contributions.

Business and foundation granting patterns are changing too, moving toward a more “strategic” approach (though “strategic” in this context can mean anything from simply linking grants to corporate objectives, to having well-thought-out goals and clear paths to achieve them). One result is that window for responsive grants has been closing, which has wide-ranging implications for the autonomy and even viability of many organizations whose programs embody their own on-the-ground experience.

Foundations and corporate donors prefer project funding, with its defined objectives and limited timeframes. Previously, their support could complement and supplement the regular donations and grants of individuals and governments. But when governments cut their funding and also tie it to projects, community organizations are starved for the core funding that maintains their staff and allows them to focus on their own missions rather than opportunistically chase after elusive funding.

Two issues have evolved significantly since 2008: the emergence of social finance—creative ways to diversify and increase funding for charities and non-profits—and the desire to “change the narrative” of the charitable or community sector. Organizations seeking to create public value face two challenges: they lack the access to resources that governments and for-profit businesses enjoy, yet they are expected to solve some of our society’s most daunting problems. This article argues that the greatest assets of charitable and nonprofit organizations, people’s creativity and entrepreneurial spirit, should be freed up and, further, that addressing our complex 21st century problems requires radically new approaches that place a greater emphasis on prevention rather than on remedy.

Social finance—creating value

In Canada, the funding pattern through 50 years of vigorous growth has been a mix of government, philanthropic, and individual grants and donations, the mix varying according to the specific purpose or cause involved. This model, however, has become increasingly unreliable, usually leading to only short-term funding commitments and limited growth—even for highly successful projects and programs.

The well-meaning advice offered by granters and consultants to organizations facing funding challenges has been, “Diversify your fundraising!” In other words, compete harder for the same diminished resources. But there is an alternative: find new resourc—es, in the form of earned revenue; in other words, shift from a “funding” to a “financing” strategy.

Many organizations already generate a portion of their revenues from earned income through the sale of goods and services, membership fees, etc. A recent study by the Mowat Centre concluded that “charities and non-profits rely on three core sources of revenue: government funding, philanthropy and earned income. Of these, only earned income offers any prospect for growth over the long-term” (Mulholland, Mendelsohn, & Shamshiri, 2011, p. 5). According to the study, earned income grew 17 percent from 2005- 2008, a trend that has likely continued (at 32 percent of total charity revenue in 2008, this source is significantly lower in Canada than in some other countries; for example, it is 79 percent in the U.S. (Aptowitzer & Dachlis, 2012, p. 3).

Diversifying revenue streams is one example of the burgeoning field of social finance (defined as “investments designed to produce social or environmental benefits while generating a financial return”). In 2010, inspired by actions taken in the U.K., a Social Finance Task Force was created by the Social Innovation Generation (SIG) group. Its report (Canadian Task Force, 2010) recommended wide-ranging measures to grow a robust social finance marketplace in Canada to meet the needs of charities, community organizations, and social enterprises. Since that report, there has been a remarkable surge of interest in impact investments that blend financial and social or environmental return, creating new pools of capital that can be tapped by community organizations to generate public benefit.

Community foundations, in particular, have been relatively quick to embrace the idea that their contribution to the betterment of their cities need not be limited to their grant programs. The Edmonton Community Foundation led the way with its community loan fund, since emulated by its peers in Hamilton, Ottawa, Vancouver, and elsewhere. Some private foundations are doing likewise, adopting policies that allocate a percentage of their assets for impact investments that blend social/environmental and financial returns (the McConnell Family Foundation, for example, has joined other foundations in setting a 10 percent target in its investment policy, and more recently it created a Social Innovation Fund). Some financial institutions, such as the Royal Bank, have created impact investment funds, and of course credit unions, including Desjardins, Vancity, Assinboine, Mennonite, and Alterna, have long considered a social return as part of their core business strategy. Meanwhile, independent efforts, such as Nora Sobolov’s Community Forward Fund, are beginning to emerge. These are early days, characterized by some skepticism and a mismatch between the availability of capital and the dearth of investment-ready projects. However, a capacity crowd of over 450 participants at the sixth Social Finance Forum held at MaRS in November 2012 attests to the growing interest.

A significant barrier to the growth of impact investing in Canada is the rigid regulatory framework governing charities and not-for-profits. The Mowat Centre, the C.D. Howe Institute (Aptowitzer & Dachis, 2012), and MaRS (Manwaring & Valentine, 2011), as well as the Chantier de l’Economie sociale in Quebec have all proposed ways to promote social enterprise and tap into the entrepreneurial talent in the not-for-profit sector to create public benefit. Internationally, the field has been catalyzed by the Rockefeller Foundation (Jackson & Associates, 2012) and extensively surveyed by the Monitor Institute (2009), among others.

Of course, not all organizations can develop social enterprises, nor should they try.2 Many argue that small businesses often fail and that trying to run an enterprise while staying true to a social mission simply compounds the difficulty and increases the likelihood that neither public nor private benefit will result. Nevertheless, the difficulty, cost, and uncertainty of the usual fundraising approaches will continue to drive people to explore alternatives. The pressure on public finances will make it increasingly attractive to governments at all levels to free up the community sector to become more entrepreneurial.3

The C.D. Howe Institute study recommended a series of measures the Canadian government could adopt to encourage social enterprises, defined as “a business venture, owned or operated by a non-profit organization that sells goods or provides services in the market for the purpose of creating a blended return on investment: financial, social, environmental, and cultural” (Aptowitzer & Dachis, 2012, p. 3). The U.S. and U.K. governments have already acted along these lines by allowing for the creation of Community Interest Corporations (CICs) in the U.K., and Low-Profit Limited Liability Companies (L3Cs) in the U.S., as well as for-profit Certified B Corporations that are growing in number year by year.

There are some signs that the federal government is interested in promoting a more entrepreneurial culture in Canada’s charitable sector. The Canada Revenue Agency (CRA) has given the green light to mission-based and program-related investments by foundations (Corriveau, n.d.) and on July 26 this year issued a new paper, Community Economic Development and Charitable Registration, which for the first time refers explicitly to social finance and social enterprise. In November, Minister Diane Finley announced that her Department was issuing a Call for Concepts to encourage innovative approaches to funding the delivery of government services.

Other jurisdictions have been more positive: Quebec has had for many years a robust économie sociale with dedicated funds like the Fiducie providing capital, while in B.C. the government has created a Social Enterprise Council, which is generating much fresh thinking to promote social innovation through supportive government policies, and has introduced legislation to create a category of Community Contributing Companies (similar to CICs). The Atlantic provinces, especially Nova Scotia, are also exploring the potential of community groups to play a larger role meeting community needs, and Nova Scotia recently introduced legislation to create a hybrid corporate form.

Social entrepreneurship, in all its forms, is proving to be a magnet for young people passionate about tackling environmental and social challenges. However, restrictive rules, increasing competition for funds, and pressure to demonstrate results are leading some to question whether the charity structure is the most effective for achieving their social or environmental goals. Some are choosing to work within a for-profit model. Although this means there will be no preferential tax treatment and they cannot receive funds from registered charities, this is more than offset in their view by the greater flexibility in determining what they will do and their ability to access financing.

In addition to growing available resources, social finance promotes innovation by enlarging the range of financial instruments that can be used by community organizations to realize their goals. Much innovation springs from the potent mix of need, imagination, and improvisation at the grassroots. The financial industry was deregulated in Canada to generate profits for a relative few. It is time, with appropriate safeguards, to let social entrepreneurs use their ingenuity to create profit for the community.

Social impact bonds (SIBs) are the latest example of the search for innovative financing models. SIBs are characterized by their reliance on verifiable results, which determine the return received by the investor. Good stewardship of grants and donations is normally demonstrated by reporting on how the money was spent; but increasingly donors are asking how their money has made a difference. That vague phrase suggests that funds must be used not just to relieve a problem or need, but also to solve it. Annual campaigns with ever-larger targets create a sense that the spiral of tasks seems only to result in more requests to give. When federal HRSDC Minister Diane Finley was quoted in the fall of 2011 as saying that future federal funding would be “performance-based,” focused on outcomes rather than outputs, and that it should lever private money, a tremor went through the sector. Would all charities be required to match government grants and contributions? Who would measure performance and by what standards? If funding was tied to projects, how could essential core costs be met or, indeed, a margin to invest in innovation be achieved?

SIBs are as yet unproven and raise a host of questions relating to measuring and attributing results, and finding private investors willing to put up capital. Other types of bonds, however, are being used successfully, particularly to raise capital for real property. The enduring importance of bond-like instruments is, first, that they signal a fundamental shift toward allocating funding based on outcomes rather than outputs, a trend that is likely to intensify in the future; and, second, that they enable programs to focus on preventing problems rather than simply remedying their symptoms. Organizations that are unable to monitor results or to produce tangible evidence of performance according to agreed criteria would be at an increasing disadvantage in their search for funding. Organizations that convincingly demonstrate they can address underlying causes should be correspondingly rewarded.

The absence of intermediaries still makes social finance relatively labour-intensive and costly, particularly as the scale of financing in the community sector is far smaller than what most investment managers can afford to consider. Building a marketplace will take time and new expertise, and the creation of the Centre for Impact Investing at MaRS is designed to help catalyze this.

While it is premature to talk of the “end of fund-raising” (Saul, 2011), it is possible that in the future two ways of raising money will predominate. One will be opportunistic, episodic, emotional, and unpredictable, responding to humanitarian crises or quirky “human interest” stories. Think of the Facebook phenomenon of three quarters of a million dollars raised for a bullied school bus monitor. The other will be evidence-based and rational. Both approaches will be highly competitive, aimed at, in the former case, finding a novel message with the potential to “go viral”—in the latter, gathering compelling data that demonstrate a clear comparative advantage in delivering the desired results. For both, the doer will be less important than what is being done.

Telling our stories—a “new narrative” ?

A new concern has arisen in the community sector: how to re-frame the “narrative.” In part this is due to the incomplete and even distorted picture conjured up by the word “charity”—in part it is a reaction to evidence that the work done by charities and not-for-profits is neither universally understood nor uncritically applauded.

Successful fundraising usually requires a simple, compelling message. Unlike the market or the state, the community sector relies on people’s voluntary support, their belief that by giving time or money they are helping to create something of public value. The message is deceptively simple: “Blessed is the giver.” All the world’s major religions link charity and righteousness: in Islam, zakat is one of the five pillars of the faith, and in Judaism tzedakah connotes more than charity, it embraces fairness and justice.

Trust is a precious asset, and opinion polls consistently show a high level of public trust in the sector; but it is fragile. A corrosive cynicism regarding most of our institutions has not entirely spared charities. In 2011, a private member’s bill in the House of Commons seeking to impose a ceiling on the salaries of charity staff members revealed a deep well of ignorance that served as a warning that the value of Canada’s 80,000 charities should not be considered self-evident.

While a simple message serves fundraising purposes, it doesn’t necessarily build understanding of the complexity of the work carried out by registered charities. The millions raised by universities and health charities are drawn from the same well that sustains the local food bank and resettlement house. In fact, people’s perceptions of the sector run the gamut from charity (remedial, voluntary, uncontroversial) through volunteerism (participatory, community-building) to change agents (engaging, challenging, often disruptive). Faced with these competing mental images, organizations tend to default to the simplest message to motivate givers and promote their causes, that of charity as non-controversial and altruistic. The message is about need, efficacy, and efficiency: help us help others.

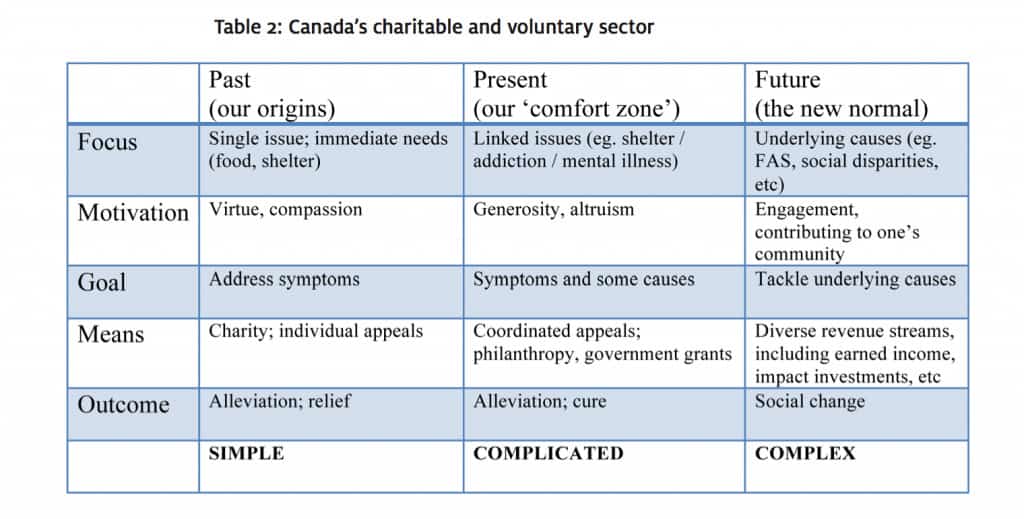

In fact, while maintaining its defining quality of creating benefit for others, the original palliative purpose of charity has evolved to embrace the need to address the root causes of social and other conditions (see Table 2).

Table 2: canada’s charitable and voluntary sector

Ashoka founder Bill Drayton uses the familiar fish analogy to capture the evolution that is illustrated by the above table. Giving someone a fish relieves hunger today; teaching the person to fish will provide sustenance tomorrow (and not create dependence on the giver); but transformative change will only come when we examine the structure of the fishing industry to ensure that all stakeholders have their needs met. All of these are necessary, but without coming to grips with the last, our efforts are fated to be repeated over and over again. Capturing that requires more than a feel-good plea to “Give,” for we live in a world of complexity.

Faced by the need to explain their role (and to articulate more clearly the justification for tax benefits), several groups are now engaged in attempts to create a “new narrative” for the charity and community sector. The most ambitious effort is being made by Imagine Canada following a consultation among its members. At a national conference in November 2011 members asked Imagine to equip them with facts to dispel some of the misunderstandings about remuneration and political activity, but more importantly to articulate a message to explain the sector’s role to Canadians. Imagine is not alone. Governor-General David Johnston’s call for a “smarter, caring” country also focuses on the important role of volunteering and philanthropy, while recognizing that a fresh approach is needed to capture people’s attention and move beyond the anodyne “do-gooder” image of traditional charity.

Crafting a “new narrative” that captures the diversity of the sector today is challenging. The traditional view of charity is deeply embedded in our culture. John Stapleton refers to John Kenneth Galbraith’s explanation of how “conventional wisdom” emerges in society. In Galbraith’s view, it is the ideas that make us feel good that become the most acceptable: “a compelling narrative is comfortable, easy to grasp, and self-esteem enhancing” (Stapleton, 2011, p. 4). Charity, helping needy people, fits the bill; it is easy to understand and when practiced makes us feel good about ourselves.

Adam Kahane (2010) speaks of the two poles of love and power: the former as the drive to wholeness and the latter as the drive to realization. Canada’s charitable sector today epitomizes the tension between the two goals of attending to immediate needs and of simultaneously attacking the causes of those needs. The former calls for empathy and appeals to the heart; the latter calls for engagement and requires the head.

So long as the sector’s “story” is designed principally for fundraising, it will be simplistic and incomplete. Some observers of the international development field likewise argue that the deliberate conflation of “aid” with “development” has sown confusion about the intractable challenges of global development and discouraged the public. Generosity in responding to humanitarian crises is not matched by sustained commitment to eradicating the poverty that makes people vulnerable.

Ian Bird, CEO of Community Foundations of Canada, has called for a new language of sharing to replace that of giving. He argues that traditionally the philanthropic sector has operated within a paradigm of scarcity and the role of charity has been re-distributive, from those who have to those who don’t. If we operate from a concept of abundance, however, philanthropy is less a matter of giving, implying a donor and a recipient (with its hierarchy of status and power), than of sharing. In a sharing mindset, everyone has something to give, and everyone has needs. The task of organized philanthropy is to facilitate the relationships, which make fruitful exchange possible.

Conclusion

As philanthropy has grown in scale and ambition, particularly in the U.S., there has been a tendency to expect it to tackle the big challenges that the state and market are unwilling or unprepared to address: poverty, mental health, youth at risk, reducing vulnerability. In a complex world, it is unrealistic to expect any sector of society to solve such multi-faceted problems alone (let alone climate change or food security); by their very nature, they require a collaborative approach that draws on the strengths, insights, and efforts of people from very different backgrounds, disciplines and skill sets. The community sector has much to contribute, notably the creativity, experience, ingenuity, and resilience of citizens, but those must be combined with the discipline and capital of the private sector and the state’s unique capacity to create incentives, set standards, and even, where necessary, compel acceptance of new rules and behaviours.

The creation of collaborative spaces, often called “change labs,” like the Solutions Lab being launched at MaRS in Toronto, is one effort to combine the talents and insights of diverse stakeholders to “co-create” solutions to intractable social and other problems facing Canadian society. Similar efforts are underway in B.C., with change labs starting up that focus on disability, belonging, and other concerns, and in other provinces. These are modeled on a number of international efforts, in Denmark, Finland, the U.K., and elsewhere, with an evolving methodology that combines system mapping, design thinking and an emphasis on data, user experience, and rapid prototyping of possible solutions. Professional and institutional blinkers must be left at the door; risk-taking and intelligent failure are encouraged.

Another example is the graduate program in social innovation launched in 2011 by the University of Waterloo, which attracts participants from business, governments, and community organizations to learn and apply new tools and concepts in a collaborative approach to tackling complex problems.

It may be that we will look back on the past few decades as an aberration, a time when the community sector was expected to compensate for the shortcomings and distortions of a model of “autistic capitalism” that focused single-mindedly on profit regardless of social or environmental consequences. As businesses begin to see a solid business case in meeting societal needs—through alternative energy production, zero-waste manufacturing methods, human-oriented services, net benefit building technologies, etc.—creating what Michael Porter and Mark Kramer (2011) call “shared value,” the community sector can revert to its indispensable roles as catalyst for connecting and engaging citizens and source of social innovation.

Social finance and a new narrative meet in their common need for data—as the starting point for evidence-based programming and results-based accountability. Sharing and comparing knowledge and experience also helps to break down the zero-sum struggle for resources and the binary donor-recipient relationship: scaling becomes less about growing a single organization and more about sharing and collaborating to achieve impact. To use the Governor-General’s term, the “caring” function of the sector, helping those with needs today, combines with the “smart” role of the sector in preventive action for the future.

The hard reality is that when financial resources are constrained, value is not a function of good intentions, institutional loyalties, or feel-good stories. Real value must be measured, compared, and disseminated. History teaches us that in times of austerity the other resources intrinsic to the community sector flourish: ingenuity, connection, and innovation, often arising in the least expected places. Evidence of that creativity can be seen around the world, in the new structures of social enterprise “hubs” and innovation “labs,” in the passion to combine public benefit and individual enterprise, and in innovative approaches to financing change. Examples abound in Canada too: that is the “new narrative” that is taking form and waiting to be told.

Notes

1. With thanks to Boris Martin, Tim Draimin and Adam Jagelewski for helpful suggestions, and to Beth Haddon for saying, “Cut it by half!”

2. See Don Bourgeois and Bob Wyatt in The Philanthropist, 23(2), 2010

3. For an excellent illustration, see The stop: The capitalist’s guide to feeding the poor, by Jason McBride, in Canadian Business, October 27, 2012.

References

Aptowitzer, Adam, & Dachis, Benjamin. (2012). At the crossroads: New ideas for charity finance in Canada. The C.D. Howe Institute, Commentary, 343. URL: http://www.cdhowe.org/pdf/Commentary_343.pdf [December 18, 2012].

Brodhead, Tim. (2010). On not letting a crisis go to waste: An innovation agenda. The Philanthropist, 23(1). URL: http://www.thephilanthropist.ca/index.php/phil/editor/

submission/813 [February 8, 2013].

Canadian Task Force on Social Finance. (2010) Mobilizing private capital for public good. URL: http://socialfinance.ca/taskforce/report [December 18, 2012].

Corriveau, Stacey. (n.d.). CRA releases new guidance on community economic Development and PRIs. URL: http://socialfinance.ca/blog/post/cra-releases-new-guidance—on-community-economic-development-and-pris (December 18, 2012).

Kahane, Adam. (2010). Power and love: A theory and practice of social change. San Francisco, CA: Berrett-Koehler.

E.T. Jackson and Associates. (2012). Achievements, challenges and what’s next in building the impact investment industry. URL: http://www.rockefellerfoundation.org// uploads/images/fda23ba9-ab7e-4c83-9218-24fdd79289cc.pdf [December 18, 2012].

Kramer, Mark, & Porter, Michael. (January 2011). Creating shared value. Harvard

Business Review.

Manwaring, Susan, & Valentine, Andrew. (2011). Social enterprise in Canada: Structural options, a MaRS white paper. Toronto, ON: MaRS.

Monitor Institute. (2009). Investing for social & environmental impact, a design for catalyzing an emerging industry. URL: http://www.monitorinstitute.com/downloads/ what-we-think/impact-investing/Impact_Investing.pdf [December 18, 2012].

Mulholland, E., Mendelsohn, M., & Shamshiri, N. (2011). Strengthening the third pillar of the Canadian union, an inter-governmental agenda for Canada’s charities and non-profits. URL: http://www.mowatcentre.ca/pdfs/mowatResearch/30.pdf [December 18, 2012].

Saul, Jason. (2011). The end of fund-raising. San Francisco, CA: Jossey-Bass. Stapleton, John. (2011). Turn out the lights. URL: http://openpolicyontario.pbworks.com/w/file/fetch/47772255/Turn%20Out%20Lights%20oct31.pdf [December 18, 2012].

Tim Brodhead, Social Innovation Generation (SIG) Former CEO, The J.W. McConnell Family Foundation. Email: tbrodhead@sigeneration.ca .