Introduction

Many registered charities carry on activities in a decentralized fashion.

These include religious bodies with numerous churches or parishes and organizations with auxiliaries, local chapters and branches (collectively referred to as branches). In these decentralized organizations, the branches may operate with varying degrees of independence from the central body or council. In some situations the branches will actually have the authority to issue “official receipts” for gifts and donations received. This article looks at the practice of administering official receipts in a multi-branch environment and the attendant risks and outlines a framework within which effective controls can be developed.

Branch Independence

By and large, the legal status of a registered charity and its branches takes one of two forms:

Multiple Legal Entities

Multiple-legal-entity organizations have a national name and image but are comprised of branches, each with a separate legal status. While the organization as a whole has common objectives and missions, each branch of the organization, as a separate legal entity, is registered individually with Revenue Canada, and must report separately.

The controls for this form of multi-branch organization are not addressed in this article; however these organizations should also be concerned about the actions of individual branches as the action of any one branch may adversely affect the image of the organization as a whole.

Single Legal Entity

Single-entity organizations are those in which the controlling central council and all branches comprise one legal entity with one set of letters patent and one Revenue Canada registration number. All repot1ing to Revenue Canada is done on a combined basis which includes all branch information.

This article deals only with this second form of multi-branch organization.

The complexity of controlling official receipts within a single legal entity can vary, depending on the degree of management independence in the branches. At one extreme are organizations where the branches arc tightly controlled by the central body and have little or no involvement in handling or controlling cash receipts and disbursements. These can be considered as “dependent” branches and normally do not have separate legal status.

At the other extreme arc organizations in which the branches operate in a semi-autonomous manner. In these situations the branches perform many of the functions of an independent organization, such as maintaining separate bank accounts and financial records, having a separate elected council, and conducting their own activities and programs, with little guidance from the main body of the organization. These can be considered as “independent” branches.

Independent branches by their nature tend to want more, rather than less, control over their operations, including control over the issuing of official receipts for donations. In many organizations with branches this function is currently in the hands of the branches but the question is: do each of the branches within the organization have adequate procedures in place to control official receipts and docs the central council have procedures in place to monitor the branches’ compliance with accepted procedures? This question should be a key concern for all organizations where the branches have traditionally enjoyed a degree of independence.

The central council of a charitable organization docs not have as much influence over a branch as a profit-oriented organization would have over its subsidiaries so the task of imposing additional control procedures on branches where weaknesses exist may require some negotiation and diplomacy. In light of this, the recommended control procedures set out below attempt to be as practical as possible. Thus, in many cases, the recommended control procedures can be established at the central council level only, with minimal impact on the branches. Ultimately though, there may need to be some concessions made at both the central and branch levels.

Legal Requirements for Official Receipts

The legal requirements under which registered charities operate include the Regulations of the Income Tax Act and those other requirements of governing bodies and acts that arc a function of the laws of the jurisdiction under which the organization was formed. Under subsection 92(7) of the

Constitution Act, 1867, the provinces have the exclusive right to regulate charities; however the provinces have tended to leave this regulation to the federal government acting through the Income Tax Act. (Recent moves suggest the provinces are starting to become more involved in the regulation process through their public trustees.)

Currently, the authority to issue official receipts is bestowed by Revenue Canada through the registration of an organization as either a charitable organization, a public foundation, or a private foundation. The Income Tax Act sets out the rules and regulations that registered charities must follow for the administration and issuing of official receipts. The significant sections of the Act are:

Sections 230 and 231 which set out requirements to keep books and records including duplicates of official receipts issued;

Sections 149.1(2), (3), and (4) and 168(1) which provide for the revocation of registration of a registered charity. Just cause can include the issuing of a receipt otherwise than in accordance with the Income Tax Act;

Section 149.1(14) which requires every registered charity to file a Registered Charity Information Return and Public Information Return, within six months of the end of its fiscal period, which includes details of donations received for which official receipts were issued;

Regulation 3501 which sets out the form and content required for an official receipt, including basic information on the gift received. When the donation is other than cash a description of the item donated, and the name and address of the appraiser, if an appraisal is done, must also be included. The signature of a responsible individual authorized by the organization to acknowledge donations is also required. This Regulation also sets out requirements for the retention of receipts and procedures for spoiled or replacement receipts.

Revenue Canada also issues Interpretation Bulletins and Information Circulars which expand on the meaning and interpretation of the Income Tax Act provisions. Several of these, including IT-IIOR and 80-IOR, have sections that provide guidance for the issuing of official receipts. They cover such matters as the definition of gifts to charities for which receipts may be issued for tax purposes, exceptions that arc not eligible, and the tax implications of a donation of services.

Common Problems Encountered

The rules and regulations that a registered charity must follow with respect to official receipts can be complex and when organizations allow branches to issue receipts the potential pitfalls increase.

IT-110R states that “charities arc expected to guard against the unauthorized use of official receipts”. This includes the intentional or unintentional issuing of an official receipt for other than a qualified gift. All charities are expected to meet this requirement, however identifying a gift that is eligible for an official receipt can be a complex process for a lay person who is providing volunteer administrative service to a charity. This can result in receipts being issued by branches for gifts that, on the surface, appear to qualify but which, in fact, arc considered by Revenue Canada not to qualify in part or in whole. Common problem areas include: membership fees, the value of non-cash gifts, amounts received through loose collections, donations of services, amounts paid for admission to fund-raising events, and donations of used clothing and furniture.

Other common problems that can arise in branches arc:

• Loss of unissued receipts or missing duplicates of issued receipts;

• Receipts that arc issued with incomplete information;

• Inconsistency of practice among branches, e.g., some branches may issue receipts for qualifying membership payments while other branches do not;

• Insufficient backup documentation retained to support receipts issued for unusual gifts such as gifts designated for specific purposes or non-cash gifts that require appraisals;

• Branches that decide to print their own receipts.

Fundamental Internal Controls

Whether the branches or the central body issue receipts, the organization must have a working system of internal controls to ensure that all official receipts are used in accordance with the wishes of the governing body of the organization and in accordance with the Regulations of the Income

Tax Act. Internal controls must be in place to ensure that:

• Official receipts arc safeguarded against loss and unauthorized use;

• The issuing of official receipts is properly authorized and executed;

• All official receipts issued, and corresponding donations received, have been properly recorded.

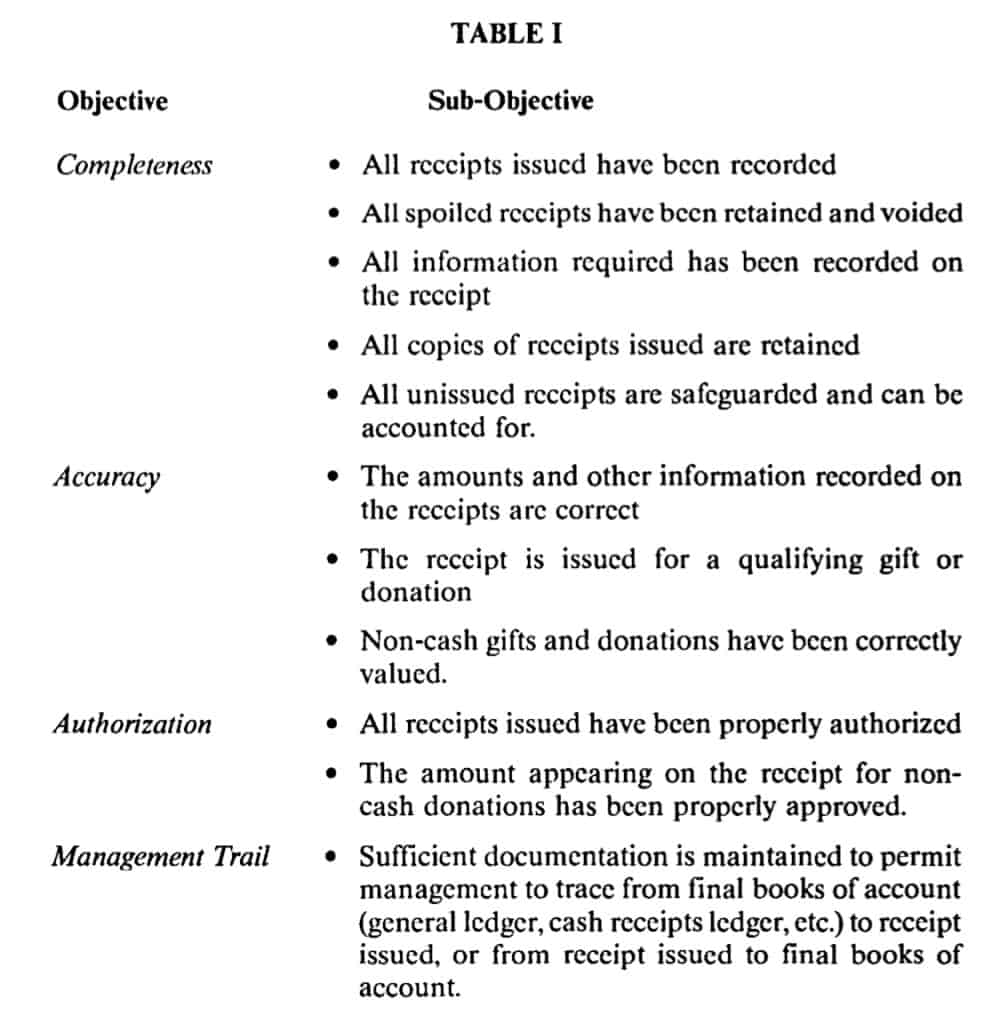

All internal controls should be instituted to achieve one of four objectives: completeness, accuracy, authorization, and a visible management trail. (Table I)

These internal controls can be further subdivided into those controls that

“prevent” errors or discrepancies (such as keeping receipts under lock and key) and those controls that “detect” errors or discrepancies (such as reconciliations and budgets). Preventive controls can be more effective but arc based on the assumption that the control has been continuously in place and well observed. Detective controls on the other hand do not, in themselves, prevent errors or discrepancies, but they do identify instances where preventive or other control procedures arc not followed properly. Ideally, an organization’s system of internal controls should consist of a balanced mix of both preventive and detective controls.

(These control objectives arc not limited to official receipts of course; they apply to all aspects of the financial operations of an organization.)

Applying Internal Controls to Branches These are the basic objectives of internal controls but what are the problems which arise in applying these controls to branches?

There are a number of factors that can stand in the way of internal controls at the branch level:

• lack of full or part-time staff at branches;

• use of volunteers with little or no accounting experience;

• frequent turnover of volunteers and/or staff;

• little or no documentation of procedures and guidelines;

• having several authorized signatories at each branch, a situation which, when multiplied by the number of branches, results in too many individuals being able to issue receipts;

• poor internal controls over cash receipts and disbursements within a branch;

• complex donations being received by branches;

• independent branch fund-raising activities, such as lotteries, that may not qualify for official receipts.

How, then, is a decentralized registered charity to control the issuing of receipts and to gather the information and documentation necessary to file the required reports with Revenue Canada?

One very effective solution is to move the responsibility for issuing official receipts from the branch level to the central council level. Where it is politically and procedurally feasible, this should be done; however in most cases it will not be feasible. In the latter case, the following guidelines and suggestions may offer a less ideal but more practical solution.

Completeness

The control objective of completeness can be managed almost exclusively by the central body of the organization through a simple arrangement whereby it maintains overall control of receipts. Under such a system the central body would order all supplies of blank receipts and would keep such supplies under lock and key. Supplies of unissued receipts would go to each branch to replenish the branch supply only as needed and duplicates of all receipts issued would be received back from the branches. By keeping continuity records of the serial numbers of the unissued receipts forwarded to the branches and of the serial numbers of duplicate issued receipts received back, the organization will be able to account for all official receipts. Then, reviewing the duplicate receipts returned from the branches, the central body can also ensure that all relevant information is recorded on the face of each receipt.

The branches themselves must also have a system that enables them to account for the supply of receipts in their possession, both issued and unissued. Branch procedures should be similar to the central body’s: unissued receipts should be kept under lock and key and a log of receipt numbers received and issued should be maintained. Within a branch the responsibility for receiving and safekeeping blank receipts and reporting back to the central body on issued receipts should be assigned to a specific individual.

One issue that also relates to “completeness” is the “timeliness” of the information received from branches. If branches arc permitted to obtain a large supply of receipts they may not be motivated to send information on issued receipts to the central body as frequently as council desires. One obvious solution is for council to provide only a short-term supply of receipts which will not be replenished until the previous supply has been accounted for.

Responsibility for achieving the other three objectives of accuracy, authorization. and management trail rests principally with the branches although the central body must have a system in place to ensure that the branches are complying with each of these objectives.

Accuracy

Accuracy may be considered the most difficult objective to meet since it requires resolution of issues such as whether a gift or donation qualifies for a receipt and the valuation of non-cash gifts. Achieving this objective requires a continuing educational process for those at the branch level who arc authorized to issue receipts. At a minimum, written guidelines describing the various types of gifts and donations that may be contentious should be provided. (The organization’s auditors can assist in preparing such guidelines.) Depending on the degree of sophistication at the branch level, the organization should also consider adopting a policy that decrees that receipts for all non-cash gifts and donations, i.e., potentially contentious gifts, must be issued by the central body of the organization. A system must be in place to ensure that all newly authorized branch signatories are identified by the central body as quickly as possible, and that these individuals are properly “educated” before they begin to issue receipts.

The central body of the organization should also review duplicates of issued receipts to ensure that the information on the face of the receipt is correct. Another requirement to achieve the objective of accuracy is to ensure the amount recorded on the receipt for cash donations is accurate.This can be a problem when inadequate bookkeeping fails to maintain an accurate record of accumulating individual donations as, for example, in church collections or other situations where receipts arc not issued immediately. Clearly, the first step to achieving accuracy must be an adequate set of books. A further control would compare the total of receipts issued to individuals to the total cash deposited from individuals. The receipts should obviously not exceed the cash received. This method can be used initially by the central body in a rough format and can later be refined to account for non-qualifying cash receipts such as partial proceeds from fund-raising events, grants, and interest on deposits.

Authorization

To meet the control objective of authorization the organization must ensure that the individuals approved to sign receipts arc of a responsible nature and that the actual signatures appcming on the receipts arc those of the authorized individuals. If the branches have good procedures in place to achieve the completeness objective, then the authmization objective is more easily managed. For example, if receipts arc kept under lock and key by a responsible individual, then access to the receipts should only be possible for persons authorized to sign. The central body should have an up-to-date list of those at the branch level who arc authorized to sign, and should have a sample signature on file. As duplicate receipts arc received from the branches, the central body should sample the receipts randomly to ensure that the signature is always that of an authorized person and matches the sample signature.

Some branches which issue a large number of receipts may automate the receipt-signing process by using a machine to imprint facsimile signatures. In these situations procedures should be in place to control access to, and use of, the signature plates, preferably by keeping the plates under lock and key when they arc not in usc. When the plates are in the machine the use of the machine should be controlled and supervised.

Management Trail

An adequate management trail is required to ensure that information on all receipts issued has been collected and properly summarized for reporting to Revenue Canada and to give management the ability to trace from summaries back to individual receipts and from individual receipts to summaries and also to trace donations to bank deposits and account books.

Documents required for an adequate management trail include duplicates of official receipts and banking records such as deposit slips and cash disbursement details. The central body can argue that it should keep the significant branch records and documents for effective control. The branches can argue that they should retain these records and documents in order to carry out their activities effectively. Much more important than the physical location is ensuring that management at both central and branch levels has easy access to the information in these records.

Reporting to Revenue Canada As a registered charity must submit a Registered Charity Information Return and a Public Information Return to Revenue Canada annually, it must have an effective system for gathering and verifying the financial information for the entire legal organization, including branches. This is in addition to a system for administering and controlling official receipts.

Issues related to the gathering and verifying of financial information from branches are not within the scope of this article. However, most organizations should already have some system in place in order to meet the requirement of producing annual audited financial statements and the same system should be suitable for collecting the information required for Revenue Canada.

A review of the gathering and verifying system may be appropriate, and the controls objectives discussed above could provide a framework for such a review.

Conclusions Adequate control of official receipts issued by branches can be achieved but it requires an awareness at the branch level of the rules and regulations governing official receipts and a degree of co-operation between the central body and the branches. The central body, specifically the treasurer, must take the initiative to bring the controls and awareness at the branches up to an acceptable level and to maintain this level on a continuing basis during the rapid turnover that typifies branch organizations. A controls checklist such as the one set out in Appendix B (page 39) may be a useful start for the treasurer who wishes to determine what control objectives are currently being met, which objectives are not being met, and the procedures and techniques that can be used to meet control objectives.

Many of the issues that have been examined in this article are equally applicable to a more general concern of decentralized registered charities: how to ensure that the branches carry out their activities in accordance with the stated objectives of the central organization and within the various rules and regulations of its applicable governing bodies. Part of the solution to this problem may also be found in the controls checklist.

Readers may also find it instructive to study Appendix A, an example of a system that meets the basic control objectives discussed in this article. (The example is based on the procedures of an actual organization, with some modifications.)

APPENDIX A

Workable Arrangements: A Typical System

Background:

• A province-wide incorporated organization with six branches;

• Each branch maintains its own bank accounts and performs its own fund-raising activities;

• Each branch has authorized two or three people to sign official receipts.

Completeness:

• Pre-numbered blank receipts arc maintained by the organization’s executive secretary operating out of the central council offices. Several branches issue receipts using a microcomputer and therefore need printer-adaptable receipts. These arc ordered from the supplier who also supplies regular receipts and a specific block of receipt numbers is assigned to the computerized receipts;

• Supplies of unissued receipts arc kept in a locked filing cabinet. A block of blank receipts is forwarded to each branch as required. This is recorded by the executive secretary in a logbook noting: the serial numbers of the unissued receipts, the date, and the branch the receipts were sent to. Branches maintain a similar logbook to record the receipts received and issued;

• Every one to two months the branches return duplicates of issued receipts and all copies of spoiled receipts to the executive secretary, together with a worksheet detailing the receipt numbers and the total dollar amount of the receipts issued;

• The executive secretary records the returned receipts in the same logbook used to record unissued receipts forwarded to branches, noting the serial numbers received and matching them to those sent out and the date;

• The worksheet and the duplicate receipts are filed numerically by branch by the executive secretary;

• Breaks in the continuity of receipts arc identified by the executive secretary and are followed up with the branch representative until the problem is resolved.

Accuracy:

• Guideline material is provided to each branch for each person who is authorized to sign receipts. This material is in the form of a “branch manual” and is designed to be understandable to lay people;

• The branch manual sets out guidelines for issuing receipts, including items specific to the particular organization such as the nature of membership fees and their eligibility for official receipts, as well as other grey areas such as fund-raising events and non-cash donations. Branches are encouraged to seek guidance on unusual donations from the central council;

• Non-cash donations, identified by the description on the receipts, are brought to the attention of the council treasurer for review.

Authorization:

• Periodically, lists of authorized signatories and their sample signatures are sent by the branches to the central council. These are used for random comparisons by the executive secretary when the duplicates of issued receipts received back from the branches are reviewed;

• Unissued receipts under control of the executive secretary and the authorized branch people arc kept under restricted access, i.e., lock and key.

Management Trail:

• A logbook is maintained by the executive secretary as noted above;

• Duplicate copies of receipts issued are returned by branches to the central council and arc filed numerically by branch;

• A second copy of all receipts issued is retained by the branches for their own records;

• All financial records of the branches are sent to the central body each year end to allow the external audit to be performed and to provide information for the Revenue Canada information returns. At this time the treasurer effects reconciliations between the total of receipts issued by each branch and the cash deposit records.

APPENDIXB Official Receipt Controls Checklist CONTROL OBJECTIVES

Completeness

Are there controls to prevent/detect incomplete recording and processing of receipts?

Check:

• All receipts issued arc recorded

• All spoiled receipts arc retained and voided

• All information required to be recorded on the receipt has been noted

• All copies of receipts issued have been received and arc retained by the main body of the organization ANSWER REFERENCE

Accuracy

• Are there controls to prevent/detect errors in the completion and on issuing of receipts?

Check:

• Amounts and other information recorded on the receipts arc correct

• Non-cash donations arc identified and correctly valued

• Branch personnel arc aware of the special rules for certain amounts received such as those from fund-raising events

CONTROL OBJECTIVES

Authorization

Arc there controls to prevent/detect unauthorized use of receipts?

Check:

• All receipts issued arc properly authorized

• Amounts appearing on receipts for non-cash donations are properly approved

ANSWER REFERENCE

Management Trail

Are there sufficient controls to ensure an adequate management trail?

Check:

• Sufficient documentation is maintained to trace from final books of account to original receipt, or from original receipt to final books of account

DOUGLAS McPHIE

Clarkson Gordon, Chartered Accountants, Toronto