Readers are invited to respond to articles in this section. If appropriate, their views will be published.

Introduction

In justifying the new two-tier tax credit scheme for charitable contributions, Finance Minister Michael Wilson has produced some rather perplexing, as well as anemic, platitudes. According to the Minister the new scheme is fairer than the old method of deductions. He also argues that the tax credit scheme provides a strong incentive for giving, apparently assuming that a decision to act charitably is fundamentally tax-driven and that hitherto uncharitable taxpayers will act charitably with the prospect of financial gains. Furthermore, the “inducement” embodied in the new system is apparently superior to any “inducement”which may have existed when charitable contributions were simply tax-deductible. According to Mr. Wilson, the new system will lead to a dramatic increase in contributions and contributors, particularly among lower- and middle-income earners with the implication that lack of financial means is a constraint on charitable action. It is abundantly evident, as the following pages will show, that these arguments are, at best, illogical and at worst deceptive.

Effects of Tax Reform on Charitable Contributions The tax deduction for charitable contributions was a significant casualty of the 1987 tax reforms. It was replaced by a two-tier tax credit scheme which corresponds with the lowest and highest marginal tax rates, which were also changed. The new combined federal and provincial marginal tax rates are: 26.35 per cent for taxable incomes up to $27,500; 40.30 per cent for taxable incomes from $27,501 to $55,000; and 44.95 per cent for taxable incomes greater than $55,000.2

Individual taxpayers can claim a combined federal and provincial income tax credit of 26.35 per cent on the first $250 contributed to registered charitable organizations and a 44.95 per cent tax credit on the balance of their annual donations, i.e., taxpayers will use the credit to reduce the income tax for which they would otherwise be liable. The general rule for maximum contributions permitted for tax purposes remains 20 per cent of the taxpayer’s net income. Charitable gifts that exceed 20 per cent of net income can be carried forward for up to five years.

Under the previous system of deductions, charitable gifts were deducted from taxable income before the taxpayer’s tax liability was calculated. Under the new two-tier tax credit scheme, however, taxpayers must first calculate their tax liability and then subtract their tax credits from this amount Both the deduction system and the tax credit scheme have the effect of reducing the contributor’s net out-of-pocket cost for acting charitably; however, under a system of deductions, the higher the marginal tax bracket, the less it costs to give. For example, under the former system of deductions and, given the new marginal tax rates, the actual out-of-pocket cost of donating one dollar would really be55 cents for a contributor in the upper tax bracket since45 cents of that dollar would otherwise go to the tax collector.3 The cost to a contributor in the lowest tax bracket of donating one dollar to charity would really be about74 cents. Therefore, the cost to a contributor in the 26.35 per cent marginal tax bracket would be about 34 per cent higher than the cost to a contributor in the 44.95 per cent marginal tax bracket To be precise, when deductibility is permitted, and assuming that the contributor claims the deduction, the net cost to the donor is equal to the product of one minus the donor’s marginal tax rate and the total amount of the contribution.4 Any marginal change in the tax rate causes an equal but opposite marginal change in the cost of giving.

Under the two-tier tax credit system, however, the cost of a dollar contribution is the same for all contributors regardless of their marginal tax brackets, i.e., the cost of acting charitably under this system depends only on the size of the contribution. For the first $250 contributed the out-of-pocket cost per dollar is about74 cents. For contributions over and above this $250 the out-of-pocket cost per dollar is about 55 cents.5

The “Fairness” Assumption

As justification for the two-tier tax credit system, Finance Minister Wilson states, “[t]his will maintain a substantial incentive for charitable giving. At the same time it will increase fairness by basing tax assistance on the amount given, regardless of the income level of the donor”.6 Does “fairness” mean equality, and “assistance” mean that poor contributors can now give amounts equal to those given by rich contributors by getting government grants for charitable donations? While this sounds ridiculous, and indeed it is, it is no more ridiculous than the only concept with which I am familiar which could offer any basis at all for this argument, i.e., that the tax-deduction system is an unfair subsidy which favours the rich over the poor.7

The argument holds that since the poor seldom make large annual contributions, it is the rich who claim most of the charitable deductions and benefit from the “subsidy”. Furthermore, because the rich have higher marginal tax rates than the poor, the “subsidy” to the rich philanthropist is larger than that received by a poor philanthropist.

This argument has been taken so far that some proponents claim that the charitable deduction has permitted the values of the wealthy to control and dominate the entire Third Sector. John G. Simon refers to this as the

“egalitarian dilemma” and the “power-to-the-rich” phenomenon.8 He writes: “the after tax cost of exercising power and influence in the charitable world is cheaper for the rich than for the poor”. Simon further asserts, after conceding “a tax write-off docs not violate the goals or rationales of progressive taxation”, that:

It may still offend the norms of democracy and equity and fairness against which all our legislation must be judged and which transcend the special commands of tax progressivity. Hence, we must consider in these terms a charitable allowance system that permits wealthy citizens to usc taxable income or property to influence the behaviour of others. In other words, we must weight in normative terms the fact that the mechanism that Congress has created for decentralizing into private hands the power to expend taxable resources is a mechanism that is biased in favour of affluent citizens.9

Here we see that the proponents of the “unfair subsidy” view, i.e., the opponents of deductibility, predicate their argument, perhaps unwittingly, on the belief that the government owns all pre-deduction income which is subject to tax. Professor Murray N. Rothbard writes of this:

…the hidden assumption of those who want to eliminate deductibility is that the government is really the just owner of all our income and property, and that allowing us to keep any of it, or any more of it than before, constitutes an illegitimate “subsidy.”10

If we were to accept the notion that the state owns all of our pre-deduction taxable income then we would be faced with some rather frightening implications, in particular, that the only thing permitting private ownership would be the level of taxation. Yet there exists no constitutional limit on the rate of taxation in either the United States or Canada and theoretically the state could impose a 100 per cent tax rate as easily as any other in the right set of circumstances.

Even the Minister’s terminology, e.g., “tax assistance”, implies the belief that the state owns all our pre-deduction taxable income. Reference to tax deductions or tax credits as “assistance” conjure up images of the government, full of the spirit of kindness, giving taxpayers some sort of gift to which they otherwise have no legitimate claim. To be sure, both the tax deduction and the tax credit are tax breaks, but they are certainly not assistance from the state in the same sense that welfare or government grants are assistance.

Furthermore, the term “subsidy” has always referred to the funds that are transferred to one person or group, after being taxed away from, or given away by, another person or group. In this respect, the only “subsidy” germane to our topic is the actual charitable donation. Using the term “subsidy” to describe a tax deduction requires the assumption that some, or all, of a contributor’s donation is a government expenditure which is financed by other taxpayers.11 Professor John Van Til (1988, p. 117) seems to take this view. He writes, “all taxpayers provide a portion of the contribution made by any one taxpayer… the philanthropist’s gift has been matched, unwittingly but as a consequence of public policy and tax law, by every other taxpaying citizen”.

But this approach is not persuasive. The assumption that a tax deduction is a government or social expenditure—a cost to the public treasury-only makes sense if we further assume three things: that the government must collect a certain amount of taxes; that this amount, once chosen, is not subject to change; and that those who pay less than their mandated share impose a cost on their fellow taxpayers who will have to make up the shortfall. It implies that this arbitrary tax-revenue total is so vital that “it must override any devotion to the rights of person and property, to the idea that people are entitled to keep the property they have earned…they [those who claim deductions] are only being ‘subsidized’ in the same sense as when a robber, assaulting someone on the highway, graciously allows his victim to keep bus fare home. How can allowing you to keep more of your own money be called a ‘subsidy’?” (Rothbard, 1985 p.4). On the contrary, with the charitable deduction, as with all deductions, the taxpayer simply suffers less expropriation of his own property by the state; he is not being paid a “subsidy”. The tax deduction can only be a “subsidy” if we abandon the idea of property rights; the two cannot coexist. Yet this would be totally at variance with the norms of democracy as well asCanada’s economic system. It therefore follows that arguments about the fairness or unfairness of tax deductions have no logical basis in our economic and political system. The entire idea is, in effect, a “straw man”.

The fairness question, by pitting poor contributors against wealthy contributors, condemns the discussion of tax policy and its relation to charitable giving to a pointlessly adversariallevel, a convenient device for circumventing the debate which should be occurring, i.e., what is the best policy for increasing total charitable contributions?

Is Charity Really Tax-Driven?

On June 18, 1987 the Minister stated in the House of Commons that “[t]he new tax credit for charitable giving has been designed to provide substantial incentive for donations, particularly for low- and middle-income earners”.

This statement implies that charitable actions (as displayed by donations) are primarily driven by financial incentives and that, somehow, a tax break will induce hitherto uncharitable people to make donations. It also implies that the Minister believes that this “incentive” is greater in a tax credit system than in a deductible system. Furthermore, it assumes that lack of means is a constraint on charity and that if a tax break for charitable giving did not exist many people could not contribute.

As is true with a deductibility system, however, a tax credit for charitable gifts does not create an inducement that somehow attracts new contributors through the prospect of financial gain. The existence of a tax break, whether it be a deduction from taxable income or a tax credit, only reduces the cost of acting charitable, it does not eliminate the cost unless the tax rate is 100 per cent. The taxpayer will always be financially better off if he simply pays the tax on his income and forgoes making any charitable contribution.12

Some economists do argue, however, that with a system of deductibility, reducing marginal tax rates (which increases the cost of giving) will result in a reduction in the total dollar amount of contributions.13 As reform has slightly lowered average marginal tax rates this may be the reason the Minister believes the tax credit better preserves the so-called “financial incentive” than does a deduction system.

This argument is by no means proven. It is true that reducing marginal tax rates increases the out-of-pocket cost of any donation when the tax break for charitable action is a deduction. This, however, is not all it does. There is also an income effect: when marginal tax rates are reduced, after-tax income increases. If we observe some people acting charitably by making donations we can only conclude that acting charitably is a positive element in their respective preference orderings. In line with the theory of demand, it follows that a contributor, assuming his preference ordering is consistent, prefers making more donations to fewer.If marginal tax rates are reduced across the board, all other things being equal, the after-tax incomes of contributors must increase and larger after-tax incomes should mean they have more to be generous with and will, therefore, increase their donations according to their preferences.

If acting charitably is a “superior good” in a contributor’s preference ordering, then the percentage of his or her after-tax income (ATI) that is budgeted for donations will increase as ATI rises. Total nominal donations, therefore, will rise at an increasing rate. Even if this is not the case and we assume that, as ATI increases, the contributors maintain a fixed percentage of ATI for their donations budgets, their total nominal contributions will remain constant, not fall.14

If the Minister’s preference for the tax credit is based on this argument then he needs to reconsider his position. If the deduction system had been maintained, we have every reason to suspect that the slight reduction in average marginal tax rates that resulted from tax reform would either have had no effect on donations, or the number and the size of charitable contributions would have actually incrcased.15

Finance Minister Wilson seems to feel that the new tax credit will make it easier for low- and middle-income earners to make donations to charity, yet neither proponents of the tax credit system nor those who favour deductions can, in fact, make this claim. Choosing to act charitably is not a choice like the choice involved in purchasing ordinary goods and services. For example, ordinary goods or services are not highly divisible. The consumer must purchase an entire unit or service or nothing at all, purchases cannot usually be made in infinitely minute amounts at a cost we are willing or able to accept. Financial means arc, therefore, a constraint on our decision to purchase ordinary goods and services.

When choosing whether or not to act charitably, however, financial means are not a constraint; donations to charity are almost infinitely divisible. People can act charitably by contributing as little as one cent or as much as everything they own. They will still gain the benefits, however they subjectively interpret them, of acting charitably since the act of charity is independent of how much is donated and some contribution, however small, can be included in any budget. The desire to act charitably does not arise from the existence of a tax break and the new tax credit scheme does not somehow make it easier for low- and middle-income earners to do so. Nor does it offer any incentive to taxpayers who have not previously demonstrated a desire to act charitably to do so. Under the circumstances it seems extremely unlikely that the new system will increase the number of active contributions.16

The existence, or nonexistence, of a tax break for charitable giving will, however, affect the size of any contributor’s total donations, i.e, a tax break for charitable contributions will provide an incentive for people who already make charitable donations to contribute more.17 The real question arising from the change to tax credits is not, then, whether the new system will increase donors (it will not) but whether it will increase donations.

Will Tax Credits Really Increase Contributions?

When we consider this claim for the tax credit system serious questions arise.

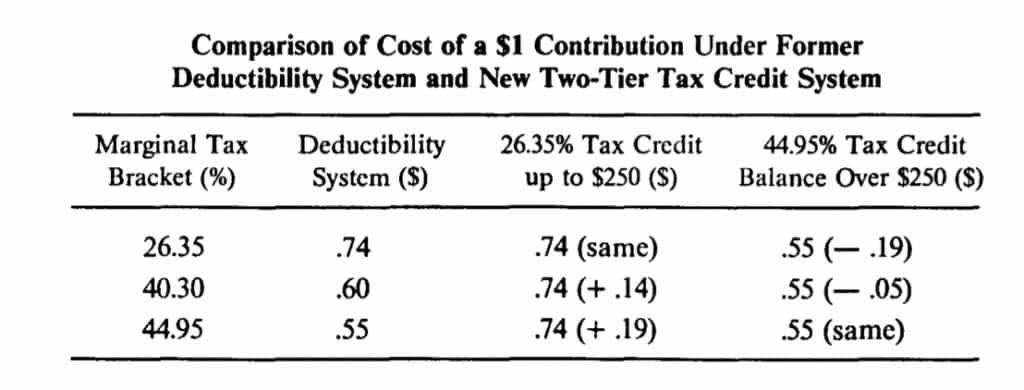

The following table compares the price of a dollar contribution for each marginal tax bracket under the old system of deductibility with the new two-tier tax credit system. (See image)

The two-tier tax credit scheme provides no reduction in the cost of giving, relative to the old tax system, for the first $250 donated by contributors in the lowest marginal tax bracket. It is only for contributions over $250 that the tax credit system provides greater benefits to this bracket, i.e., to taxpayers whose taxable income is $27,000 or less. People in this category,

however, seldom make annual contributions that exceed $250.18 It will therefore be rare for a contributor in this group to benefit from the new two-tier tax credit and any increase in total donations from these contributors will be minimal.

The cost of contributing amounts above $250 is five cents per dollar less than under the tax credit system, as compared with the deduction system,

for contributors in the middle tax bracket. Their first $250 of annual donations, however, will cost them 14 cents per dollar more under the new system. Thus, for all claimed donations up to $1000, the out-of-pocket cost to the contributor is higher with the two-tier tax credit scheme than would be the case with a system of tax deductions.

For example, under a deduction system a contributor in the 40.3-per-cent marginal tax bracket who claimed total donations amounting to $1000 would suffer a net out-of-pocket cost of $597, i.e., $1000 minus $403 in income taxes. Under the new tax credit system, however, there are two costs associated with acting charitably. First is the after-tax income that contributors would retain if they did not make contributions (a cost that must also be considered under the deduction system), but there is an additional cost: the foregone use of the net tax liability, if any, that exists after the tax credit is subtracted from the tax liability associated with that portion of income constituting the gift.

If total claimed contributions amount to $1000, the tax liability associated with that $1000 is $403. The tax credit is also $403. With the two-tier tax credit scheme there is no net tax liability for claimed contributions amounting to $1000 or more. For total claimed contributions less than

$1000, however, the tax credit is smaller than the tax liability, and leaves a positive net tax liability which the contributor must pay. Thus the two-tier tax credit scheme, when compared to the system of deductibility, provides no incentive for contributors in this tax bracket who donate less than $1000 annually to increase their contributions as their total cost of giving is actually higher. Realistically, it follows that their contribution levels will now be lower.

The only contributors in this marginal tax bracket who have an incentive to increase their generosity are those whose annual donations exceed $1000, an unfortunately small number.19 Obviously, any increase in generosity on the part of this small group will, in all probability, be more than offset by the reduced generosity of the large number of taxpayers in their 40.3-per-cent tax bracket who give less than $1000 annually.

For example, a taxpayer in this category who budgets $500 annually (i.e., a net out-of-pocket cost of $500) for charitable contributions would have contributed a total amount of $837.55 under the deductions system. Under the two-tier tax credit system, however, to total claimed donations of $837.55 will be added the foregone use of $507.58.20 In order to remain within the budfteted $500, total contributions must be reduced to slightly less than $824.Ignoring all others in this tax bracket who annually contribute less than $1000, if the above example were true for as few as 15,000 contributors, their reduced generosity alone (a direct result of the change to the two-tier tax credit system) would cost the charitable sector donations amounting to $200,400. It is difficult to imagine, therefore, how the two-tier tax credit scheme can foster greater total annual donations from contributors in the 40.3-per-cent tax bracket Similarly, it is preposterous to argue that the two-tier tax credit scheme provides a greater incentive to give to those in the highest marginal tax bracket since the out-of-pocket cost of giving for these contributors will always be greater with the two-tier tax credit regardless of the amount of the annual contributions.

As in the middle tax bracket, the cost-per-dollar for the first $250 donated is substantially greater under the new system (in this case 19 cents per dollar) than it would be under a deduction system. However, the cost per dollar donated for amounts over and above $250 has not decreased for these contributors as it did for those in the middle bracket People in this category must pay a positive net tax liability for any amount donated. For total contributions of more than $250 the net tax liability is always $46.50.22

This net tax liability is an out-of-pocket cost to the contributor which is over and above the cost of the foregone use of the after-tax income the contributor would have enjoyed had he or she not made the donations, i.e., the only cost which would have been suffered under the old system.

The two-tier tax credit scheme must now be seen for what it is: a lame and poorly conceived concept. It is incomprehensible that the Department of Finance should be asserting that it will increase charitable contributions by $80 million annuallr’ and the Minister’s rationale for imposing the new system (that it will create a greater incentive for charitable giving) is faulty. Few lower- and middle-income contributors will benefit from the changes and we cannot, therefore, expect any significant increases in total contributions from these groups. On the other hand, the “reforms”, far from providing a stimulus to increase charity, have made it slightly more costly for those in higher brackets to donate money and the tax credit scheme has created a distinct disincentive for them to even maintain their traditional contribution levels. It is a real possibility that the new system will result in additional financial hardship for organizations that rely on charitable contributions for their survival.Implications and Consequences for the Third Sector In light of these findings the paramount question is: why would the government want to replace the former system of deductions with a confusing two-tier tax credit scheme?

A number of critics have noted that the Coalition of National Voluntary Organizations (NVO) has lobbied for the last decade to get a tax credit system. The system NVO wants, however, is quite different from the one it got. and it seems unlikely that it will be satisfied with the government’s new scheme. However, although the Minister apparently did not fully accept NVO policy recommendations, he does seem to have acquired some of his misconceptions about tax policy and charitable action from NVO.

In brief, it appears that NVO views charitable action as fundamentally tax-driven. As early as 1978 it was lobbying for, among other things, the elimination of the standard $100 deduction for nonitemized charitable gifts.24 In a 1980 NVO Discussion Paper the organization states “[t]he $100 standard deduction constitutes an incentive to taxpayers not to contribute to charitable organizations.”25 NVO reasoned that since taxpayers did not have to present itemized receipts to claim this deduction they would, therefore, not give to charity, implying that charity is entirely tax-driven.

On the contrary, no tax break, including the standard deduction, induces people to act charitably; people who wish to act charitably will do so with or without a tax break. It is wholly incorrect. however, to suggest that the standard deduction is an incentive not to give. Since it reduces the out-of-pocket costs for those who give less than $100, if anything, it encourages them to give more than they would if the deduction did not exist. The standard deduction can only be interpreted as an incentive not to give if we assume that the decision to act charitable is tax-driven.

NVO combines the belief that charitable action is tax-driven with a belief that the tax deduction is an unfair or inequitable form of tax break. Ian Morrison writes, in reference to deductibility, “[t]he present Income Tax Act has created an inequitable treatment of voluntary gifts and has offered no incentive towards voluntary giving for many Canadians” (1978, p. 1). The 1980 NVO Discussion Paper states “…deductibility provides the greatest incentive to those who need it least..a much smaller proportion of the donations comes from high-income taxpayers who receive very substantial benefits for their contributions” (1980, p. 3).

Nevertheless, whatever their theoretical shortcomings and their ethicsbased preference for a tax credit system, NVO has hit upon a very sound tax policy proposal with two key points: i) replacement of the deductibility system with a 5Q-per-cent tax credit; and ii) allowing taxpayers to retain the option of deducting contributions from their taxable incomes if it is in their best interest to do so (NVO Discussion Paper, May 13, 1980). Since the highest marginal tax rate is now only 44.95 per cent, point two seems unlikely to be implemented but remains, however, an excellent idea since tax rates seem to change with the seasons in Ottawa.

Under current marginal tax rates the NVO tax-credit scheme would be superior to the deduction system. The cost of contributing would be reduced for all contributors and for all amounts contributed and it would, indeed, result in increased contribution revenues for nonprofit organizations. With the exception of the tax credit idea, however, the current two-tier tax credit scheme bears no resemblance to the NVO proposal.

The NVO campaign notwithstanding, we must still wonder why the Minister chose his particular tax credit scheme. An editorial in the Toronto Star of Monday, June 22, 1987 seems prophetic. The editors, reflecting on the scheme’s true casualties, donation-funded charitable organizations, wrote: “[w]ill they have to tum to the government to make up the shortfall? Is that what Wilson wants?”

It is wise to question the motives of the state, especially when the issues are taxation and social services policy. Not only does the two-tier tax credit scheme spell hardship for private social service organizations which rely on private contributions (i.e., those in direct competition with the state’s own social service organizations), it also makes it possible for the state to increase tax rates without a commensurate tax credit increase,26 a situation that point two of the NVO proposal was perhaps designed to protect us against.

Under the old system of deductions the state could not increase taxes without also increasing the tax breaks for charitable contributions. Thus, it was difficult for the state to take over fully the social services sector by raising taxes and crowding out private contributions. Under the tax credit scheme, however, the state can fix the size of the tax break while continually increasing the marginal tax rates.

There is great danger in this. As private social services organizations become increasingly reliant on state funding they also inevitably become increasingly state-directed. In practice, this means that the government dictates to the private aid organization who is in need and who, and how, the organization should help. The state, however, has historically shown itself poorly equipped to determine who is in need and how best to help.27

Furthermore, with greater state control the threat that partisan politics, rather than human and social needs, will govern the distribution of resources, also becomes much greater. When the private sector (both for-profit and not-for-profit enterprises) finances and directs social services, a multitude of competing social goals exists and private citizens have the right to support the goals they favour most highly. Government grants and subsidies, however, are effective tools for ensuring that social services serve narrow political goals. The cost to those in need can be exclusion from assistance. The cost to charitable organizations is a surrender of independence. The cost to the citizenry—the further erosion of the precious freedom to choose—is beyond measure.

FOOTNOTES

1. The author wishes to thank his brother Jordan L. Hughes, John D. Gregory, editor of The Philanthropist, and his colleagues Dr. Graeme Littler and Jeffrey A Tucker for their helpful comments on earlier drafts of this article. Any remaining errors or omissions arc, however, his own.

2. New federal marginal tax rates are 17 per cent, 26 per cent and 29 per cent.

The combined federal and provincial rates are based on the estimation that most provincial marginal income tax rates arc about 55 per cent of the federal rates.

3. The true cost of a deductible donation is the foregone after-tax income the taxpayer would have enjoyed had the contribution not been made. In the absence of this, or any other tax break, the true cost is the full amount of the donation.

4. Example: The real cost to a contributor of $100 who has a marginal tax rate of 40.3 per cent would be:

(l-40.3%) X $100 = $59.70

5. Example: The real cost of a donation of $700 is the same for all taxpayers: ((l-26.35%) X $250) + ((l-44.95%) X $450) = $432.86

6. Tax Reform 1987, a White Paper published June 18, 1987, p. 32

7. For a short review of the arguments both for and against this position see John H. Files (chairman), “Giving in America: Toward a Stronger Voluntary Sector”, Report of the Commission on Private Philanthropy and Public Needs, Washington, 1975. See also John G. Simon, “The Tax Treatment of Nonprofit Organizations: A Review of Federal and State Policies”, in Walter W. Powell (1986), pp. 67-98.

8. John G. Simon, “Charity and Dynasty Under the Federal Tax System”, in Probate Lawyer 5, 1978, pp. l-92. A revised and abridged version appears in Susan Rose-Ackerman, The Economics of Nonprofit Institutions: Studies on Structure and Policy, Yale Studies on Non-Profit Organizations, New York: Oxford University Press, 1986, pp. 246-264.

9. Ibid., Rose-Ackerman, p. 248.

10. Murray N. Rothbard, “Deductibility and Subsidy”, The Free Market, November, 1985, p. 5, Auburn, Alabama: The Ludwig von Mises Institute. See also Murray N. Rothbard. Power and Market, Institute for Humane Studies, Inc., 1977.

11. For a brief critique of the “government expenditure” approach see John G. Simon, footnote 3, supra.

12. See Burton A Weisbrod in Rose-Ackerman, footnote 8, supra, p. 43, n. 33 and Clotfelter and Salamon, 1982, p. 174.

13. They arrive at this conclusion because the elasticity of total giving with respect to net cost is negative, i.e., all other things remaining the same, any increase in the cost of giving at the margin will be accompanied by a marginal decrease in total giving and vice versa. For a survey of some 16 econometric studies whose estimates of this elasticity range from -0.10 to -2.54, see Clotfelter (1985), Table 2.12, pp. 57-59.

14. Example: A contributor’s gross income is $100,000 and he budgets 2 per cent of his ATI for contributions, whatever his ATI.If the contribution is deductible he can give $2000 to charity and remain within his budget whatever the reduction in the tax rate (for simplicity we will assume a single tax rate).

a) In year one the tax rate is 75 per cent so the ATI is $25,000. His budget for donations is therefore $500, however, he can actually give $2000 since each donated dollar costs him only 25 cents.

b) In year two there is tax reform and the tax rate is reduced to 50 per cent.

The ATI rises to $50,000 and the donations budget is therefore $1000. The taxpayer still gives $2000 to remain within his budget since each donated dollar now costs him 50 cents.

c) Should the tax rate go down to even 10 per cent, the donations can remain the same even though the donations budget has become $1800 since the donated dollars now cost 90 cents.

15. Indeed, this seems to have occurred in the United States. Empirical evidence suggest that acting charitably is a “superior good”. In 1980 average marginal tax rates in the United States were 28.5 per cent; by 1987 they had been reduced to 22.8 per cent This reduction has been accompanied by a massive increase in charitable giving. In 1980 charitable donations amounted to 1.78 per cent of GNP; in 1983 they had increased to 1.91 per cent of GNP. All this, despite the fact that the cost of contributing was on the rise.

This is in stark contrast to the 1970s when charitable contributions were declining despite the steadily falling cost of contributing as average tax rates rose. During this period there was a 58 per cent increase in the average marginal tax rate, from 18.0 per cent in 1970 to 28.5 per cent in 1980. The corresponding out-of-pocket cost of contributing each dollar was therefore reduced by approximately 12.75 per cent, from $.82 in 1970 to $.71 in 1980. Contributions, however, fell from 2.07 per cent of GNP to 1.78 per cent of GNP over that same period. See Warren Brookes, “Trying to paint the elephant greedy”, The Washington Times, Thursday, July 14, 1988, p. F2.

16. Theoretically of course there could be a number of taxpayers who would rather give away money at a personal loss than see it go to the government in taxes but it seems unlikely they exist in significant numbers.

17. For example, suppose a person who wishes to act charitably budgets $100 for charitable contributions. If a tax break is not available he or she can only donate $100. If, however, there is a tax break in the form of a deduction and the taxpayer is in the 50 per cent marginal tax bracket then he or she can donate $200 to charity and still remain within the budgeted $100. The same effect is present if the tax break is some kind of tax credit

18. In 1982 the average total contribution by Canadian families who made charitable donations was $200.32 but 71 per cent of the families who made contributions donated $200 or less. The average total contribution of families whose gross income was $25,000 or less was roughly $125. (Calculated from Tables I and II, Harry Kitchen, “Some Evidence on the Distribution of Charitable Donations by Families in Canada”, (1986), 6 Philanthrop. No. 1, pp. 3-33.)

19. In 1982, only about 5.6 per cent of all Canadian families who made contributions donated $1000 or more. Indeed, families whose gross income was between $25,000 and $50,000 and who made charitable contributions, donated an average total amount of approximately $222. (Calculated from Harry Kitchen, 1986.)

20. Under the old system, claimed contributions of $837.55 would have cost the contributor the forgone use of$500 (i.e., if the contribution had not been made, the tax liability would have been 40.3 per cent of $837.55 = $337.53, leaving about $500.02 in ATI).

Under the new system, however, there is an additional cost There is the forgone use of $500 as above and there is also the forgone use of $7.58, the net tax liability. With the two-tier tax credit the contributor first calculates the tax liability and then subtracts the tax credit For a total contribution of $837.55 the tax liability is $337.53. The total tax credit is (26.35% of $250 = $65.89) + (44.95% of$587.55 = $264.10) = $329.97, therefore, the net tax liability is $337.55-$329.97 = $7.58. This $7.58 is paid out of the contributor’s pocket and represents a cost over and above the cost of the forgone use of the $500.

Total cost under the new system is therefore the forgone use of $507.58.

21. If a taxpayer in the 40.3-per-cent marginal tax bracket makes total contributions worth $824, tax liability on this portion of income is $332.07. The taxpayer would have been left with $491.93 had the contribution not been made. The tax credit for $824 is $65.89 + $258.01 = $323.90, and net tax liability is therefore $332.G7—$323.90 = $8.17, therefore, the total out-of-pocket cost of contributing $824 is the foregone use of $491.93 + $8.17 = $500.10.

22. The tax liability on an extra $250 for a person in the 44.95 per cent tax bracket is $112.38 so the cost of contributing $250 under the old system would be

$137.62. Under the new system, however, the tax credit permitted for a $250 donation is only $65.88 which leaves a net tax liability of $46.50. For contributions less than $250 the net tax liability will be some amount less than $46.50. It will, however, always be positive. For total contributions more than $250 the net tax liability will always be $46.50 since the tax credit for donations over and above $250 equals the tax liability.

23. A Department of Finance pamphlet, The New Charitable Donations Credit states, in reference to the tax credit, “(t]he resulting tax savings for Canadians will mean that total federal and provincial tax assistance to charities will increase from some $820 million to about $900 million in 1988”.

It is possible that the result of overall tax reform will be an increase in charitable giving because of the income effect associated with reduced marginal tax rates. This is an unlikely prospect, however, since the reforms have cut off, at best, only five percentage points from average marginal tax rates and the coming changes to the sales tax are expected to eat this up. In any event, even if contributions do increase there will be absolutely no grounds for claiming a causal connection between the tax credit system and the increased generosity of contributors.

24. See “Tax Treatment of Gifts to Voluntary Organizations: Reform of the Income Tax Act” A Proposal To the Government of Canada, March 8, 1978, p.

2. The Proposal was signed by Ian Morrison, Chairman, Committee of

National Voluntary Organizations.

25 Committee of National Voluntary Organizations, “Give and Take: A Tax

Incentive For Charitable Giving”, Discussion Paper, Ottawa, May 13, 1980.

26. M.L. Dickson and Laurence C. Murray, “Proposed Tax Reform Affects

Individual Donors,” (1987), 7 Philanthrop. No. l, pp. 42-43.

27. John C. Goodman and Michael D. Stroup, Privatizing 111e Welfare State, Dallas, Texas: National Center for Policy Analysis, Policy Report #123, June, 1986, pp. 31-33.

BIBLIOGRAPHY

Boskin, Michael J. and Feldstein, Martin. “Effects of Charitable Deduction on Contributions by Low And Middle Income Households”. Review of Economics and Statistics. Vol. 59, 1976, pp. 351-354.

Brookes, Warren. ”Trying to paint the elephant greedy”. The Washington Times,

Thursday, July 14, 1988, p. F2.

Clotfelter, Charles and Feldstein, Martin. ”Tax Incentives and Charitable Contributions: Part 2—The Impact on Religious, Educational and Other Organizations”. National Tax Journal, 28:209-226 (1975).

Clotfelter, Charles and Feldstein, Martin. ”Tax Incentives And Charitable Contributions In the United States: A Microeconometric Analysis”. Journal of Public Economics, Vol. 5, 1976, pp. l-26.

Clotfelter, Charles T. ”Tax Incentives And Charitable Giving: Evidence From A Panel Of Taxpayers”. Journal of Public Economics, 1980, pp. 319-340.

Clotfelter, Charles T. and C. Eugene Steuerle.”Charitable Contribution”. In Henry Aaron and Joseph Pechman (eds.), How Taxes Affect Economic Behaviour, Washington: Brookings Institution, 1981, pp. 403-466.

Clotfelter, Charles T. and Salmon, M. Lester. ”The Impact of the 1981 Tax Act on Individual Charitable Giving”, National Tax Journal, 35:171-187 (1982).

Clotfelter, Charles T. Federal Tax Policy and Charitable Giving. Chicago: University of Chicago Press, 1985.

Feldstein, Martin. ”The Income Tax and Charitable Contributions: Part l —Aggregate and Distributional Effects”, National Tax Journal, 28: 81-l 00 (1975).

Feldstein, Martin and Taylor, Amy. “The Income Tax And Charitable Contributions”, Econometrica. 44:1201-1222 (1976).

Feldstein, Martin and Lindsey, Lawrence. “Simulating Nonlinear Tax Rules and Nonstandard Behaviour: An Application to Tax Treatment of Charitable Contributions”, Working Paper No. 682. National Bureau of Economic Research, May 1981.

Heald, Morrell. The Social Responsibilities of Business: Company and Community,

1900-1960. Cleveland: Case Western Reserve University, 1970.

Morgan, James N., Dye, Richard F., and Hybels, Judith H. “Results From Two National Surveys of Philanthropic Activity”, Commission on Private Philanthropy and Public Needs, Research Papers, Vol. l. Washington: Department of the Treasury, 1977, pp. 157-323.

Powell, Walter W., ed. The Nonprofit Sector: A Research Handbook. Yale University

Press, 1987.

Rothbard, Murray N. Power and Market. Institute for Humane Studies, Inc. 1977. Rothbard, Murray N. “The Myth of Neutral Taxation”, Cato Journal. Vol. l, No.

2 (Fall 1981).

Rothbard, Murray N. “Deductibility and Subsidy”, 111e Free Market, November,

1985, p. 4. Auburn, Alabama: The Ludwig von Mises Institute.

Rose-Ackerman, Susan, ed. The Economics of Nonprofit Institutions: Studies in Structure and Policy. Yale Studies on Nonprofit Organizations. New York: Oxford University Press, 1986.

Simon, John G. “Charity and Dynasty Under the Federal Tax System”, Probate

Lawyer, 5:1-92 (1978).

Schwartz, Robert A “Personal Philanthropic Contributions”, Journal of Political

Economy. 78:1264-91 (1970).

Taussig, Michael K. “Economic Aspects of the Personal Income Tax Treatment of Charitable Contributions”, National Tax Journal, 20:l-19 (1967).

MARK D. HUGHES1

Academic Coordinator, Lawrence Fertig Center, Ludwig von Mises Institute, Fairfax, Virginia