Introduction

Readers of The Philanthropist will recall a 1993 article by Blake Bromley of Vancouver, entitled “Parallel Foundations and Crown Foundations”.! Mr. Bromley was instrumental in the establishment of Crown agency foundations in British Columbia and described their creation and many of the issues surrounding their implementation.

This article, developed from a paper presented to the Canadian Association of Gift Planners Conference in April, 1994, will show the evolution of the legislation establishing Crown agency foundations across the country and discuss some of the issues raised at the Conference.2

Definition of a Crown Agent

A Crown agent can be created by a specific document that creates an agent, a statute that deems an entity to be an agent, or the common law.3

Traditionally, most of the organizations which are agents of the Crown have relied on a province for a significant part of their funding. Agents of the Crown are creatures of their provincial governments. Pursuant to the provisions of the Income Tax Act, agents of the Crown are able to provide donors with special tax treatments for their gifts.

Taxation of Charitable Gifts

Donations to registered charities and other entities listed in the Income

Tax Act

Section 118.1 (1) of the Income Tax Act allows an individual to claim a tax credit for charitable gifts, Crown gifts, and cultural gifts made during a taxation year. These gifts qualify for tax credits at specified rates and serve to reduce income tax payable. If sufficient tax credits exist from charitable gifts and gifts to the Crown, the taxpayer’s entire tax payable could be eliminated.

The maximum amount that an individual may claim for charitable gifts is 20 per cent of his or her income for the year. To be claimed, the gift must be made to a registered charity, a registered Canadian amateur athletic association, certain housing corporations, a Canadian municipality, the United Nations or its agencies, prescribed universities outside Canada and certain organizations outside Canada to which the government of Canada has made a gift.

Donations to Her Majesty in right of Canada or a province

An individual who makes a “Crown gift” or a gift to Her Majesty in right of Canada or a province (including the territories) may claim a tax credit against up to I 00 per cent of his or her income for the year. (Agents of Her Majesty in right of Canada are primarily federal institutions such as national museums or public archives.)

Agents of Her Majesty in right of a province traditionally have been provincial galleries, museums and public archives. With the advent of new legislation in many provinces, new foundations for universities, colleges and other educational institutions, hospitals and museums have been created. These foundations are designated agents of the Crown in right of the province and accordingly, allow donors to the foundation to claim a tax credit against up to I 00 per cent of their incomes.

Donations of certified cultural gifts

Individuals who donate objects which have been certified as cultural property (pursuant to the Cultural Property Export and Import Act4) to a designated institution receive tax credits based on donations of up to 100 per cent of income.

Inter vivos and testamentary gifts

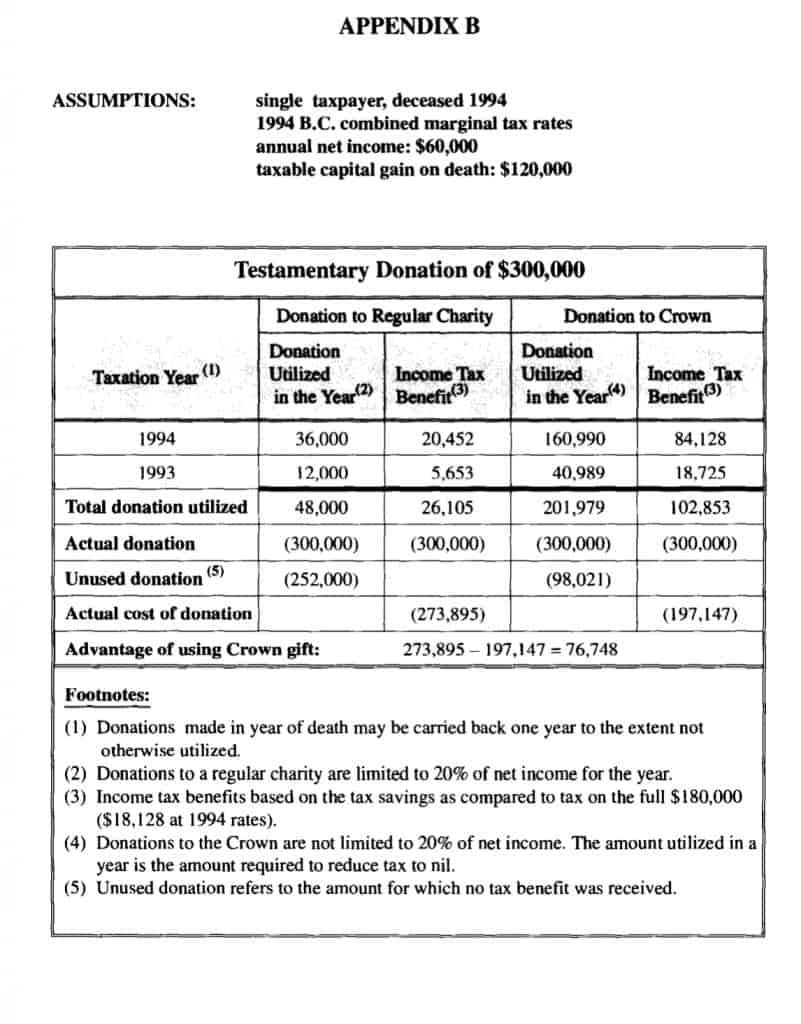

Any unused credits resulting from an inter vivos gift can be carried forward for five years during the lifetime of the donor.

Any unused credits resulting from a gift on death can be carried back one year. These provisions apply whether the gift is a charitable gift, a Crown gift or a cultural gift as defined in Section 118.1 (1) of the Income Tax Act.

The Creation of Crown Agency Foundations British Columbia

The Government of the Province of British Columbia has enacted legislation to create Crown agency foundations to benefit universities, colleges and institutes, hospitals and cultural activities.

Hospitals

In November, 1989, Part 3 of the Hospital ActS was amended to create the Hospitals Foundation of British Columbia as an agent of the Crown in right of British Columbia. The governing bylaws of the foundation were approved on October 24, 1991 and active operations commenced on that date.

The purposes of the Foundation are:

(i) to develop, foster and encourage public knowledge and awareness of hospitals and of the benefits to the people of the province in connection with the work of hospitals;

(ii) to encourage, facilitate and carry out programs and activities that will directly or indirectly increase the financial support of, or confer a benefit on, the Foundation to be used for the support of hospitals and for programs in which hospitals are involved;

(iii) to receive, manage and invest funds and property of every nature and kind from any source for the establishment, operation and maintenance of the Foundation and to further the purposes of the Foundation.

Over 100 hospitals are eligible to receive grants from the Hospitals Foundation of British Columbia, as well as several extended care facilities, diagnostic and treatment centres, Red Cross nursing stations and two federal hospitals.

The board consists of six members appointed by the Lieutenant Governor in Council (LGIC) and five members appointed by the LGIC from a list of not less than 10 persons nominated by the British Columbia Health Association.

The board has the power to establish bylaws but, with the exception of bylaws regulating its own procedure, all bylaws require the approval of the LGIC. The board has, by way of such bylaws and resolutions, begun to establish policies and procedures to further the purposes of the Foundation.

The bylaws cover myriad areas including membership of the Foundation (restricted to those persons appointed to the board), term of office for the directors, proceedings of the board, conduct of meetings, appointment of patrons, advisory councils and auditors, duties of officers, the fiscal year end, holding of the annual general meeting, preparation of the annual report to the Minister of Health, and other administrative functions.

In regulating its own procedure, the board is entitled to take such steps as it deems necessary to enable the Foundation to receive gifts, described as “gifts, donations, bequests, devises, property, trusts, contracts, agreements and benefits”, to further the purposes of the Foundation.

The board has sole discretion to accept or refuse any gift. The exercise of such discretion is usually related to the fair market value of the gift. At present, the Foundation will not accept a gift with a fair market value of less than $5,000. The board is otherwise required to be governed by the provisions of any gift with regard to the use and distribution of funds and property available in any one year. The gift may be designated by the donor for the benefit of a particular hospital or other eligible institution.

To govern the receipt and distribution of funds, the board has adopted the policy that

… where funds or property are donated to the Foundation with a request from the donor that the funds or property be used for the benefit of a particular hospital, such funds or property and any interest or income which accrues to those funds or property shall be held by the Foundation and upon receipt by the Foundation of a grant request letter in the standard form adopted by the Board, such funds or property and any interest or income which accrues to those funds or property, net of costs incurred and such handling fees as may from time to time be levied by the Board, shall be distributed to the hospital which the donor has directed.

Subject to a contrary intent expressed in a gift, the board is not limited to investments prescribed in the Trustee Act6and may make investments that a prudent person would make.

Universities

In 1987, the government of British Columbia enacted the University Foundations Act.7 This Act created three agents of the Crown in right of British Columbia: the University of British Columbia Foundation, Simon Fraser University Foundation and the Foundation for the University of Victoria. The University of Northern British Columbia Foundation was created in 1990 after the University of Northern British Columbia was established.

Similar to the Hospitals Foundation of British Columbia, the purposes of each of the foundations are to develop, foster and encourage public knowledge and awareness of the relevant university and the benefits to the people of the province in connection with that university. The other two purposes set out in the legislation creating the Hospitals Foundation of British Columbia are also included in the legislation creating the university foundations with the substitution of “the relevant university” for “hospitals”.

The board of each foundation is composed of five members, three appointed directly by the LGIC and two appointed by the LGIC from a list of five members of the board of governors of the relevant university nominated by that board of governors. The board may, by bylaw, determine its own procedure; otherwise all bylaws must be approved by the LGIC.

Like the Hospitals Foundation of British Columbia, the boards of the university foundations are not restricted solely to trustee-authorized investments, but may make investments that a prudent person would make, subject to a contrary intent expressed in the gift.

As mentioned in Blake Bromley’s article,8 the legislation permits the operation of the university foundations with minimal interference from the governmentappointed board with respect to the terms of the gift imposed by the donor or the university. Any conditions which are imposed by the donor at the time of the gift will continue and will be imposed on both the university and the Foundation. Further, any capital which is transferred to the university Foundation may be transferred back to the university from which it was received.

Colleges and Institutes

The various colleges and provincial institutes in British Columbia are agents of the Crown in right of British Columbia pursuant to the provisions of the College and Institute Act.9

The board consists of five or more members appointed by the LGIC. The board has the power to administer funds, grants, fees, endowments and other assets of the institution, but is limited to trustee-authorized investments or those authorized by the LGIC.

Effective April I, 1986, the British Columbia Institute of Technology became an agent of the Crown in right of British Columbia pursuant to the provisions of the Institute of Technology Act.10

Cultural Organizations

In July 1993 the Cultural Foundation of British Columbia Act was enacted. II When proclaimed, this legislation will establish the Cultural Foundation of British Columbia as an agent of the Crown in right of British Columbia.

The board will consist of a prescribed number of members appointed by the LGIC for a term of three years. The board, by bylaw, may determine its own procedures; all other bylaws require the approval of the LGIC.

The purposes of this foundation are to develop, foster and encourage cultural activities; to encourage, facilitate and carry out programs and activities that will directly or indirectly increase the financial support of the Foundation to be used for the support of cultural activities in the province; and to receive and manage funds and property for the establishment of the Foundation and to further the purposes of the Foundation.

The Cultural Foundation of British Columbia must refuse a gift if it would not further the purposes of the Foundation. If the terms of the gift imposed by the donor are no longer in the best interest of the Foundation, the board may make an application to the Supreme Court of British Columbia for an order varying the terms of gift. The Court must consider the intent of the donor and determine what will best further that intent and the best interests of the Foundation. Pursuant to the provisions of the legislation, the funds or property may only be distributed by the board of the Foundation if the board is satisfied that, first, the recipient is a municipality or a not-for-profit organization and second, the recipient will use the funds or property for the purposes of supporting a public art gallery, a public museum or the performing, visual, literary or media arts.

The recipient must also have received funding from the government in the immediately preceding fiscal year and be receiving funding from the government in the current year for one of the stated purposes.

Subject to a contrary intent expressed in the gift, the board is entitled to invest as a prudent person would and is not limited to trustee-authorized investments.

Donors to museums and galleries can also benefit from a 100 per cent tax credit for gifts of cultural property pursuant to the Cultural Property Export and Import Act.12

Heritage

In 1978, the Heritage Conservation Ac3was enacted to promote heritage conservation in British Columbia. Pursuant to the legislation, the B.C. Heritage Trust was created as both a Crown corporation and an agent of the Crown in right of British Columbia.

In 1992, the B.C. Heritage Trust created the Legacy Program to encourage gifts in support of the purposes of the Trust, that is, to support all aspects of heritage, including language, culture and properties. Gifts to the Legacy Program are treated as gifts to the Crown.

Alberta

Universities

In December 1991 the government of Alberta enacted the Universities Foundations Act.14 This legislation permitted the establishment of a foundation for each of the universities in Alberta. Pursuant to the Regulations, 15 the Athabasca University Foundation, the University of Alberta 1991 Foundation, the University of Calgary Foundation and the University of Lethbridge Foundation were established.

The legislation was later amended in September 1992 by the Universities Foundations Amendment Act 199216 to provide for the establishment of foundations for the Banff Centre, public colleges and technical institutes in the province. Pursuant to the Universities Foundations Amendment Act 1992, the title of the legislation was repealed and changed to the Advanced Education Foundations Act.17

Each Foundation is an agent of the Crown in right of Alberta. The purposes of the Foundation are to receive gifts of real and personal property, including money, and to provide grants and real and personal property to the organization for which it was established to support and promote the educational or research activities of that organization.

The board consists of five members appointed by the LGIC, with at least two members coming from a list submitted by the appropriate institution. The board of a particular foundation may make bylaws respecting the criteria for grants and governing the administration of the Foundation’s fund. The bylaws must be approved by the Minister of Advanced Education.

The Foundation’s “fund” consists of all money received by the Foundation from any source and includes the income as it accrues. All expenditures and grants made by a foundation must be paid from the fund. The Universities Foundations Act 1 8 provided that the Foundation may consider the general directions of the person who has made the gift to the Foundation. The Universities Foundations Amendment Act 1992 19 later repealed this provision and substituted the following section:

When providing grants or real or personal property to an advanced education institution, a foundation may consider the directions of persons who have made gifts to the foundation, including that a particular advanced education institution is to benefit from the gift, but a foundation is not bound by the directions.

Donors may be concerned that such a provision could lead to government interference in the terms of a gift through the government-appointed board.

The board may only invest in securities issued by, or guaranteed as to principal and interest by, the Province of Alberta or any other province or by Canada; or in instruments issued by, or guaranteed as to principal and interest by, a bank, credit union, loan corporation, treasury branch, trust corporation or insurance company authorized to carry on business in Alberta.

Private Colleges and Universities

Negotiations are under way to confer agent-of-the-Crown status on private colleges and universities in Alberta.

Hospitals

A request has been made to the Minister of Health for Alberta to grant agent-ofthe-Crown status to Alberta health care institutions (primarily hospitals and auxiliary care programs). At the time of writing, no response had been made by the Minister.

Saskatchewan

Universities

Legislation was passed in May 1994 in the province of Saskatchewan granting Crown agency status to the foundations which support the universities in that province. It was anticipated that the legislation would be proclaimed in the fall of 1994.

The legislation, known as the Crown Foundations Act,20establishes a Foundation for The University of Regina and a Foundation for The University of Saskatchewan.

Once created, the foundations will be agents of the Crown in right of Saskatchewan. Their purposes will be to promote contributions to the Foundation; to receive gifts of real and personal property, including money, and to provide grants and transfers of real and personal property to the university to which the Foundation relates for the purpose of supporting and promoting the educational or research activities of that university.

The board of each Foundation will consist of five members appointed by the LGIC. At least two of the members must be appointed from a list of persons nominated by the university to which the Foundation relates. The board may make bylaws governing its procedures; respecting the criteria on which grants and transfers of real and personal property may be provided to the appropriate university; and governing the administration of the Foundation’s assets.

When providing grants or transfers of real or personal property to a university, the Foundation shall consider the directions of the person making the gift but, as in the legislation in Alberta, is not bound by those directions.

The board is restricted to investing in securities authorized for investment of moneys in the general revenue fund pursuant to the Financial Administration Act, 1993.

Hospitals

The Standing Committee of Base Hospitals in Regina and Saskatoon has been actively lobbying the Government of Saskatchewan to grant agent-of-the-Crown status to a foundation to support hospitals. The intention is to establish a single foundation model similar to the Hospitals Foundation of British Columbia.

Manitoba

Educational/Hospital/Museum Institutions

The government of Manitoba has enacted legislation to grant agent-of-the-Crown status to several organizations funded primarily by the Government. In November 1993 The Manitoba Foundation Act21 was proclaimed. Pursuant to this legislation, The Manitoba Foundation was established in relation to the institutions defined in the Act, namely:

i) Educational Institution-The University of Manitoba or a university in Manitoba established under The Universities Establishment Act, a college in Manitoba formally affiliated with The University of Manitoba or a university in Manitoba established under The Universities Establishment Act, or a college in Manitoba established under The Colleges Act, that is funded primarily by the Government of Manitoba; ii) Hospital Institution- a hospital in Manitoba as defined by The Hospitals Act that is funded primarily by the Government of Manitoba;

iii) Museum Institution—the Manitoba Museum of Man and Nature or a museum in Manitoba funded primarily by the Government of Manitoba.

Unlike most other provincial legislation which mandates the individual institutions to create their own foundations which, in turn, are given Crown-agent status, this legislation creates The Manitoba Foundation which acts for the benefit of each of the institutions designated in the regulations set out in the Act.

The purposes of The Manitoba Foundation are to receive gifts of real and personal property, including money, and to make grants of money and transfers of real and personal property to support the programs and activities of the institutions. The Manitoba Foundation maintains a fund of all money and real and personal property received from any source and adds to this fund the income earned from the management of the fund. All grants and transfers, plus all administrative expenses of the Foundation, are paid from this fund.

The board is to be composed of not less than three members and not more than 13 members appointed by the LGIC. The board shall, at all times, consist of a majority of members appointed directly by the LGIC but may include two members in respect of (a) all educational institutions; (b) all hospital institutions; and (c) all museum institutions, appointed by the LGIC from a list of nominees submitted by each of these categories of institution.

The board may make bylaws respecting the conduct of meetings, the administration of the fund and the criteria for grants of money and transfers of property. All bylaws are subject to the approval of the minister responsible.

In granting money or transferring property to an institution, the board shall give effect to any specific directions for charitable purposes made by the donor and shall consider any general directions for charitable purposes made by the donor. Where the gift is intended to benefit a particular category of institution, a committee of two trustees appointed in respect of that category is to be struck to make recommendations for the granting of money or transferring of the property.

The board is empowered to manage and invest money and real or personal property as the trustees may determine.

The Manitoba Foundation is currently being administered by an interim board of directors. Nominations from the institutions have been reviewed and formal appointments to the board were expected in the fall of 1994.

Ontario

Universities

In November 1992, An Act respecting University Foundations was proclaimed in Ontario. The short title of the Act is the University Foundations Act, 1992.22

This Act creates a Foundation for each of the universities in the province. Each

Foundation is an agent of the Crown in right of Ontario.

The objects of each Foundation are: to solicit, receive, manage and distribute money and other property to support education and research at the particular university. The foundation may use money and other property to support education and research at the particular university. The foundation may use money and other property that is received by it for the purpose of carrying out its objects, subject to any terms under which the gift is made.

The universities which are named in the Schedule to the Act and which may be designated by the LGIC as a university for which a foundation shall be established are: Brock University, Carleton University, Lakehead University, Laurentian University of Sudbury, McMaster University, Ontario College of Art, Queen’s University at Kingston, Ryerson Polytechnical Institute, The University of Western Ontario, Trent University, University of Guelph, University of Ottawa, University of Toronto, University of Waterloo, University of Windsor, Wilfrid Laurier University, and York University.

The board of each Foundation is composed of not less than five and not more than 11 members appointed by the LGIC. In law there is no requirement for nominees from the relevant university, although in practice it may submit a list for consideration by the LGIC. The board may pass bylaws governing its own procedure and generally for the control and management of the affairs of the Foundation.

The minister responsible may issue policy directives that have been approved by the LGIC on matters relating to a Foundation’s exercise of its powers and duties but the minister is required to consult with the board before issuing a policy directive. Compliance with the policy directive is deemed to be in the best interests of the Foundation and the members of the board are required to ensure that the policy directive is implemented promptly and efficiently.

Hospitals

Draft legislation has been prepared for hospitals in Ontario following the multiple-foundation model. This legislation establishes a foundation for each of the public hospitals or groups of hospitals prescribed in the regulations. (It has been proposed that a group of hospitals, established on the basis of region, religious denomination or medical specialization, for example, could establish a hospital foundation.) Once created, the foundations will be agents of the Crown in right of Ontario. Their purposes will be to promote contributions to the foundation; to receive gifts of real and personal property, and to provide grants and transfers of real and personal property to the hospital or group of hospitals to which the foundation relates for the purpose of supporting and promoting the activities of that hospital or group of hospitals.

The affairs of each foundation will be under the control and management of a board of directors. Itis proposed that each board would be composed of not less than three and not more than 11 members. The members would be appointed by the LGIC from a list of not less than 20 nominees submitted by the relevant public hospital or group of hospitals.

Cultural Institutions

The McMichael Canadian Art Collection in Kleinberg, Ontario is an agent of the Crown and is currently the only cultural organization in Ontario with this status. The Canadian Museums Association is lobbying for agent-of-the-Crown status for museums across the country. Several cultural institutions in Ontario are also seeking to establish related Crown agency foundations.

Quebec

The province of Quebec has no Crown agency foundations. Currently, several groups are actively lobbying to have legislation similar to the University Foundations Act, 1992 of Ontario23 enacted in Quebec. Lobbyists include individual institutions and CRADUQ (the committee responsible for development in Quebec universities).

New Brunswick

Universities/Community Colleges/Educational Institutions

The Higher Education Foundation Act24was proclaimed in New Brunswick in August, 1993. This legislation provides for the establishment, by regulation, of a foundation for each of the universities, community colleges and other educational institutions listed in the schedule to the Act, as follows:

Universities: Mount Allison University, St. Thomas University, Universite de Moncton- Moncton, Edmundston and Shippagan, The University of New Brunswick-Fredericton and Saint John;

Community Colleges: New Brunswick Community College;

Other Educational Institutions: Saint John School of Nursing, The Miss A.J. McMaster School of Nursing, Ecole de Formation Infirmiere d’Edmundston, L’Ecole d’lnfirmiere de Bathurst School of Nursing, Ecole d’Enseignement Infirmier Providence, Maritime Forest Ranger School, School of Fisheries of New Brunswick, New Brunswick College of Craft and Design.

Each Foundation is an agent of the Crown in right of New Brunswick. The purposes of each of the Foundations are to receive gifts of real and personal property, including money, on behalf of the institution; to invest and administer such property; and to make grants and gifts to the institution in support of its programs and activities. The income earned from the gifts is to accrue to the fund administered by the Foundation.

The board is composed of five trustees, two appointed directly by the LGIC from a list of nominees submitted by the institution. The board may pass bylaws regarding its procedures and the criteria for selecting programs and activities to be supported.

When providing grants, the board shall give effect to the specific directions of the person who has made the gift and consider the general directions of the person who has made the gift providing the gift is for charitable purposes. The board is authorized to invest as a reasonably prudent person would invest and is not limited to trustee-authorized investments.

The University of New Brunswick Foundation was established for the University of New Brunswick—Fredericton and Saint John pursuant to a Regulation to the Act, in December 1993. The board of directors of The University of New Brunswick Foundation has been appointed for a term of three years and its bylaws are being considered.

Nova Scotia

Universities

In February 1993, the University Foundations Act25was proclaimed in Nova

Scotia. This Act resembles the legislation in British Columbia and Alberta and establishes autonomous university foundations for Nova Scotia’s 13 degreegranting institutions.

To date, no university in the province has established a foundation; however once the foundations are established, each foundation will be an agent of the Crown in right of Nova Scotia.

The purposes of the proposed university foundations are similar to those established in the other provinces. The legislation provides that the board of each foundation will have five members, three appointed directly by the LGIC and the remaining two appointed from a list of five nominees who are members of, and nominated by, the governing body of the particular university.

The foundation may receive by gift, bequest, devise, grant or otherwise, property, including money; may make bylaws for the more effective management of its affairs; may borrow money; and, subject to a contrary intent expressed in the terms of the gift, may make any investments that a prudent person would make.

Like the British Columbia legislation, the University Foundations Act26provides for some autonomy on the part of the university with respect to the use of funds and property. A designated university may determine the manner in which funds and property available in each year shall be used for the benefit of the university and its programs and is, in so determining, governed by the terms of any gift or transfer of property. If any of the capital of a university is transferred to its foundation, the property vests in the foundation subject to the same conditions expressed at the time of the gift or transfer. The foundation may transfer the property back to the university.

Prince Edward Island

The Province of Prince Edward Island has no Crown agency foundations.

Newfoundland

Universities

Memorial University of Newfoundland is lobbying the Government of Newfoundland to establish a Crown agency foundation for the university. At the time of writing, discussions are pending.

Issues Discussed at the Canadian Association of Gift Planners

Conference- Apr1994

Given the diversity of our country, our governments, and the thousands of charities which serve a multitude of interests in this vast land, it is not surprising that diverse opinions were expressed by delegates to the Canadian Association of Gift Planners Conference held in April 1994. Since that time, much has been said at provincial roundtables and by individual organizations as they lobby for agent-of-the-Crown status. The comments which follow reflect that diversity of opinion and are not necessarily the author’s own.

What are the advantages?

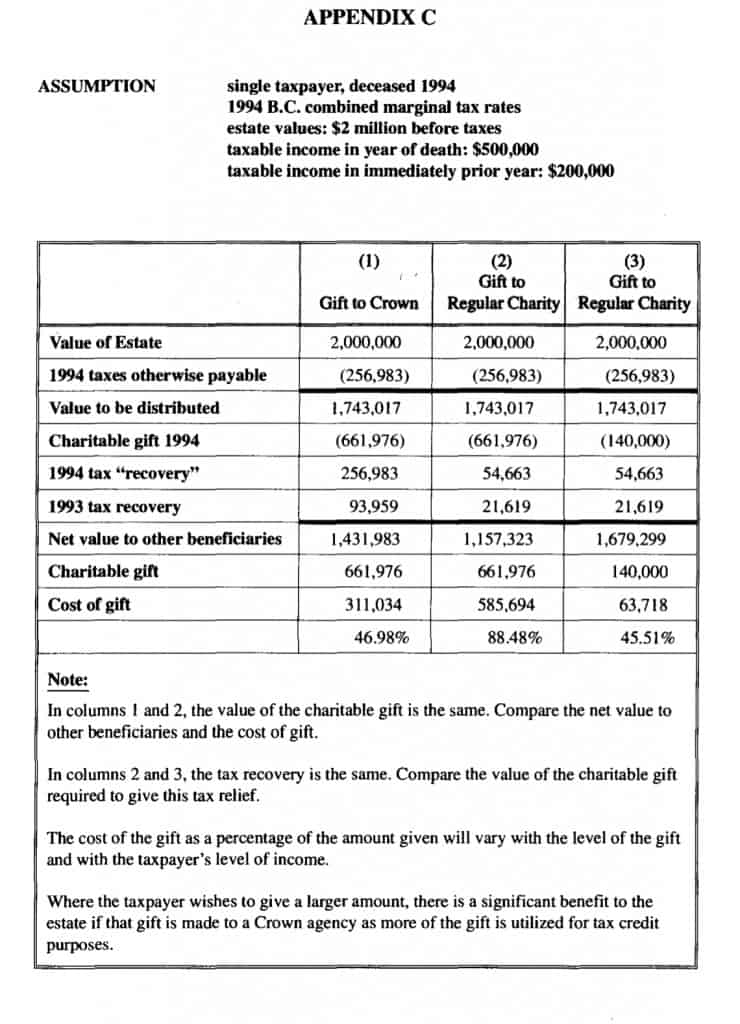

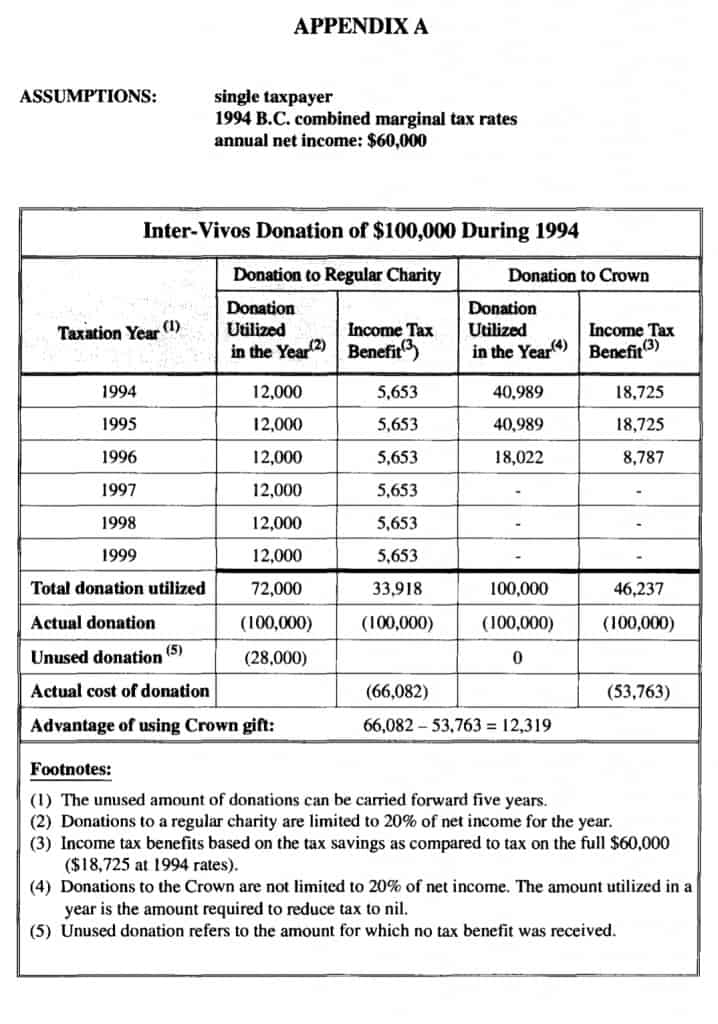

While all individuals and organizations making charitable donations to registered charities and other organizations as defined in the Income Tax Act are entitled to claim a tax credit for such donations, the key feature of a Crown agency foundation is the enhanced tax credit it can offer its donors.

An organization which is supported by a Crown agency foundation in effect receives government support through the philanthropy of private citizens. The enhanced tax benefit encourages the private sector to give while at the same time it reduces the number of tax dollars which the government can use for its own purposes.

While we would like to believe that all donations are made on a purely philanthropic basis, it is clear that some gifts are at least partially motivated by tax planning. This raises several questions that should be answered before judgement is passed on Crown agency foundations.

Does a donor give to an organization because of tax benefits alone or because of a belief in the work of the organization and the interests it serves? Are donors motivated by a combination of factors? Although to the best of my knowledge there are no hard data on this issue many organizations which do not have agent-of-the-Crown status believe that donors prefer to support a Crown agency foundation simply because of the enhanced tax benefits.

The key issues are first, how many donations are made simply because of an enhanced tax benefit and second, is it only the universities and hospitals which can attract this type of major donor?27

One of the advantages of agent-of-the-Crown status is the impact on the size and immediacy of a gift. The donor is able to claim a greater tax credit in the year of the gift rather than carrying the tax credit forward for up to five years, as might be required for full tax benefits from other gifts. This, in turn, affects the timing of the delivery of the gift to the institution. It is possible that, rather than give up to 20 per cent of income over five years, the donor can give up to

100 per cent of his or her income in the first year.

Having said this, the question remains as to how many donors would, in fact, take advantage of this. Even if an individual is able to donate up to 100 per cent of income in one year, will that individual make the same gift for five years? If not, then the ultimate tax benefit is much reduced, if not eliminated.

What are the drawbacks?

Surrender of control over the use of funds by both the donor and the foundation are major issues. The legislation affecting these issues varies from province to province.

From the donor’s perspective, often one of the key advantages of making a charitable gift is being able to designate one’s gift for a particular area of interest. With a gift which takes effect on the death of the donor, the circumstances may dictate that the terms on which the gift were made are no longer possible or practicable. This is addressed by including in the terms of the gift (i.e., the bequest) a provision that the board of directors may apply the gift in a manner most consistent with the wishes of the donor.

However, in some of the provinces, notably Alberta and Saskatchewan, the legislation provides that the board of the Crown agency foundation may consider the directions of the donor, but is not bound by the directions. Unless there is an agreement between the donor and the institution to the contrary, this provision of the legislation may well cause a donor to think twice about making a gift through such a foundation.

With respect to the appointment of the board for the multiple foundation model, for the most part, members are appointed by the government, either directly or in consultation with the particular institution.

The same applies to the single or umbrella foundation model, such as the Hospitals Foundation of British Columbia or The Manitoba Foundation. However, each institution which may benefit from grants issued by the umbrella foundation will probably have its own board whose members are usually appointed by the institution itself, thus achieving some independence from the government. It is accepted that there will continue to be some level of government control of the institutions such as hospitals. However, a smaller organization must consider whether the benefits of agent-of-the-Crown status (in terms of the number and size of gifts it would generate) would outweigh the level of government control which would necessarily follow from this status.

How Can Excluded Charities Compete?

Not all organizations have Crown-agency status nor can they obtain it. If a particular organization does not fit the common law definition of a Crown agent, then its status as an agent of the Crown must be a creature of provincial legislation.

Whether an organization is or is not an agent of the Crown affects its ability to compete in the marketplace with other organizations, both among provinces and within each province. This affects competition for dollars among organizations which serve the same charitable purpose as well as those serving different purposes.

For example, will a graduate of both McGill University and the University of Alberta choose to support higher education by making a gift to the University of Alberta Foundation because of its status as an agent of the Crown while bypassing any obligation to McGill? Will a supporter of health care in Alberta make a gift to a university foundation because of the enhanced tax treatment rather than offering support to a local hospital?

Lobbying efforts in British Columbia in the mid-to-late 1980s saw the creation of Crown agency foundations for the universities. Lobbying also brought changes to the Hospital Act to create the Hospitals Foundation of British Columbia. Since those early days, many organizations and associations representing common interests have lobbied for, and obtained, agent-of-the-Crown foundations to support their activities.

Organizations which have been primarily supported through public funding can lobby for continued support through the benefits offered to philanthropic taxpayers.

Are There Likely to be More Crown Agency Foundations in the Future? There is a strong movement afoot among many organizations to join the ranks of those who have achieved agent-of-the-Crown status. The developments which have occurred over the last several years illustrate the increasing interest in, and efforts being made, to offer this enhanced tax benefit to those who

donate to many kinds of charities.

At the same time, charities are wary of how this status will continue to be viewed by the federal and provincial governments should the benefits be perceived as carrying an unacceptable level of costs in the form of foregone taxes.

How Can We Maintain a Level Playing Field?

A donor’s choice should be made on the basis of evaluation of the worth of the cause, not skewed by a search for enhanced tax benefit.

Short of increasing the number of organizations which have agent-of-the-Crown status, the solution appears to be to increase the level of tax benefit for all charitable donations so that all charities would benefit.

This increase would level the playing field between organizations which are similar in purpose, but which are subject to different tax rules based on ownership.

In the recent article in Front & Centre,28tax expert and lawyer Arthur Drache commented that he believes that the federal government will be giving serious consideration to the fiscal implications of legislation dealing with Crown foundations. He believes that the issue will be addressed in the next federal budget and notes that one solution is to raise the creditable limit from 20 per cent to 50 per cent and apply it to all charities, including Crown foundations and agents of Her Majesty.

Whether this would result in a rash of donations remains to be seen, but it would at least provide an equal opportunity to all charities to attract tax-driven donations. This approach seems to be favoured by many charities, particularly those which are unlikely to qualify for agent-of-the-Crown status.

Conclusion

From the early negotiations in British Columbia to the lobbying which is now occurring in almost every province, the last 10 years have seen considerable evolution of Crown agency foundations in Canada. Crown agency foundations have changed the face of philanthropy in Canada. Although, like all charities, they allow donors to direct their support to areas of particular interest, nevertheless they do exert a pull through the enhanced tax benefits they offer. This is the issue which is causing the greatest concern among both charities and governments.

There are also a number of other issues to be considered. Control by the donor and the institution over the use of donated funds is a concern, as is the question of how charities which are not eligible for agent-of-the-Crown status will be able to compete for dollars. As these issues are examined, one hopes that the philanthropy amongst Canadians and for Canadians will be fostered.

FOOTNOTES

l. (1993), II Philanthrop., No.4. pp. 37-52.

2. The author is indebted to all those across the country who have provided copies of the relevant legislation and tenders her apologies to any organizations and institutions which she may have overlooked.

3. Murdoch v. MNR, [1979] C.T.C. 2184,79 D.T.C. 206.

4. R.S.C. 1985, c. C-51.

5. R.S.B.C. 1979, c. 176.

6. R.S.B.C. 1979, c. 414.

7. S.B.C. 1987, c. 50.

8. Supra, footnote I, at p. 49.

9. R.S.B.C. 1979, c. 53, s. 53 (I).

10. The Institute of Technology Act, R.S.B.C. 1979, c. 199 was amended in 1985 by S.B.C. 1985, c. 81, s. 15, to grant this status to the British Columbia Institute of Technology.

II. S.B.C. 1993, c. 40.

12. Supra, footnote 4.

13. R.S.B.C. 1979, c. 165.

14. S.A. 1991, c. U-6.5.

15. AB Regulations 795.91.

16. S.A. 1992, c. 34.

17. The chapter number for the Advanced Education Foundations Act is now S.A.

1991, c. A-2.5.

18. Supra, footnote 14.

19. Supra, footnote 16.

20. S.S. 1994, c. C-50.12.

21. S.M. 1993, c. 50 (may be referred to as: chapter F155 of the Continuing Consolidation of the Statues of Manitoba).

22. S.O. 1992, c. 22.

23. Ibid.

24. S.N.B. 1992, c. H-4.1.

25. S.N.S. 1991, c.8.

26. Ibid.

27. In a recent article in Front & Centre, Vol 1, No.4 (published by The Canadian Centre for Philanthropy, Toronto), Blake Bromley commented that other than universities and hospitals, “very few institutions are in a position where they will attract the $10-million donor… I don’t think small, struggling charities are in the running for this type of gift”.

28. Supra, footnote 27.

SARA P. NEELY

Manager, Planned Giving, British Columbia’s Children’s Hospital Foundation, Vancouver