Introduction

The concept of a negative tax to funnel money to low-income individuals has been widely discussed as a means of alleviating poverty. In fact, Canada’s income tax system is already being used by governments to give money to people who have little or no income. Depending on circumstances, an individual’s “refundable tax credits” can amount to several thousand dollars. But to receive the money an eligible person must first ftle an income tax return, a task beyond many of those who need the money most: the destitute, the illiterate, the mentally ill, the disabled, and the uninformed.

Refundable tax credits will become even more important to low-income people with the introduction of the Goods and Services Tax in 1991. The government intends to use the income tax system as a means of distributing GST refunds to low-income individuals if they undertake the unfamiliar and complex task of preparing a return.

Helping the needy to ftle tax returns so they can get the money they’re entitled to is a task which many welfare agencies could add to their services. This paper will describe the available tax credits and demonstrate how to prepare returns.

The Theory of Refundable Tax Credits

Tax professionals refer to a tax on income as a “progressive” tax-the rate of tax increases as income increases. Other forms of tax such as sales tax, excise tax and property tax are described as “regressive” in that everyone pays the same rate regardless of income. To reduce the burden of regressivity on low-income people, the tax planners have turned to the income tax system as the most practical way to refund some of the sales tax-and in some provinces some of the property tax-paid by low-income people. In addition, a refundable tax credit is also used to reduce the income tax paid by lower-income families with children.

Refundable credits are not part of the universal social assistance plan which has been so hotly debated in recent months but instead are subject to an income test The amount of the credits, if any, is based on the amount of income reported on the tax return.

Points to Remember

Certain basic principles apply to refundable tax credits:

1. There are two refundable tax credits in the federal system: the Sales Tax Credit and the Child Tax Credit. Eligibility for a credit and the amount of any credit depend on income.

2. Ontario and Manitoba have additional refundable tax credits.

Ontario will refund part of the provincial sales tax levied on most purchases and part of the property tax paid on a home or added to rent. Manitoba provides a property tax credit as well as a “cost-ofliving” credit for people with little or no income.

3. Credits are paid only to people or families whose income is below a threshold amount. Different credits have different thresholds.

4. Welfare and Workers’ Compensation payments are not subject to income tax, but they must be added to income when calculating refundable tax credits and may reduce or eliminate the amount of credit

5. It is not too late even for those who have not flled a tax return in previous years. Those who act before the end of 1990 can flle returns for 1989, 1988, and 1987 and still receive the credits they were entitled to in each of those years.

6. In 1991, tax credits under the new Goods and SeiVices Tax will be paid in quarterly instalments beginning in December 1990-but only to those who have filed 1989 income tax returns.

The Federal Sales Tax Credit

The federal sales tax credit gives back to low-income people some of the federal sales tax buried in the price of many of the things they buy. The maximum credit for 1989 was $100 for an adult and $50 for each dependent child under age 19. The credit is reduced by five per cent of any income over $16,000.

EXAMPLE

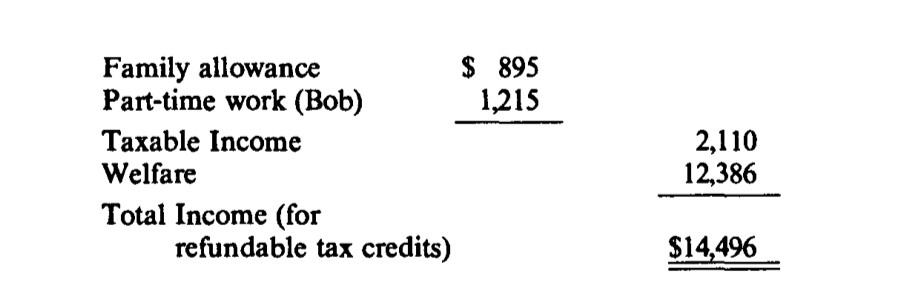

To see how this credit is calculated, consider Bob and Betty, a low-income couple with two children. Assume their 1989 income was:

Only $2,110 of the family’s income is subject to income tax. Since no tax is levied on such a small amount, Bob is not required to file a return, but if he fails to file, helose several hundred dollars of refundable tax credits. If he does file, he must report all income-including the $12,386 in welfare payments.

Only $2,110 of the family’s income is subject to income tax. Since no tax is levied on such a small amount, Bob is not required to file a return, but if he fails to file, helose several hundred dollars of refundable tax credits. If he does file, he must report all income-including the $12,386 in welfare payments.

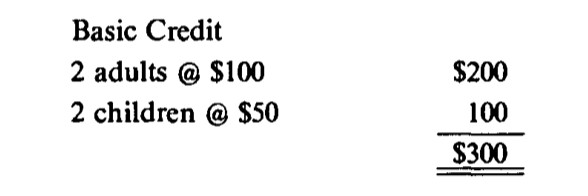

Bob’s federal sales tax credit for the 1989 tax year would be calculated this way:

Since total income is less than $16,000, he will be entitled to the full credit of$300. If his total income had been, for example, $18,500, the credit would be reduced by $125 (five per cent of $18,500-$16,000). At a total income of $24,000, his sales tax credit would reduce to zero.

In 1991, his sales tax credit (assuming passage of the Goods and Services Tax legislation) will increase to $580, paid in quarterly instalments.

The Federal Child Tax Credit

The federal government has four different ways of helping people with dependent children:

(i) family allowances;

(ii) a non-refundable tax credit which applies to parents whose income is sufficient to require payment of tax;

(iii) child-care expenses which can be deducted from the incomes of people who must incur such expenses in order to make a living;

(iv) the refundable Child Tax Credit for parents whose income is below a specified threshold amount.

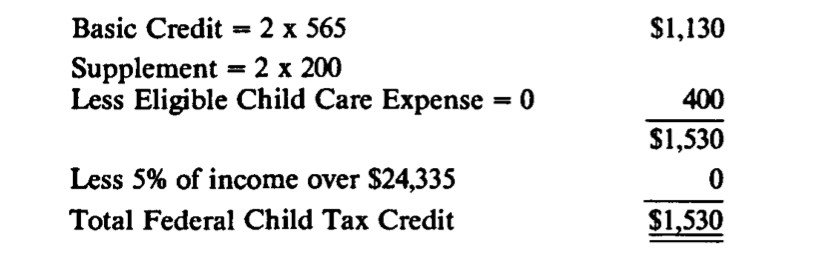

The basic Child Tax Credit in 1989 was $565 for each child qualified for Family Allowances. If the applicant is not claiming a deduction for child care expenses, there is a supplement of $100, but only for children born in 1983 or later. For those claiming child care expenses, the $100 supplement is reduced by 25 per cent of the child care expenses. Finally, the total credit is reduced by five per cent of family income (including welfare and Workers’ Compensation payments) over $24,335.

EXAMPLE

Consider the case of Sally, a single parent of two children, both born after 1982. She received $9,000 in welfare payments in 1989 and $895 in Family Allowance. She has no job and thus has no job-related child care expenses to qualify her for the Child Care Credit

Her Child Tax Credit for the 1989 tax year would be calculated this way:

The Child Tax Credit can be claimed only by the parent receiving Family Allowance payments. (In the example of Bob and Betty, above, Betty would file a return and claim the Child Tax Credit. While nothing prevents Bob from filing to receive the other credits, it would obviously be more convenient for Betty to file for the family and receive all the refundable credits.)

Ontario Tax Credits

The Ontario tax credit system provides two income-tested refundable credits: a sales tax credit and a property tax credit for either renters or homeowners. The two plans in combination would pay a maximum amount of $1,000 to a family unit. Ontario residents over age 64 are not eligible for this credit Instead, they receive sales tax and property tax credits on a universal basis, regardless of income.

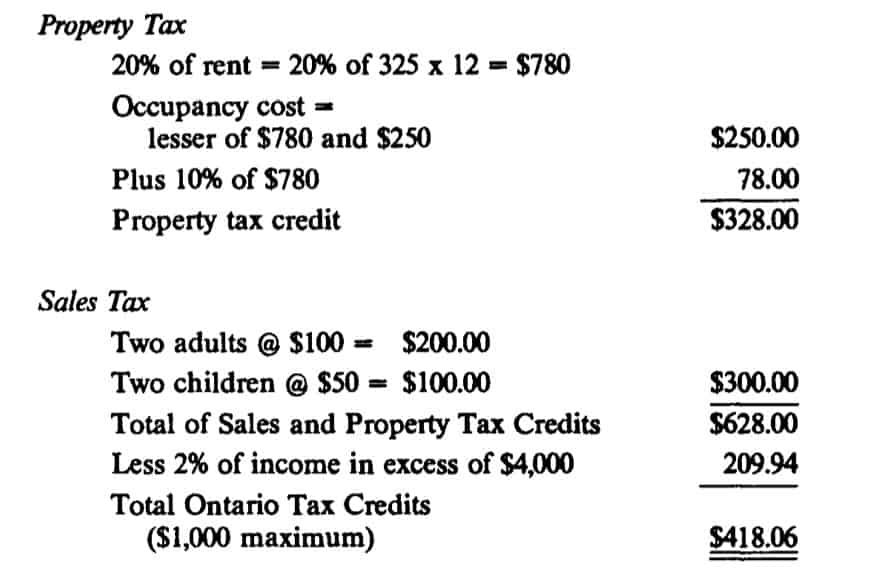

In 1989, the basic sales tax credit was $100 for each adult in the family and $50 for each dependent child under age 19.

The property tax credit is calculated on the “occupancy cost” for either an individual or a family. The occupancy cost is 20 per cent of total rental payments in a year plus property taxes paid if you are a homeowner or a tenant who is required to pay property taxes in addition to, or in lieu of rent There is a flat $25 for each student in a college residence. The credit is the total occupancy cost, subject to a maximum of $250, plus 10 per cent of the occupancy cost.

The total of the sales and property tax credits is then subjected to two further tests. First, the total credits are reduced by two per cent of income in excess of$4,000.Then they are subject to an overall allowable maximum of $1,000.

EXAMPLE

Bob and Betty (the family in the federal sales tax example) have two dependent children and total income (including welfare) of $14,496. Assume their rent is $325 monthly.

Here is how their tax credits would be calculated:

Manitoba Tax Credits

In addition to a property tax credit, Manitoba has a cost-of-living credit Like the federal and Ontario credits both Manitoba credits are incometested, but in calculating the income threshold they ignore any money received from welfare, Workers’ Compensation, and the Old Age Supplement.

Cost-of-Living Credit

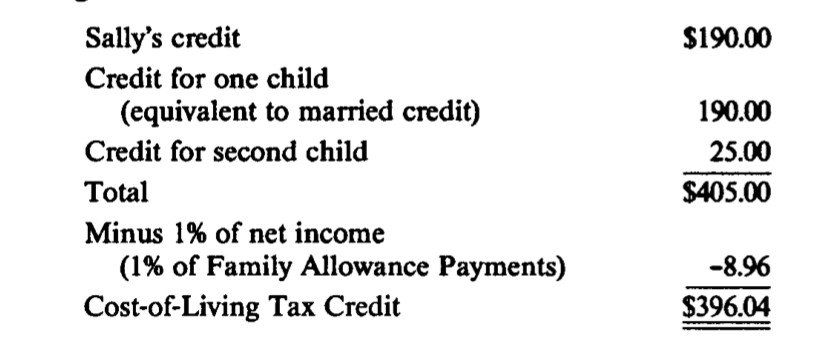

In the 1989 tax year, the basic credit was $190 for each adult in the family and $25 for each dependent child born in 1970 or later. In the case of a one-parent family, one of the dependent children can claim a credit of

$190. Additional credits are available for people who are 65 or over or disabled.

EXAMPLE

If Sally in the previous example lived in Manitoba, the family’s cost-of-living credit would be:

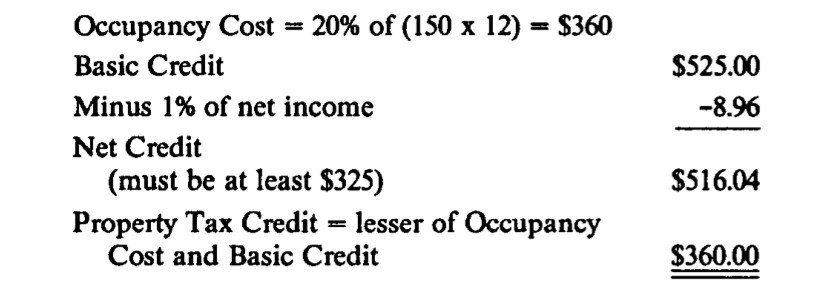

The property tax credit is based on “occupancy cost”: the total of actual taxes paid and 20 per cent of rental payments. Occupancy cost is then compared to a basic credit. The basic credit is $525 ($625 for those 65 and over) minus one per cent of net income. The basic credit must be at least $325. The net credit is the lesser of the occupancy cost and the basic credit

EXAMPLE

Assume Sally pays $150 a month in rent

Summary

Bob and Betty, living in Ontario, would receive total refundable tax credits of$2,248.06. Sally, living in Manitoba, would receive refundable tax credits of $2,485.04. If no returns have been filed for 1988 and 1987, both families can still file returns and receive additional money for those years.

The Goods and Services Tax

The proposed Goods and Services Tax provides for an increased refundable tax credit for families with incomes of $36,000 or less. For Bob and Betty, with two dependent children, the credit will increase from the present $300 to $580. For Sally, with two dependent children, the credit will increase from $200 to $480.

The income test for the 1991 Goods and Services Tax will be based on the 1989 return. A special Goods and Services “Information Form” was included with the 1989 tax form. This will enable Revenue Canada to calculate the amount of tax credit for eligible individuals and families and pay the credit in quarterly instalments starting in December 1990.

Conclusion

For government officials who design the tax system, a reduced tax on income accompanied by an increased tax on consumption has many attractions, not the least being the opportunity to collect revenue from the underground economy whose members are able to evade tax on all or part of their incomes. But a consumption tax bears most heavily on those who are least able to pay. Refundable tax credits are an unsatisfactory solution to this problem for the thousands of people at the bottom of the socio-economic ladder who lack the skills or the information to collect the tax credits owing to them.

In many Canadian cities accountants and other professional tax practitioners work with agencies to conduct no-charge clinics to prepare returns for elderly, disabled, and disadvantaged people. But these services fail to reach many people who have so little income that no tax return is required. Many of the agencies whose mission is to help them are equally unaware of the existence of tax credits.

If the poorest of the poor arc to receive the money ear-marked for them, they need the help of the organizations-welfare agencies, hostels, and church groups-that work to aid the underprivileged. The challenge for the organizations is, first of all, to make sure their clients are aware of their entitlement to tax credits and, second, to recruit and train volunteers to assist in the preparation of the necessary tax returns.

GEORGE V. FORSTER

Financial Planning and Tax Consultant, Toronto