One of the more remarkable aspects of Canadian life is the way in which ideas which have been in circulation for many years in the United States can suddenly be discovered by a few Canadians and treated as if they were new Canadian inventions.

One example is the so-called “tax expenditure concept” which was developed in the United States quite a number of years ago by Professor Stanley S. Surrey. It states that whenever government departs from the theoretical norm by modifying its income-tax laws in order to deal with special situations so that it collects less in taxes than it would otherwise, this constitues a “tax expenditure”, which ought to be accounted for in the government’s budget to the same extent, and in much the same manner, as the monies it lays out directly in grants, subsidies and other expenditures.

A moment’s thought should enable us to recognize that there really is no generally accepted theoretical norm; no recognized concept of what an ideal, neutral tax system should be like. As a result, it would be unusual to find two experts who would agree on whether a particular provision in the Income Tax Act is merely an appropriate refinement, enabling income to be more properly measured for tax purposes in some specific case, or whether it is a departure from the norm, which has to be specifically justified as a tax expenditure.

Unfortunately, the federal government has recently contributed mightily to this confusion by producing astronomical figures which are said to represent the total cost of tax expenditures permitted by the Canadian tax system. Upon closer investigation, it will be discovered that the vast bulk of this total results from the inclusion in it of so-called “imputed income” arising from the occupation by many Canadians of homes which they own as opposed to renting a home from someone else. Inclusion of this item ignores the fact that our tax system, like the systems of most other countries, refrains from attempting to tax the national income which an economist considers we enjoy if we own and occupy our own homes. A large part of the balance of this enormous total reflects the tax deferrals involved in our ability to temporarily put away some funds out of before-tax income in pension plans and RRSPs, as though such tax deferral were contrary to sound tax policy. Charitable donations, of course, are lumped into the total as tax expenditures. In the end result, in my view, the tax expenditure concept has become, in the hands of its Canadian advocates, merely a club which they use to belabour groups they wish to have taxed more heavily, by labelling certain tax provisions as giving rise to tax expenditures. Much heat, but little light, can be generated by such discussion; it succeeds only in trivializing debate on tax

* Member, The Ontario Bar

policy, debate which must be conducted seriously and with intellectual rigour if we are to survive.

I am greatly concerned that we in Canada are now seeing a major campaign for another imported American tax-policy concept which is also being presented as though it were newly discovered and as though it had not already been the subject of vigourous controversy in the United States. I refer to the campaign which has been mounted by the Coalition of National Voluntary Organizations (NVO), which purports to speak for more than I 00 charitable organizations in this country. This campaign favours permitting those who donate to charity the option of deducting one-half of their donations as a tax credit when they are computing their tax I iabi lity instead of the present practice which permits deduction of donations from the taxable income on which tax liability is calculated. That is, if an individual earning $20,000 who is in a combined federal and provincial marginal income-tax bracket of, say, 30 per cent, makes a $1 ,000 donation to charity, instead of reducing his taxable income by $1 ,000 to $19,000, and thereby reducing his tax liability by $300, he would, under this proposal, be entitled to calculate his tax liability first on the basis of his income of $20,000 and then to deduct $500 as a tax credit from the tax which would otherwise be payable.

Obviously, if the tax credit were equal to 50 per cent of the charitable donation, such an arrangement would be advantageous to any taxpayer who is in a combined marginal tax bracket which is lower than 50 per cent. Such a tax credit would, of course, be less advantageous than the present system of deduction from income for any taxpayer whose combined marginal tax rate exceeded 50 per cent. Although in some provinces, including Ontario, the top combined marginal tax rate is about 50 per cent, in other provinces, including Quebec, it is considerably higher. Under the NVO proposal, however, taxpayers in higher tax brackets than 50 per cent would still have the option of deducting their donations when they were computing their taxable incomes, as they do under the present rules.

There are two levels at which this proposal can be discussed. On the practical level, we can seek to discover what its effect would be on the level of donations by different income groups to different kinds of charities. On the theoretical level, we must ask whether the proposal can be justified on an intellectually satisfying basis as an improvement in the equity or efficiency of the tax system.

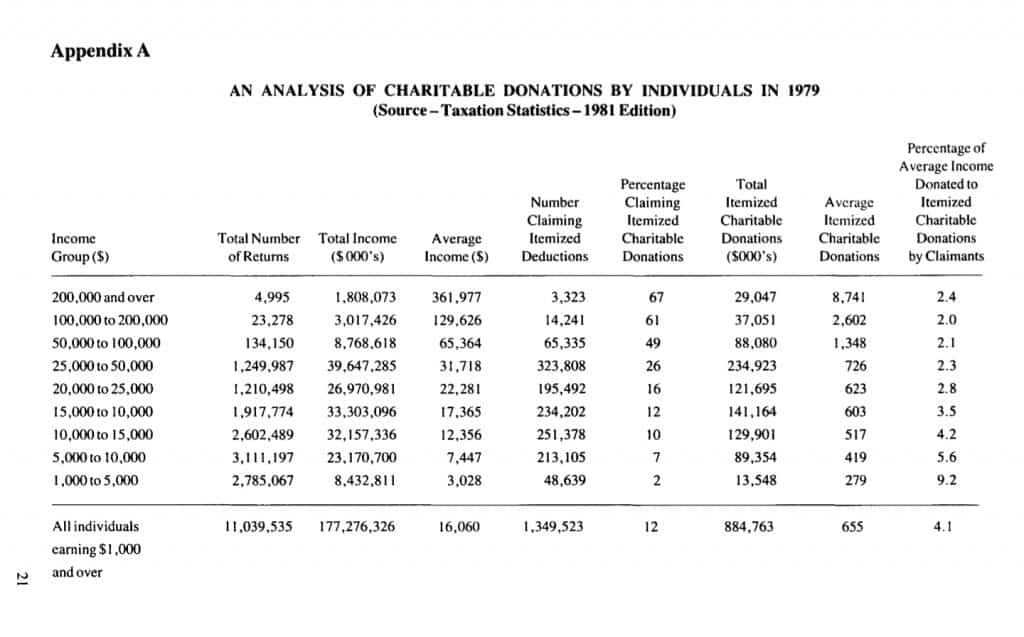

At the practical level, we must start by considering who gives money to charity and how much they give. In 1979 only 12 per cent of Canadian individuals who filed income tax returns claimed itemized charitable donations. The remaining 88 per cent-seven out of every eight individuals–claimed the standard deduction of $100 in respect of charitable donations and medical expenses. About 1,350,000 individuals claimed itemized deductions averaging about $650 each, or 4.1 per cent of their incomes. However, more detailed analysis of these donations by income groups reveals some shocking figures. For example, one out of three individuals earning over $200,000 a year claimed only the standard deduction. The amount of income devoted to charity by individuals earning over

$50,000 was only slightly more than two per cent. In fact, although the percentage of individuals claiming itemized charitable donations naturally declined as income declined, individuals in lower income classes who did claim itemized donations actually devoted a larger percentage of their incomes to charity than did more affluent members of our community. My detailed analysis will be found in Appendix A.

These figures demonstrate, beyond doubt, that Canadians generally do not give generously to charity. Proponents of tax credits for charitable donations point to the relatively low after-tax cost of such donations, under our present system, to individuals in higher tax brackets, inferring that wealthier people must give away large amounts of money because it costs them very little. In fact, as the statistics shown in my analysis demonstrate, even the rich generally give away very little, because, unfortunately, they know that the tax deduction arising from a charitable gift is less advantageous than keeping the money and paying the full tax.

We must also bear in mind that there is a considerable difference in the kinds of charitable activity which are supported by different income classes. All the evidence suggests that those in lower income groups generally direct the bulk of their charitable donations to churches and church-related activities, while those in higher income groups tend to support educational and cultural institutions. It is by no means clear whether those in lower income groups would be likely to increase their support of charities other than churches and church- related organizations if greater tax incentives, such as a 50 per cent tax credit, were provided. Charitable giving seems to be a habit learned from parents, teachers and religious leaders, and those who have not learned the habit early seem to be unlikely to acquire it later, no matter what tax incentives may be provided.

Interesting calculations have been made by Martin Feldstein, the eminent American economist, and his colleague, Amy Taylor, suggesting that if, in 1970, the United States had substituted a 30 per cent tax credit for its system of deductions for charitable donations, total gifts would have increased by 13 per cent but gifts to educational institutions would have decreased by 17 per cent. With a 30 per cent optional credit, available to those to whom it was advantageous, and a continuing system of deductions for those in higher tax brackets, Feldstein and Taylor estimated that total gifts would have increased by 20 per cent and gifts to educational institutions would have increased by eight per cent. However, everyone who has attempted to produce reliable figures of this type seems to be conscious that they are, at best, uncertain.

As long ago as 1960, in discussing tax credits as an alternative to deductions from income, Professor C. Harry Kahn of Rutgers University pointed out:

“The tax credit accords with the reasoning that an allowance for philanthropic contributions is a deliberate instrument of public policy to encourage decentralized decision-making in the allocation and administration of funds in areas commanding the public interest. In this view, the contribution allowance is not an appropriate adjustment for the determination of net income. It would be justified only if a relation between the deduction and the refinement of gross income to taxable income could be shown, and then there would presumably be little reason to limit the amounts deductible as under the federal tax.

‘The desirable form, if any, of a deduction depends ultimately upon acceptance of a rationale supporting the deduction. Two plausible foundations … are: that the deduction is intended to assist by tax relief in the financing of activities in the public interest; and that its purpose is to refine income, as implied by current practice. The first interprets the deduction as an application of income, rather than as a reduction of income for tax purposes; the second interprets the deduction as a means of obtaining the best possible index of ability to pay- net taxable income.”

In a lengthy article in 1972, Professor Boris Bittker, a major writer on U.S. tax policy, summarized the indictment brought by critics of deductions from income for charitable donations:

Firstly, that a charitable gift is a personal and voluntary expenditure by the taxpayer that should have no impact on his tax liability. The view that a charitable gift is merely a form of personal expenditure has been widely held by some very eminent economists. R.M. Haig wrote that, “a man who makes a gift to some person or corporation outside his immediate family deliberately chooses that way of spending his money because it yields him a greater satisfaction that some alternative use”.

Henry Simons stated that, “if it is not more pleasant to give than to receive, one may still hesitate to assert that giving is not a form of consumption for the giver”. Melvin White wrote, “a charitable or other such contribution by an individual is a voluntary allocation of funds, presumably more gratifying than expenditure on goods and services. Its deduction is thus not an appropriate adjustment for the calculation of net income”.

Secondly, that deductions, even assuming they are to be allowed as a device to encourage philanthropy, are ineffective, because they do not distinguish between gifts generated by a tax incentive and those that would be made in any event.

In this connection, much reliance is placed on a 1965 investigation by Professor Michael K. Taussig, which concluded that, “the incentive effect of the deduction for charitable contributions is, in the aggregate, weak”. He found no statistically significant incentive effect in income classes below $100,000; only for income above $100,000. In his view, therefore, the $2.5 billion of U.S. tax revenues foregone by reason of the deduction in 1962 were said to have accounted for as little as $57 million of charitable contributions.

Lastly, that deductions vary in value with the taxpayer’s marginal tax rate and hence are of greatest benefit to upper-income taxpayers, in violation of the progressive rate schedule.

The NVO has stated, “among those who do give, those with the highest income receive the highest tax subsidy on charitable gifts, while the majority of charitable giving comes from taxpayers with more modest incomes”.

These three criticisms are labelled by Professor Bittker, “impropriety”, “inefficiency” and “inequity”.

Concerning the “impropriety” argument, Professor Bittker states,

“The assertion of unfairness when A’s tax liability is lower than B ‘s solely because A has made a charitable contribution is based on the premise that the taxpayers’ income-tax liability should be based on the amount available to him for consumption expenditures, taking no account of how he chooses to spend his money, coupled with the premise that a charitable gift is a consumption expenditure.”

He points out that, if this criticism is liccepted, it ought to lead to denial of all forms of tax relief for charitable contributions, a position which has, in fact, been advocated by some eminent economists, including Sylvester Gates and John R. Hicks, who wrote the minority opinion in the 1975 final report of the British Royal Commission on the Taxation of Profits and Income. After all, as Professor Bittker points out, a tax credit to A for making a gift to charity, if nothing goes to B for supporting his mistress, also distinguishes between taxpayers by reason of their expenditures. To use the economist’s terminology, the price to A of enriching his favourite charity by $2 is reduced by the tax credit to $1; but if B wants to give $2 to his companion, it will cost him the full $2. The “impropriety” argument therefore cannot be advanced in support of the tax credit proposal.

Concerning the “inefficiency” criticism, Professor Bitker pointed out in his 1972 article that the evidence in support of the view that the charitable deduction subsidized charitable gifts, most of which would be made in any event, was really quite weak. Support for his view is contained in the 1975 Report of the U.S. Filer Commission on Private Philanthropy and Public Needs, which quoted Professor Feldstein’s analysis, in which he concluded that for each $1 of tax revenue foregone by virtue of the deduction, charitable organizations in the United States received between $1.15 and $1.29 in additional contributions. If this conclusion is accepted, it contradicts the charge of “inefficiency”. The “inequity” criticism is based on the view that it is wrong that X, who gives the same amount to charity as Y has more income than Y and is therefore subject to a higher marginal tax rate. Is there really an upside-down subsidy, by which X’s deduction is worth more than Y’s. It is this aspect of the matter which has been most emphasized by the NVO in their well-publicized “Give-and-Take” proposal. They argue that the present system involves a greater subsidy to the taxpayer who is in a higher tax bracket than to one in a lower bracket and this is perceived to be unfair. I suggest, however, that this line of argument will not withstand analysis.

A simple analogy can be used to illustrate this point: let us suppose that there are two salesmen, both earning their incomes entirely from commissions, and both spending $1 ,000 per year on gasoline for a car which each uses to earn his income, and let us assume that one of these salesmen earns $100,000 per year and is in a 50 per cent tax bracket, while the other earns only $10,000 per year and is in a 15 per cent tax bracket. Since each can deduct $1 ,000 from his income for tax purposes in respect of his expenditures on gasoline, it is obvious that the salesman with the higher income gets a bigger dollar reduction in his tax liability for his $1,000 expenditure. This simply follows from the fact that income tax is levied on income, net of expenses. No one would argue that the price of gasoline is cheaper if it is purchased by a well-to-do salesman rather than by a poor one. Nor can it be said, as one advocate of tax credits for charitable contributions has suggested, that, “under the present system, the price of charitable donations is significantly cheaper if made by a wealthy donor rather than a poor one”.

Those who make charitable contributions do so because they feel a moral obligation to share their incomes with voluntary organizations in the private sector that carry on vital charitable activities. A person who feels such a moral obligation has partners: the charities with whom he shares his income. I suggest that the commonsense of our community dictates that we do not tax such a person both on the income he retains and on that which he gives away. On this basis, a person who earns $30,000 and who gives $3,000 to charity has the same capacity to pay taxes as the person who earns $27,000 and who gives nothing away; he does not have the same capacity to pay taxes as the person who earns $30,000 and gives nothing away. The reason why our tax system makes an allowance for charitable donations is, I suggest, simply that when a person makes a donation the money he parts with is no longer available for his own use. This line of reasoning supports the deduction of charitable contributions in calculating the donor’s taxable capacity which, under our law, is measured by his taxable income. It does not support a system of tax credits.

I should like to end this part of my discussion with a quotation by Irving Kristol, whom I consider to be one of the most perceptive social commentators in the United States:

“Many economists and tax experts—Stanley Surrey most notably—nevertheless do favour subsidies rather than tax incentives, and argue persuasively for them. But in the course of making these arguments, a very interesting rhetorical transformation takes place. They begin to think and talk as if the basic decision to subsidize had already been made-only, the subsidies are now incarnated in the tax system rather than in positive legislation. So they come quickly to refer to all exemptions and allowances in our tax laws as ‘tax subsidies’ or even

‘tax expenditures’ but note what happens when you make this assumption and start using such terms. You are implicitly asserting that all income covered by the general provisions of the tax laws belongs of right to the government, and what that government decides, by exemption or qualification, not to collect in taxes constitutes a subsidy. Whereas a subsidy used to mean a governmental expenditure for a certain purpose, it now acquires quite another, i.e., a generous decision by government not to take your money. When a man makes a tax-deductible gift to charity, whose money has he given away? Traditionally, it has been thought that he gives away his own money, and that the tax deduction exists only to encourage him to give away his own money for this purpose. Today, however, one hears it commonly said that he has only in part given away his own money—in actuality, he has also given away some ‘public’ money. This ‘public’ money consists of that sum which, were such deductions not permitted by law, he would have to pay in taxes. It is then said-indeed, it is now a cliche-that the object of his philanthropy (a museum, say) is ‘in effect’ being subsidized by public monies.

“What we are talking about here is no slight terminological quibble. At issue is a basic principle of social and political philosophy—the principle that used to be called ‘private property’. The conversion of tax incentives into ‘tax subsidies’ or ‘tax expenditures’ means that, in effect, a substantial part of everyone’s income really belongs to the government–only the government, when it generously or foolishly refrains from taxing it away, tolerates our possession and use of it. To put it another way, when you start talking glibly of some 70 billion dollars oflegal deductions and allowances as ‘tax subsidies’ you have already in imagination socialized that amount of personal and corporate income.”

There is, however, a proposal by the NVO which, in my opinion, deserves far more serious consideration, namely, the elimination of the standard deduction of $100 in respect of charitable donations and medical expenses. It can be argued that, since a deduction of $100 is available whether or not an individual actually makes any charitable contributions, the first $100 of contributions are, in effect. being made out of after-tax income. To this extent, there is clearly a tax disincentive under our present system for individuals to make the first $100 of charitable donations. It is more debatable, however, whether this disincentive is really significant in the case of the seven out of every eight Canadian individuals who claim the standard deduction. Would they really be prepared to start making charitable donations or to increase their charitable donations above a merely nominal amount, if they received a modest tax incentive, or is the problem simply that they have never learned the habit of giving money to charity? Perhaps the best thing that can be said about the present standard deduction is that $100 today is really much less than it was in 1957 when this allowance was first permitted.

The situation in the United States is quite interesting. Basically, an individual’s deduction for a charitable contribution is an itemized deduction there; that is, it must be taken in lieu of the standard deduction and not in addition to it. Nevertheless, as a compromise, President Reagan’s Economic Recovery Tax Act of 1981 introduced an experiment. For taxable years beginning after 1981, individuals who claim the standard deduction (which, in the U.S., is far more generous than our own), may also deduct from their incomes a percentage of their charitable contributions. The amount deductible is 25 per cent of a $100 maximum for 1982 and 1983, i.e., a maximum deduction of $25; 25 per cent of a $300 maximum contribution for 1984; 50 per cent of contributions without a maximum for 1985; and 100 per cent of contributions without a maximum for 1986. The five-year phase-in schedule presumably is designed to allow Congress to make this relief permanent if the revenue loss permits.

Finally, there is an area of tax policy concerning which a number of submissions have been made recently to the federal government, so far without any perceptible result. This concerns gifts of substantial business interests to charity. Canadians should, I think, be very pleased when a well-to-do businessman decides to make a gift to charity of a substantial interest in his company. However, far from encouraging him to do so by giving him a reasonable deduction for income tax purposes, our present Income Tax Act may actually impose a serious tax burden on him when he makes such a gift. Imagine an individual with a salary of $100,000 who owns 100 per cent of a company which was worth $1,000,000 at the end of 1971 and which is now worth $10,000,000 and who wishes to give a 10 per cent interest in the company (value $1 ,000,000) to charity. Under our present law, when he makes this gift he will be deemed to have realized a capital gain of $900,000 and he will have to include $450,000 in his income as a taxable capital gain. He will be permitted to deduct only $110,000 as a charitable contribution in the current year and a further $20,000 in each of the five following years, a total of only $210,000. As a result, his charitable gift will result in a net inclusion of $240,000 in his income. If he lives in Ontario this is likely to cost him about$120,000 in taxes.

I suggest that if we are actually to encourage such large charitable gifts, we shall have to change the law which treats a person who has given valuable shares to charity as though he had disposed of them at their fair market value, that is, we must exempt such gifts from the operation of paragraph 69(l)(b) of the Income Tax Act. There is precedent for this, since our law now encourages individuals to donate valuable paintings and other works of art to public galleries by exempting them from this deemed disposition rule. This rule must, I suggest, be extended to include gifts of shares to charity.

Of course, government ought to be concerned that a charity which has received a gift of valuable shares does not immediately sell them in a manner which would avoid payment of the income tax which the donor would have suffered if he had simply sold them himself and made a gift of the cash proceeds to the charity. However, since such gifts of shares are almost always intended to be held for a considerable number of years, it should be possible for the law to be amended so as to exempt gifts of shares to charity from the deemed realization rule, as long as they are held by the charity for at least two or three years.

We have seen how favourable tax laws have greatly increased gifts of works of art to the public and we therefore have reasonable grounds for optimism that similar incentives in respect of gifts of shares to charity may have equally encouraging results.

Appendix A

AN ANALYSIS OF CHARITABLE DONATIONS BY INDIVIDUALS IN 1979 (Source- Taxation Statistics -1981 Edition)