Don McRae writes a newsletter that monitors charity data to see how the sector is changing. In the 2022 revocations, he sees a wake-up call: in particular around the loss of community groups that were hubs of volunteering and community action, and the loss of services and connection that results.

This article looks at the 2022 calendar year to see how, and to some degree why, groups lost their charitable status. It also takes a quick look at the new charities registered in 2022. It mainly uses voluntary revocations, where the group decides to revoke its status, and failure-to-file revocations, where the group fails to file its public T3010 Registered Charity Information Return within six months of its year-end.

The article starts with some overarching observations and implications before diving into the details gleaned from T3010 forms.

Executive summary

The number of charities in Canada is relatively stable. Over the past six or seven years, it has hovered around 86,000. This plateauing reflects what a number of charity regulators in other jurisdictions are doing and it has the tinge of being intentional. Registration of new charities has been tightened up, and the revocation of moribund charities looks to be a policy goal for the Canada Revenue Agency (CRA).

COVID-19 and the related restrictions on activity affected charities. For some, their revocation can be seen as a direct result of the pandemic. The groups couldn’t meet, undertake their activities, or raise the necessary funds to stay solvent. This was the case for some churches, arts groups, auxiliaries, or seniors’ organizations, where face-to-face contact is a necessity. The pandemic also affected weaker groups, putting them over the edge or wounding them to such a degree that they decided to close.

There are a number of groups that are losing favour. Unfortunately, these groups play a key role in community building and the encouragement of volunteering.

The revocations also continued trends that have been building over the years. There are a number of groups that are, for lack of a better term, losing favour. Unfortunately, these groups play a key role in community building and the encouragement of volunteering. Churches, auxiliaries in a healthcare or care-of-seniors setting, certain types of fundraising groups, and convening groups are losing status. There are also a number of charities that are consolidating or regionalizing their operations. This is a warning sign that their brands are losing their sway in the charitable marketplace.

With the hesitation of some people, especially seniors, to volunteer, our communities are losing social capital. Efforts to replace this by virtual means weakens social bonds and cannot deliver food, provide face-to-face contact, or drive people to appointments. As Canadians, we need to find ways to build back better so that we can provide the services and connection that people need in their lives.

The two leading indicators for loss of status are that groups are moribund or have no traction after they register (minimal revenue) and decreasing revenue (including reductions related to COVID restrictions).

Studying revocation

There is a time difference between voluntary and failure-to-file revocations. With voluntary revocation, the group has more control of its fate. There are more comments on the T3010s, and some groups actually say that they are going to fold in their penultimate or ultimate T3010. Essentially, these groups are operating in real time.

Failure-to-file revocations demonstrate a lack of control, which can happen to even very capable groups. The pandemic reduction or elimination of revenue is the stuff of crisis, and the group’s activities are focused on trying to survive. Given that the CRA failure-to-file timeline is 18 months after the last T3010, followed by six months or so of reminders, the time lag for revocation is essentially two years plus.

Information was collected for each revocation through the T3010 Registered Charity Information Return, an internet search, and articles in the media. Through this a determination was made on the probable cause of revocation. It’s not an exact science, shown by the number of groups with not enough information, but it’s a good indication of what is happening.

Overall numbers

On January 5, 2022, there were 86,032 charities. This year, there is a slight decline: on January 7, 2023, there were 85,959 charities. As usual, not all the numbers add up. While we have the number of revocations and the number of new registrations, some failure-to-file charities re-register. We also have a small number of errata charities, where charities have been incorrectly listed as having failed to file or voluntarily revoked their status. Those numbers show up after the initial count of revocations, so the numbers don’t align. All this to say that one should see this account as close but not precise.

There were 1,583 notices of revocation in 2022. This is fewer than 2021, but one must remember that 2021 was a catch-up year for CRA after the pandemic work restrictions delayed some of its registration and revocation work.

Table 1 – Comparison of revocations 2021 and 2022

| REVOCATION | 2022 | 2021 |

| VOLUNTARY | 757 | 875 |

| FAILURE TO FILE | 767 | 770 |

| AUDIT | 48 | 23 |

| OTHER | 11 | 3 |

| TOTAL | 1,583 | 1,671 |

In 2022, there were 1,444 newly registered charities. Unfortunately, we do not have a count of the number of new registrations in 2021, so there is no comparison with that year.

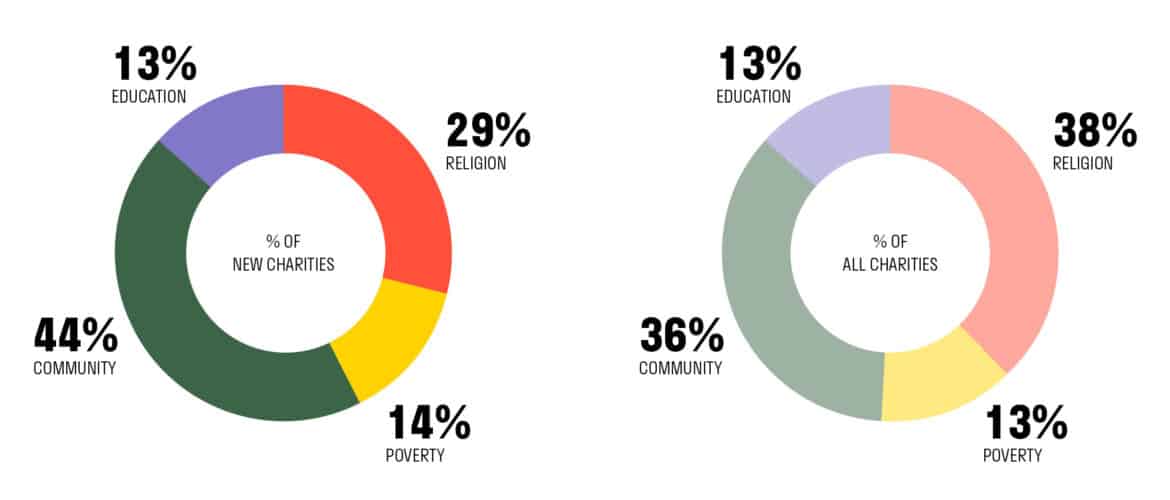

Religion was underrepresented in terms of the number of new charities compared to its share of all charities. The other three heads of charity (there are four categories, or “heads,” of charity in Canada: relief of poverty, advancement of education, advancement of religion, and “other purposes beneficial to the community not falling in the other categories”) were overrepresented, with community benefit taking the prize for most new charities. It had 119 more charities than expected given its share of all charities.

Table 2 – New registrations by head of charity

Overall assessment of 2022

In 2022, we saw the effects of the COVID pandemic and its restrictions on charities. Organizations that were already weak (churches) or that relied on face-to-face contact (churches again, choirs, hospital auxiliaries, arts groups, animal welfare, local heritage or historical societies) were losing their status. It showed up first in voluntary revocations and later, because of the time lag, in failure-to-file revocations.

The pandemic restrictions affected a number of revoked charities. Groups talked about the loss of volunteers, the inability to meet in person, and the lack of opportunity to fundraise through special events, performances, or collecting face-to-face donations. COVID was cited as a key factor for some groups closing down, but for many others it was the last straw. They were weaker groups with no revenue cushion and, many times, a small and tired group of volunteers. Smaller charities are usually staffed by volunteers and deliver their services through volunteers.

Groups mentioned the lack or loss of volunteers as one of the reasons that the organization failed or decided to revoke its status. With COVID restrictions, this showed up especially for those groups that relied on older volunteers. The groups mentioned this in their T3010s or in news articles about their dissolution. A number mentioned the health and safety concerns of volunteers, especially seniors (those who give the most hours).

We are losing hub organizations – those that either gather people together to help out or that organize people to raise funds. Churches, auxiliaries in a healthcare or care-of-seniors setting, certain types of fundraising groups, and convening groups are losing status. Churches were especially stymied by the restrictions on gatherings, and several stated that COVID restrictions exacerbated an already difficult situation (a few old volunteers, no church services, reduced revenue, aging building, increased expenses).

We are losing hub organizations – those that either gather people together to help out or that organize people to raise funds.

Churches not only undertake good deeds in the community; they also provide meeting spaces, infrastructure, and financial support for local initiatives. A number of service clubs failed, as did the foundations they created to raise funds. Hospital auxiliaries and community information centres lost their status. Arts groups, especially choirs, but also any group that needed an audience to pay the bills, lost their status.

The relief of poverty, community benefit, and education heads of charity had a greater share of the revocations than their percentage of all charities would have predicted. Only religion had a lesser share, which hides the fact that Christian organizations are failing (the difference in the number of these charities being made up by other religions).

The year also presented something fairly new for revocations: there were 49 charities that had no T3010s and, therefore, no date of registration because they had not filed their first T3010. In other words, they registered as charities and never got started. Some of these were voluntary revocations, suggesting these groups gave up with the onset of the pandemic. Charities with no date represented 3.1% of all revoked charities. If one takes out the audits and “other” revocations, neither of which involved newly formed charities, then the rate is 3.2%.

There were also a larger-than-average number of audits, at 48. This was increased because 10 of these organizations were run by two groups of people who appear to create charities and then make a habit of engaging in non-charitable activities. It was also increased because some of the audits targeted inactive and financially moribund charities. These 48 audited charities represent 8.5% of all charities revoked after an audit.

While the number of charities has remained relatively stable, some patterns emerge. The table below shows the number of charities in early January of each year from 2021 to 2023. One can see that there are small increases in the number of religious, relief of poverty, and community benefit charities over the three years. Education charities decreased by 61 groups over the same time period. There are indications that trend with education groups will continue.

Table 3 – Percentage of charities by charitable head

| CHARITY HEAD | 2023 * | 2022 * | 2021 * |

| RELIGION | 32,564 – (37.8%) | 32,560 – (37.8%) | 32,500 – (37.9%) |

| POVERTY | 11,400 – (13.3%) | 11,396 – (13.3%) | 11,373 – (13.3%) |

| COMMUNITY | 30,732 – (35.8%) | 30,784 – (35.8%) | 30,584 – (35.6%) |

| EDUCATION | 11,263 – (13.1%) | 11,292 – (13.1%) | 11,324 – (13.2%) |

| TOTAL | 85,959 – (100.0) | 86,032 – (100.0%) | 85,871 – (100.0%) |

That said, there are some other movements hidden in the overall numbers. For example, in 2022 the number of Christian religious charities decreased. As Table 4 shows, there were more revocations than registrations in this area (support of religion includes groups like Presbyterian women, several Catholic orders in Quebec, and similar groups).

Table 4 – Christian registrations and revocations*

| CATEGORY | REGISTRATIONS | REVOCATIONS | VARIANCE |

| CHRISTIANITY | 299 | 364 | (-65) |

| SUPPORT OF RELIGION | 20 | 92 | (-72) |

| TOTAL | 319 | 456 | (-137) |

Table 5 includes information about the community-resource and public-amenities category codes. When combined with Christianity (read churches), we show the number of groups registered in 2022 and the number of those same groups that have been revoked in 2022. This is a blunt instrument, but we appear to be losing our community capacity. The variance is greater than the number 137. Not only have we lost 137 groups that nurture communities over the year; we have lost some groups with long community histories and connections.

Table 5 – Community capacity

| CATEGORY | REGISTERED | REVOKED | VARIANCE |

| COMMUNITY RESOURCE | 77 | 105 | (-28) |

| PUBLIC AMENITIES | 55 | 99 | (-44) |

| CHURCHES | 299 | 364 | (-65) |

| TOTAL | 431 | 568 | (-137) |

Table 6 shows that the number of foundations has increased both in number and in percentage of all charities over the last three years. This growth has been furnished solely by the increase in the number of private foundations, as the number of public foundations has decreased over the same time period.

Table 6 – Public and private foundations 2021–2023

| DESIGNATION | 2023 | 2022 | 2021 |

| PUBLIC FOUNDATIONS | 4,863 – (5.7%) | 4,907 – (5.7%) | 4,944 – (5.8%) |

| PRIVATE FOUNDATIONS | 6,533 – (7.6%) | 6,360 – (7.4%) | 6,102 – (7.1%) |

| TOTAL FOUNDATIONS | 11,396 | 11,267 | 11,046 |

| PERCENTAGE ALL CHARITIES | 13.3% | 13.1% | 12.9% |

This trend is exacerbated when comparing the number of registrations and revocations in 2022 for both types of foundations.

Table 7 – Public and private foundation registration and revocation numbers

| 2022 | REGISTRATION | REVOCATION | VARIANCE |

| PUBLIC FOUNDATION | 65 | 123 | (-58) |

| PRIVATE FOUNDATION | 307 | 153 | 154 |

The decrease in public foundations is due to a number of factors. Public foundations as fundraising vehicles for major groups has been losing favour over the years (foundations created for a specific group, employee trusts, community chests, Comités des oeuvres charitables in Quebec, and service club foundations). The increase in newly registered private foundations is partly due to the number of family foundations (55 in 2022) and a surprising number of religious private foundations (63 in 2022).

Voluntary revocation

Voluntary revocation means that the group is actively relinquishing its charitable status, and it’s easier to find the major suspected cause of the revocation. Some of these groups include reasons for dissolution in their T3010s. If they are churches, local media usually cover the story, including what happens to the building. Table 8 shows the breakdown of voluntary revocations by head of charity.

Table 8 – 2022 voluntary revocation by head of charity

| HEAD | RELIGION | POVERTY | COMMUNITY | EDUCATION | TOTAL |

| NUMBER | 267 | 100 | 282 | 108 | 757 |

| PERCENTAGE | 35.3% | 13.2% | 37.2% | 14.3% | 100.0% |

| % ALL CHARITIES | 37.8% | 13.3% | 35.8% | 13.1% | 100.0% |

Table 9 shows what appears to be the major reason for the revocation, given the evidence. More than half the revocations are due to the group being moribund (low revenues over the last five years) or because of decreasing revenue. In 2022, there was a higher number of groups losing their major funding source, causing the group to fail abruptly.

Table 9 – Reasons for voluntary revocation

| REASON FOR REVOCATION | NUMBER | PERCENTAGE |

| MORIBUND | 272 | 35.9% |

| DECREASING REVENUE | 171 | 22.6% |

| NOT ENOUGH INFORMATION | 96 | 12.7% |

| MERGERS | 74 | 9.8% |

| OTHER | 59 | 7.8% |

| RAN DOWN ASSETS | 57 | 7.5% |

| DEFICIT | 28 | 3.7% |

| TOTAL | 757 | 100.0% |

It should be noted that 164 of the moribund groups (21.7% of the sample) had $0 in revenues for at least three years. The large number in the “other” category comprised a dog’s breakfast that included COVID, loss of volunteers, loss of funding, loss of building, loss of founder, project completed, group closed down (no reasons given), building sold, no members, and fires.

Failure-to-file revocations

The failure-to-file revocations usually mean that the group is not in control of the process. There are larger revenue and expenditure variations and usually less commentary on the T3010s. Religious groups are underrepresented here, as the major denominations have a diocesan or regional office that favours voluntary revocation. That said, a higher-than-average number of rural parishes of major denominations failed to file in 2022.

Table 10 – 2022 failure-to-file revocations by head of charity

| HEAD | RELIGION | POVERTY | COMMUNITY | EDUCATION | TOTAL |

| NUMBER | 211 | 114 | 312 | 130 | 767 |

| PERCENTAGE | 27.5% | 14.9% | 40.7% | 16.9% | 100.0% |

| % ALL CHARITIES | 37.8% | 13.3% | 35.8% | 13.1% | 100.0% |

There is less information about the cause of the revocation with failure to file. This shows up in Table 11, with “not enough information” leading the pack with 236 cases, or 29.6% of the sample. For those who have already looked at the table, the total number of groups is 798 and not the 767 noted in Table 10. The difference is caused by re-registrations and the errata where groups were incorrectly put into a revocation notice.

Table 11 – Possible reason for failure-to-file revocations

| REASON FOR REVOCATION | NUMBER | PERCENTAGE |

| NOT ENOUGH INFORMATION | 236 | 29.6% |

| MORIBUND | 179 | 22.4% |

| STILL ACTIVE | 163 | 20.4% |

| DECREASING REVENUE | 135 | 16.9% |

| DEFICIT | 28 | 3.5% |

| OTHER | 26 | 3.3% |

| RAN DOWN ASSETS | 17 | 2.1% |

| MERGER | 14 | 1.8% |

| TOTAL | 798 | 100.0% |

It should be noted that 95 of the moribund groups (11.9% of the sample) had $0 in revenue for at least three years.

All revocations

Table 12 shows revocations by head of charity. As usual, the revocation of religious groups is less than their share of all charities, which means that the other heads of charity are overrepresented.

Table 12 – All revocations by head of charity

| HEAD | RELIGION | POVERTY | COMMUNITY | EDUCATION | TOTAL |

| VOLUNTARY | 267 | 100 | 282 | 108 | 757 |

| FAILURE TO FILE | 211 | 114 | 312 | 130 | 767 |

| AUDIT | 7 | 7 | 26 | 8 | 48 |

| OTHER | 1 | 2 | 3 | 5 | 11 |

| TOTAL | 486 | 223 | 623 | 251 | 1,583 |

| REVOCATION % | 30.7% | 14.1% | 39.3% | 15.9% | 100.0% |

| % ALL CHARITIES | 37.8% | 13.3% | 35.8% | 13.1% | 100.0% |

The leading indicator for loss of status is that the groups are moribund or have no traction after they register. Four hundred and fifty-one (29.0%) of the 1,555 charities revoked were moribund or could not find any traction for their cause. Of these, 259 groups (16.7% of the 1,555) had $0 in revenue for at least three years or the duration of their existence.

There was not enough information to make a determination of the group’s status in 332 cases (21.4%). A major reason for this was that, aside from limited budget information on the T3010, the group had no public presence. This is especially true for “relief of poverty” groups and private foundations. Which brings up the notion that private foundations should, at the very least, have a website. They receive tax treatment (i.e., public dollars) for their donations, so they should have a public presence. But I digress.

A number of older charities are finding that their revenue-generation models are no longer working.

There were 306 groups with decreasing revenues (19.7%). In many cases, the decline was over a number of years, but with COVID some decreases were precipitous. That said, a number of older charities are finding that their revenue-generation models are no longer working.

One hundred and sixty-three groups were still active (10.5%). This was very common for failure-to-file revocations, but less so for voluntary revocations. A number of the still-active groups did not need the charitable number for their revenue streams.

There were 88 groups (5.7%) involved in mergers. Seventy-four groups (4.8%) ran down their assets, the majority being voluntary revocations where they spent their assets and then closed down.

Newly registered charities by category code

Table 13 shows the number of all the charities under each category code for 2019 and 2022. The fourth column shows the number of new charities created in 2022 under these codes. It is incomplete because the database does not give the number of Canadian amateur athletic associations or national arts-serving organizations (truth be told, the author was too lazy to make a request for the information).

Table 13 – Comparison of newly registered charities 2019 to 2022 by category code

| CATEGORY CODE | ALL 2019 | ALL 2022 | 2022 NEW |

| Agriculture | 84 | 94 | 4 |

| Animal welfare | 1,005 | 1,044 | 34 |

| Arts | 2,623 | 2,692 | 41 |

| Christianity | 26,239 | 26,134 | 299 |

| Community resource | 4,889 | 4,910 | 77 |

| Complementary or alternative health care | 123 | 137 | 8 |

| Core health care | 3,284 | 3,272 | 52 |

| Ecumenical and inter-faith organizations | 0 | 1 | 0 |

| Education in the arts | 1,829 | 1,777 | 16 |

| Educational organizations not elsewhere classified | 1,086 | 1,106 | 46 |

| Environment | 406 | 477 | 31 |

| Foundations | 8,572 | 8,684 | 207 |

| Foundations advancing education | 1,120 | 1,057 | 4 |

| Foundations advancing religions | 366 | 358 | 2 |

| Foundations relieving poverty | 3 | 20 | 5 |

| Health care products | 2 | 13 | 3 |

| Islam | 380 | 470 | 41 |

| Judaism | 358 | 391 | 16 |

| Organizations relieving poverty | 11,367 | 11,380 | 193 |

| Other religions | 971 | 1,057 | 36 |

| Protective health care | 402 | 411 | 12 |

| Public amenities | 6,477 | 6,394 | 55 |

| Relief of the aged | 428 | 461 | 20 |

| Research | 200 | 236 | 17 |

| Support of religion | 4,353 | 4,153 | 20 |

| Support of schools and education | 3,860 | 3,873 | 72 |

| Supportive health care | 2,005 | 2,099 | 79 |

| Teaching institutions | 3,236 | 3,214 | 31 |

| Upholding human rights | 26 | 44 | 5 |

Table 14 shows some of the newly registered 2022 charities with the 2022 revocations under the same category code. In some cases, as with Christianity, the comparison supports the idea that the Christians are taking a beating overall with declining numbers. The same can be said for the two categories of arts groups, with 50 being registered and 82 being revoked. For other category code comparisons, the numbers will show areas of growth or stability.

Table 14 – 2022 registration and revocation numbers by category code

| CATEGORY CODE | 2022 REGISTRATIONS | 2022 REVOCATIONS |

| Animal welfare | 34 | 34 |

| Arts | 34 | 39 |

| Christianity | 299 | 364 |

| Community resource | 77 | 105 |

| Core health care | 52 | 61 |

| Education in the arts | 16 | 43 |

| Education organizations not elsewhere classified | 46 | 27 |

| Environment | 31 | 3 |

| Foundations | 207 | 208 |

| Foundations advancing education | 4 | 32 |

| Foundations advancing religion | 2 | 6 |

| Organizations relieving poverty | 193 | 222 |

| Public amenities | 55 | 99 |

| Support of religion | 20 | 92 |

| Support of schools and education | 72 | 91 |

| Supportive health care | 79 | 55 |

| Teaching institutions | 31 | 51 |

Implications

The revocations are a wake-up call. We should think of the 86,000 charities as a charitable ecosystem. There are those groups that grow and prosper and those that are no longer as relevant in today’s society.

Think of community information networks. The internet has replaced their function (by providing access to information, but not giving a person the wherewithal to navigate the system). Think of churches, where the exodus of congregants in the 1960s and 1970s is being realized now (but with no suitable replacement for the social capital churches provided).

We need to address the loss of community groups that were hubs of volunteering and community action. It’s not only the churches; the signs are there that a number of other major charities are next in line. They are consolidating and creating regional entities, but this is a short-term strategy. They are losing revenue and relevance at best. Their model needs to change or they will be the new canaries in the coal mine.

We need to understand what has happened to volunteer rates across Canada and how to create safe spaces for older volunteers to contribute to their communities. Virtual volunteering can do some things, but all readers know that a Zoom meeting conducts business but does little to strengthen ties. We are social animals.

We need to understand what has happened to volunteer rates across Canada and how to create safe spaces for older volunteers to contribute to their communities.

Organizations need to actively create succession plans or, if that’s too late, decommissioning plans. We will have thousands of church buildings that will be available in downtown cores or in the centre of many rural communities over the next 10 years.

The pandemic has shown that charities need reserve funds. Groups that suffered revenue reductions and a complete halt to their activities survived because they had assets that allowed them to wait until the conditions changed. That said, these reserves should not be used to withhold spending on charitable activities.

Finally, private and public foundations should have websites. This is especially important if the trend toward more private foundations continues. Forgone tax revenue is forgone public money. The least they can do is have a public face.

Don McRae worked with charities and non-profit groups for more than 30 years in the federal government dealing with research, fundraising, and sector-wide issues. Since retiring, he monitors charities to see how the sector is changing. He writes a newsletter that looks specifically at charitable revocations and other major issues. Anyone interested in subscribing can reach him at donmcrae@.bell.net.