The Goods and Services Tax: An Update for Charities and NonProfit Organizations

[For several years the federal government has been preparing the Canadian public for the introduction of a new federal sales tax, now known as the Goods and Services Tax. This article was developed from an article in Network, the newsletter of The Canadian Centre for Philanthropy. It examines what we now know about the proposed tax and how it will affect charities and nonprofits.]

The Technical Paper on Sales Tax Reform released August 8, 1989 contained few surprises. It elaborated the basic approach of Canada’s multi-stage goods and services tax (GST), confirmed details announced previously, and addressed some of the issues of special interest groups including registered charities and nonprofit organizations (NPOs). There is little doubt that registered charities and non-profit organizations will be dramatically affected by the proposed GST.

Registered charities and non-profit organizations should take an active approach to the GST-assessing its impact on their activities, anticipating where problems may arise, and finding ways to alleviate them while there is still time for change. (The government scheduled hearings to consult with industry, special interest groups, and others this fall.)

Basic Approach

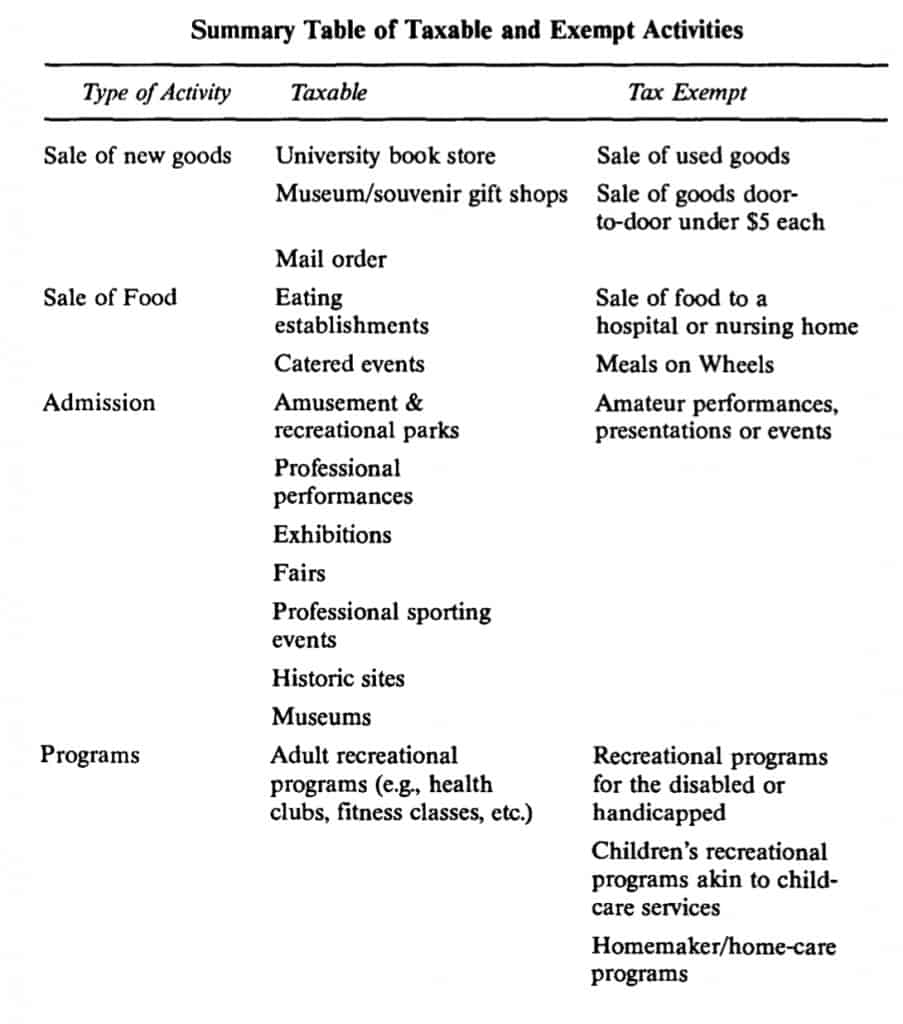

Goods and services supplied by a charitable or non-profit organization in Canada will be accorded either “tax-exempt” or “taxable” status under the GST. For charities, only specified activities carried out in competition with commercial businesses will be taxed. However, given the diverse nature of the activities of non-profit organizations, their goods and services (“supplies”) offered in the course of a commercial activity will be taxed unless a specific exemption is available. It is the classification of “tax exempt” or “taxable” that will determine whether or not the GST must be collected on supplies and whether or not the GST may be recovered on purchases. Many registered charities and NPOs will find that they provide both tax-exempt and taxable supplies and, accordingly, are subject to both sets of rules.

Tax-exempt status will be granted to a wide range of research, counselling, educational, and rehabilitative services as well as sales of used or donated goods; the supply of prepared meals to hospitals, nursing homes or organizations such as Meals on Wheels; certain recreational programs; street and door-to-door sales of items selling for under five dollars each; admission to amateur performances, presentations or events; subsidized homemaker or home-care services; certain membership, trade union and professional dues; non-commercial gambling activities; and supplies of non-residential real property. For these goods and services, there will be no need to collect GST.

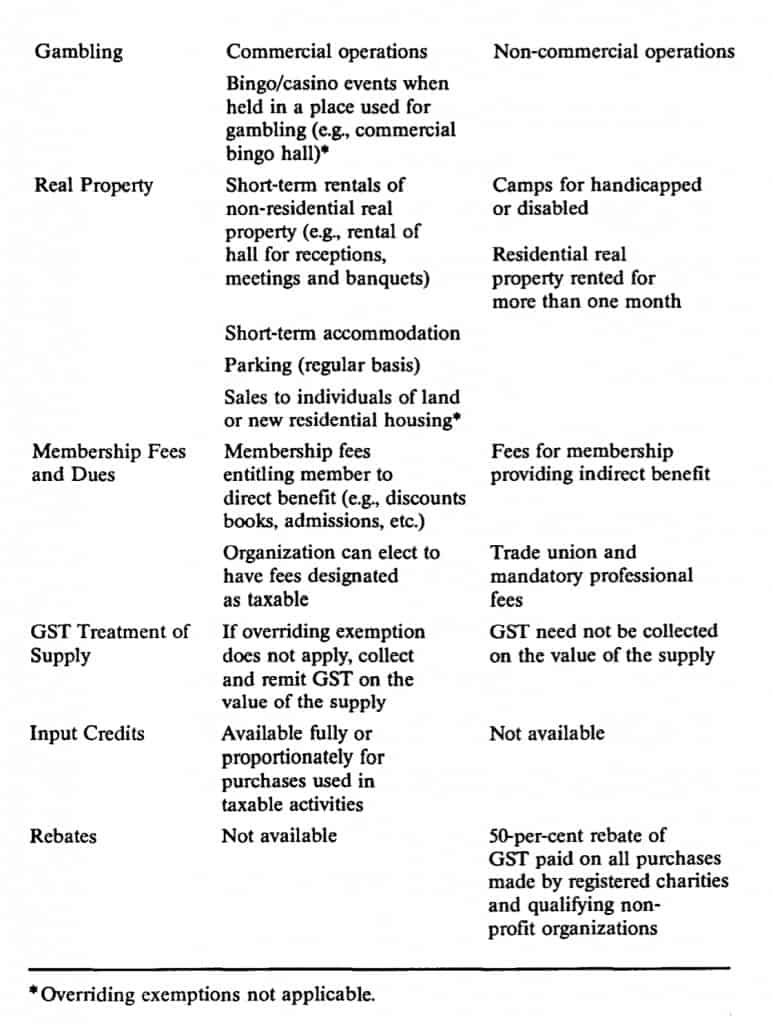

Supplies furnished in competition with commercial operators have been designated as taxable activities. It is in respect of these activities that a registered charity or non-profit organization must register and account for the GST on the value of the taxable supply. An input credit will be permitted in respect of purchases used in taxable activities.

In assessing taxable activities of registered charities there are, however, four overriding exemptions to consider: the small traders’ exemption, the volunteers’ exemption, the nominal consideration exemption, and the relief of poverty, suffering or distress exemption. Where any one of these exemptions applies, the activity will be tax-exempt and there will be no need to collect GST on the value of the supply.

For purposes of the small traders’ exemption, sales are not to exceed $30,000. A charity that is organized by division or branch may apply the $30,000 threshold to each division or branch. Under the volunteers’ exemption, an activity is exempt if substantially all of the administration and operation of the activity are undertaken by volunteers. The volunteers’ exemption is not to apply to commercial gambling activities or sales of real property; however, it could apply to weddings catered by church volunteers. Supplies by charities will also be exempt if the consideration received does not, or cannot, reasonably exceed the direct cost of making the supply. Supplies of food, drink and accommodation also will be exempt where they are provided in the course of relieving poverty, suffering or distress. The following activities of a registered charity will be taxed unless an overriding exemption can apply: sales of new goods, prepared food or beverages; admission charges to places of amusement or recreation; membership fees or charges for certain recreational activities; gambling activities; parking and rental of some commercial property.

For non-profit organizations, all commercial activities, such as those described above, are taxed unless one of the 12 overriding exemptions applies: (i) overriding small traders’ and nominal-consideration exemptions; (ii) relief of poverty, suffering or distress exemption; (iii) volunteer, street and door-to-door sales of items priced under five dollars; (iv) admission to amateur performances; (v) children’s recreational programs; (vi) subsidized homemaker/home-care programs; (vii) Meals on Wheels and similar programs; (viii) membership dues; (ix) trade union and professional dues; (x) non-commercial gambling; (xi) supplies of non-residential real property; and (xii) lodging supplies at recreational camps for the disadvantaged. Unless the activity is covered by one of the above, the non-profit organization is obliged to collect GST.

Input Credits In respect of tax-exempt supplies there will be no requirement to register and collect GST on sales of goods and services, nor will there be a GST input credit for tax paid on purchases of goods and setVices used in exempt activities; however, a 50 per cent rebate of GST paid on purchases will be available to certain organizations. The intent of the rebate is to eliminate any added tax burden created by GST.

In regard to taxable supplies, registered charities and nonprofit organizations will be treated like all others. First they must register and then remit GST on the value of taxable supplies net of GST paid on purchases used in taxable activities. There is to be no requirement to match purchases and sales.

Apportionment rules will apply where an input is used on providing both taxable and tax-exempt supplies. Special rules will also apply to capital and real property, i.e., the property must be used primarily in taxable activities to qualify for an input tax credit. Change-of-use rules, both in the case of real property and capital property, are to apply.

Rebate of GST All registered charities and registered Canadian amateur athletic associations will be eligible for the 50 per cent rebate of GST paid on purchases of goods and services used to provide tax-exempt supplies. Special provisions will be introduced to ensure that all non-profit nursing homes qualify for the rebate.

Registered charities that are organized into multiple divisions will be permitted to claim the 50 per cent rebate in respect of all divisions. Claims for rebate may be made with the regular GST return or on an annual or quarterly basis. There is to be further consultation with the sector to determine the most efficient reporting system.

The 50 per cent GST rebate on purchases made by non-profit organizations will be more restrictive. Only those organizations which receive 50 per cent or more of their revenue from federal, provincial, or municipal grants will be eligible. “Revenue” is to include all sales and donations as well as loans from non-arm’s-length parties. Government funding is to be limited to direct financial assistance; gifts-in-kind, low-interest loans, loan guarantees or other indirect non-financial assistance will not be included. It is intended that the non-profit organization must support such claims for rebate, i.e., non-profit organizations will be required to file for refunds on an annual basis with evidence supporting the fact that their government funding exceeds 50 per cent of their revenue.

Administrative Procedures There is little doubt that the effect of the GST on the activities of charities and non-profit organizations will be profound. The self-assessment of GST on imported services (e.g., from architects, consultants, etc.) may present some difficulties, as will determining which activities are tax-exempt and which are taxable and whether any of the overriding exemptions apply. Complications will also arise in apportioning input credits and tracking property which has undergone a change of use. The internal accounting systems for handling the GST will be complex. New procedures will be required to identify the tax status of existing and new supplies offered; to evaluate whether any overriding exemptions apply; to account for, and remit, GST on taxable supplies; to apportion applicable input tax credits; to obtain rebates of GST paid on inputs used in “tax-exempt activities; and to monitor, recover, and remit GST in respect of goods subject to the change-of-use rules.

Points of Interest Non-profit organizations will have to consider the cash-flow implications of the proposed rebate system, as they will only be permitted to claim annually. Sophisticated reporting systems will also be required to verify that a non-profit organization is assisted substantially by government funding and, to ensure that they qualify, non-profit organizations may well be discouraged from carrying out fund-raising events if such events threaten to jeopardize their eligibility for the rebate.

Registered charities and non-profit organizations may benefit under the GST system on many taxable activities, particularly where the expenditures exceed the revenue earned. This may be the case for certain fairs, exhibitions, historic sites or adult recreational programs. The benefit comes because the credit on the purchases will be greater than the tax to be remitted from sales or admissions.

Certain non-profit organizations may also benefit from electing to have their membership fees regarded as taxable. In these cases, the non-profit organization will be permitted to recover GST paid on purchases used in membership activities. This approach would be beneficial where the fee is paid by a registered business.

HOLLY MacLACHLAN-TOONDERS

Peat Marwick Thome, Toronto