What is social innovation?

most simply, social innovation is about new ideas that work to address pressing unmet needs. Poverty, homelessness, and violence are examples of social problems that still need dedicated solution-seeking space. Social innovation addresses these challenges by applying new learning and strategies to solve these problems. For social innovations to be successful and have durability, the innovation should have a measurable impact on the broader social, political, and economic context that created the problem in the first place.

Social innovation generation’s (SiG) working definition of social innovation

SiG is a collaborative initiative seeking to address Canada’s social and ecological challenges through training and advisory services for social entrepreneurs, supporting enabling policy for social innovation, conducting research, and inspiring social action through public engagement.

Social innovation is an initiative, product, process, or program that profoundly changes the basic routines, resource, and authority flows or beliefs of any social system (e.g., individuals, organizations, neighbourhoods, communities, whole societies). The capacity of any society to create a steady flow of social innovations, particularly those that re-engage vulnerable populations, is an important contributor to overall social and ecological resilience. For an extensive analysis of the process of social innovation, download Frances Westley’s Making A Difference; Strategies for Scaling Social Innovation for Greater Impact: http://sig.uwaterloo.ca/highlight/making-a-difference-strategiesfor-scaling-innovation-for-greater-impact%20.

Examples of social innovation

Microfinance is the provision of financial services to low-income clients, including consumers and the self-employed, who traditionally lack access to banking and related services. More broadly, microfinance is a movement whose objective is a world in which as many poor and near-poor households as possible have permanent access to an appropriate range of high quality financial services, including not just credit but also savings, insurance, and fund transfers.2

Those who promote microfinance generally believe that such access will help poor people out of poverty.

Three decades after Muhammed Yunus founded Grameen Bank, a bank that provides credit without any collateral to the poorest of the poor in rural Bangladesh, microfinance institutions (MFIs) serve about 160 million people in developing countries. As of June 30, 2009, BRAC, one of Bangladesh’s largest MFIs, had a loan portfolio of about US$810 million to 194,000 borrowers and member savings of US$953 million from 536,000 savers.3 Still, the majority of people in developing countries are “unbanked”– they have no access to formal financial services.

Peacekeeping is defined by the United Nations as “a unique and dynamic instrument developed by the Organization as a way to help countries torn by conflict create the conditions for lasting peace.”4

Peacekeepers monitor and observe peace processes in post-conflict areas and assist ex-combatants in implementing the peace agreements they may have signed. Such assistance comes in many forms, including confidence-building measures, powersharing arrangements, electoral support, strengthening the rule of law, and economic and social development. Accordingly, UN peacekeepers (often referred to as Blue Beret because of their light blue berets or helmets) can include soldiers, civilian police officers, and other civilian personnel.

Fair trade is an organized social movement and market-based approach that aims to help producers in developing countries and promotes sustainability. The movement advocates the payment of a higher price to producers, as well as social and environmental standards. It focuses in particular on exports from developing countries to developed countries, most notably handicrafts, coffee, cocoa, sugar, tea, bananas, honey, cotton, wine, fresh fruit, chocolate, and flowers.5

Fair trade’s strategic intent is to work with marginalized producers and workers in order to help them move towards economic self-sufficiency and stability. It also aims to allow them to become greater stakeholders in their own organizations, as well as play a wider role in international trade.

Other definitions of social innovation

“Our business is social innovation—finding and developing new and better ways of meeting pressing unmet needs.”6

– The Young Foundation

Study On Social Innovation, A Paper By Six And The Young Foundation For The Bureau Of European Policy Advisors

“Social innovations are innovations that are both social in their ends and in their means. Specifically, we define social innovations as new ideas (products, services, and models) that simultaneously meet social needs (more effectively than alternatives) and create new social relationships or collaborations. In other words they are innovations that are both good for society and enhance society’s capacity to act.”7

Stanford Social Innovation Review

“Social innovation is defined as a novel solution to a social problem that is more effective, efficient, sustainable, or just than existing solutions and for which the value created accrues primarily to society as a whole rather than private individuals.”8

Centre For Social Innovation: Toronto

“Social innovation refers to new ideas that resolve existing social, cultural, economic, and environmental challenges for the benefit of people and planet. A true social innovation is systems changing—it permanently alters the perceptions, behaviors, and structures that previously gave rise to these challenges.”9

Centre For Social Innovation: New Zealand

“A simple definition is ‘the design and implementation of better ways of meeting social needs.’ When we talk about ‘better ways,’ we mean transformational improvements, not incremental gains.”10

What is the adaptive cycle?

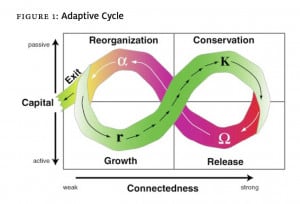

The adaptive cycle is a theory of the relationship of transformation to resilience in complex systems.11 It is represented in Figure 1, which provides a heuristic for understanding the dynamics that drive both continuity and change and is best understood as a diagram that charts this dynamic at a single scale or in a single system. It could represent either the evolution of a single innovation from idea to maturity or the organization that designs and delivers that innovation.

It is important to the idea of resilience, i.e., the capacity to adapt to shocks and changes while preserving sufficient coherence to maintain identity, that the four phases are not represented as linear but rather as an infinity loop. Once an idea or organization reaches the maturity (conservation) stage, it needs to release resources for novelty or change and re-engage in exploration in order to retain its resilience. The release and reorganization phase is often termed the “back loop,” where non-routine change is introduced. The exploitation and conservation phases are often termed the “front loop,” where change is slow, incremental, and more deliberate.

figure 1: Adaptive Cycle

What is resilience?

From a social innovation perspective, resilience, like sustainability, is linked to the capacity to balance a healthy environment with a vibrant economy and social justice. It suggests, however, a focus on a continuously changing balance rather than a stable state. Systems that are better able to introduce novelty (e.g., new products, services, ideas, etc.) are more resilient and, in turn, better able to withstand and adapt to large shocks. (For a deeper understanding see The Resilience Alliance website: http://www.resalliance.org/ 576.php .)

What is vulnerability?

From a social innovation perspective, vulnerability is a measure of those cultures, social groups, and ideas that are disenfranchised from resources and threatened with extinction. Much of social innovation addresses their re-engagement: reintegrating the poor, the homeless, the mentally ill, and the lonely into a community. Social innovation not only serves vulnerable populations, however, but is also served by them in turn. They represent a key source of diversity that could be lost and are an important resource for social innovation. (Re)engaging vulnerable populations increases the diversity of the whole system.

What is social entrepreneurship?

Social entrepreneurship is the work of a social entrepreneur. Change-maker organization Ashoka writes that the most effective way to promote positive social change is to invest in social entrepreneurs with innovative solutions that are sustainable and replicable, both nationally and globally.12

Social entrepreneurship is the practice of responding to market failures with transformative and financially sustainable innovations aimed at solving social problems.

Who is a social entrepreneur?

A social entrepreneur is someone who recognizes a social problem and uses entrepreneurial principles to organize, create, and manage a venture to make social change. Whereas a business entrepreneur typically measures performance in profit and return, a social entrepreneur assesses success in terms of the impact s/he has on society as well as in profit and return. Although social entrepreneurs often work through nonprofits and citizen groups, many work in the private and governmental sectors.

Bill Drayton, founder of Ashoka, says, “Social entrepreneurs are not content just to give a fish or teach how to fish. They will not rest until they have revolutionized the fishing industry.” Daniel Bornstein (2004), in his book How to Change the World: Social Entrepreneurs and the Power of New Ideas, writes

Social entrepreneurs identify resources where people only see problems. They view the villagers as the solution, not the passive beneficiary. They begin with the assumption of competence and unleash resources in the communities they’re serving.13

On its website, the Skoll Foundation, an organization committed to large-scale change through investment in and celebration of social entrepreneurs and other innovators, notes:

Entrepreneurs are essential drivers of innovation and progress. In the business world, they act as engines of growth, harnessing opportunity and innovation to fuel economic advancement. Social entrepreneurs similarly tap inspiration and creativity, courage and fortitude, to seize opportunities that challenge and forever change inequitable systems. The social entrepreneur aims for value in the form of transformational change that will benefit disadvantaged communities and, ultimately, society at large. Social entrepreneurs pioneer innovative and systemic approaches for meeting the needs of the marginalized, the disadvantaged and the disenfranchised—populations that lack the financial means or political clout to achieve lasting benefit on their own.14

What Is Intrapreneurship?

Intrapreneurship is the practice of a management style that integrates risk-taking and innovation approaches, as well as the reward and motivational techniques that are more traditionally thought of as being the province of entrepreneurship. Intrapreneurship refers to employee initiatives in organizations to undertake something new without being asked to do so. Intrapreneurship is an example of motivation through job design.

Who Is A Social Intrapreneur?

A social intrapreneur is

1. Someone who works inside major corporations or organizations to develop and promote practical solutions to social or environmental challenges where progress is currently stalled by market failures.

2. Someone who applies the principles of social entrepreneurship inside a major organization.

3. One characterized by an “insider-outsider” mindset and approach.15

The intrapreneur focuses on innovation and creativity, transforming a dream or an idea into a profitable/beneficial venture by operating within the organizational environment. Thus, social intrapreneurs are inside entrepreneurs who follow the goal of the organization.

What Is Social Enterprise?

A social enterprise is defined by its purpose: its social and/or environmental outcomes and its mission inform the structure and governance of the enterprise. Within the definition of social enterprise, SiG@MaRS, a partner in the SiG collaborative providing advisory support, events, and resources for social entrepreneurs, uses two distinct categories: social enterprise and social purpose business.

Social enterprise

A social enterprise is a business operation commonly run by a charity or not-for-profit organization. Revenue raised by the business operation is reinvested into the charity or not-for-profit to support the programs and operations of the organization.

In addition to revenue generation, a social enterprise will often engage the services of the clients that the organization is supporting. The skills that the clients develop in sales, business operations, and administration are crucial to accessing job opportunities outside the enterprise.

Social enterprise encourages greater resiliency and independence within the nonprof—it sector by helping organizations to stabilize and diversify their funding base while enhancing their programs or services. The result: stronger nonprofits and healthier communities.16

Social purpose business

A social purpose business is a profit-making enterprise that has a positive social and/or environmental impact. A term often used to describe the social purpose business model is blended value. The blend is the combination of profit, social, and environmental return on investment. This business model is also often referred to as having a double or triple bottom line.

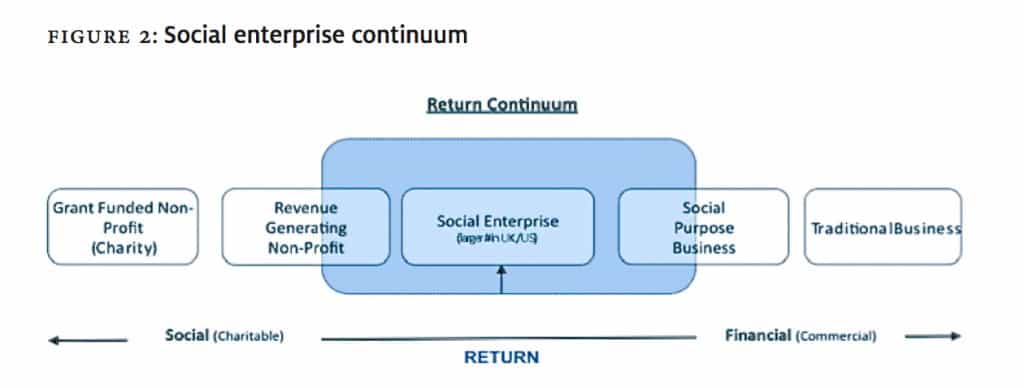

Social enterprise continuum

The broad social enterprise space can be seen on a continuum as demonstrated in Figure 2. This continuum consists of:

• innovative enterprises that combine a strong social purpose with sound business principles;

• traditional businesses that are primarily driven by the need to maximize profit and/or charities that are primarily driven to serve a social need; and

• for-profit and nonprofit entities as long as they boast a core social mission.

figure 2: Social enterprise continuum

For more information on the social enterprise continuum, see the Social Venture Finance White Paper on the MaRS website: http://www.marsdd.com/buzz/reports/socialventure finance .

Who Is The Not-for-profit Sector?

In Canada the not-for-profit section consists of:

• 161,000 registered charities and not-for-profit organizations,

• 2 million employees, and

• represents $79.1B or 7.8% of GDP.

For further reading on the sector, visit the Imagine Canada website: http://www.imagine canada.ca/node/32 .

What Is The Enabling Environment?

The enabling environment is a term used to describe a context that allows for a broad range of programs, services, investment, and support that cultivate and encourage social innovation. On a practical level, this can mean changing policy, creating tax incentives, or opening up capital markets to social innovation initiatives.

Who Are The Enablers Of The Public Benefit Universe?

Enablers are networks, organizations, individuals, and institutions that have spurred the growth of Canada’s public benefit universe. They may be government departments, foundations, corporations, nonprofit organizations, or social capital investors. A thriving social economy that includes for-profit and nonprofit blended value enterprises needs to work together with government, community programs, academic institutions, and investors to open, operate, and scale revenue generating enterprises that provide a social and/or environmental benefit as part of their core operations. (For more information see http://socialfinance.ca ‘s Enablers Hub: http://socialfinance.ca/index.php/enablers .) More broadly, enablers are individuals, organizations, and academic or philanthropic institutions that enable an idea, enterprise, or organization to succeed.

The definition of enable is 1a. To supply with the means, knowledge, or opportunity. 1b. To make feasible or possible.

2. To give legal power, capacity, or sanction.

3. To make operational; activate.17

Enablers may also be referred to as capacity builders or intermediaries. An intermediary is a third party who facilitates a deal between two other parties. Although the definitions are different, they are often used interchangeably, albeit inappropriately.

What Is Capacity Building?

Capacity building often refers to assistance provided to entities, usually developing country societies, that have a need to develop a certain skill or competence, or for general upgrading of performance ability. Most capacity is built by societies themselves, sometimes in the public sector, sometimes in the non-governmental sector, and sometimes in the private sector.

Many international organizations, often of the UN family, have provided capacity building as a part of their programs of technical cooperation with their member countries. Bilaterally funded entities and private sector consulting firms or non-governmental organizations (NGOs) have also offered capacity-building services. Sometimes NGOs in developing countries are themselves recipients of capacity building.

Capacity building is, however, not limited to international aid work. More recently, governments are using capacity building to transform community and industry approaches to social and environmental problems.

What Is Social Finance?

Descriptions of social finance are varied and sometimes compete with each other. For the purposes of consistency, this primer uses the work previously done by http://socialfinance.ca , with whom we closely work. Social finance is an approach to managing money that delivers a social and/or environmental dividend and an economic return.

Traditionally, nonprofit organizations dominated the social sector and were financed by government grants and philanthropy. There was no financial return and the measurement of social return to the community was loose and inconsistent. Today we are seeing a different approach to social investment, largely led by successful investors with experience in finance, technology, and start-up operations. They are working at new funds, developing new financial tools, and looking for new kinds of deals.

These investors are interested in both nonprofit and for-profit social and environmental enterprises, and have invested in the following business sectors: affordable housing, clean technology and green energy, community development, education, fair trade, health and home care, microfinance, and sustainable agriculture.

In an attempt to enhance capital flowing to this sector, the new investor class is developing innovative financing instruments and structures that recognize social, environmental, and financial returns (“blended value investments”).

Since these blended value enterprises (BVEs) are rooted in the discipline of operating a sustainable business model, some of the invested capital can be reused. As a result, the capital available for social investment is considerably enhanced and a cycle of success is created that further drives social and environmental impact. (For further reading on this topic, visit http://socialfinance.ca .)

What Is Social Venture Capital?

Social venture capital is a form of venture capital investing that provides capital to businesses and social enterprises that are deemed socially and environmentally responsible. These investments are intended to provide attractive returns for investors and marketbased solutions to social and environmental issues.

What Are Social Capital Markets?

A capital market is a market for securities (debt or equity) where business enterprises (companies) and governments can raise long-term funds. The capital market includes the stock market (equity securities) and the bond market (debt).

A social capital market is a new concept that is gathering momentum globally. The social capital market would function in the same way as a traditional capital market; however, the capital would be traded and/or invested solely in social enterprises or blended value enterprises.

For a more in-depth analysis, watch Katherine Fulton’s video presentation at http://www. linktv.org/video/3142/katherine-fulton-keynote-presentation . Delivered at SOCAP08, Fulton, president of the Monitor Institute, takes a look ahead at the future of the social capital markets.

What Is A Program-related Investment?

Program-related investments (PRIs) are investments made by foundations to support charitable activities that involve the potential return of capital within an established time frame. PRIs include financing methods commonly associated with banks or other private investors, such as loans, loan guarantees, linked deposits, and even equity investments in charitable organizations or in commercial ventures for charitable purposes. In Canada, PRIs must be implemented under the terms of Canadian charity law and within the requirements of the Income Tax Act. Canadian foundations’ PRIs are currently restricted to registered charities.

What Is Impact Investing?

According to the Monitor Institute, impact investing is actively placing capital in businesses and funds that generate social and/or environmental good and at least a nominal return to the investor. The Monitor Institute report is available on the Global Impact Investing website at http://www.globalimpactinvestingnetwork.org/cgi-bin/iowa/resourc—es/research/6.html . According to the Global Impact Investing Network (GIIN), impact investments aim to solve social or environmental challenges while generating financial profit. Impact investing includes investments that range from producing a return of principal capital to offering market-rate or even market-beating financial returns.

Although impact investing could be categorized as a type of “socially responsible investing,” it contrasts with negative screening, which focuses primarily on avoiding investments in “bad” or “harmful” companies. Impact investors actively seek to place capital in businesses and funds that can harness the positive power of enterprise.

In an article in Forbes Magazine, Jed Emerson described impact investing as that catego—ry of investment that is viewed as “sustainable,” generating financial returns by integrating consideration of social and environmental factors into the investment strategy.18

What Is Socially Responsible Investing?

According to the Social Investment Organization, socially responsible investing is the integration of social responsibility and environmental sustainability with investment. It includes the financial decision-making processes that are part of a prudent investment management approach and the selection and management of investments based on issues of sustainability or social responsibility.19

What Is The Blended Value Proposition?

According to Jed Emerson, The blended value proposition (BVP) states that instead of operating in terms of nonprofit and for-profit constructs there is a single, blended value proposition for both for-profit and nonprofit firms, as well as for philanthropy and market-rate capital investments, with multiple value components and generated returns.

Within a BVP framework, value is understood to consist not simply of economic or extra-economic elements (such as social or environmental factors), but rather as a natural blend of economic, social, and environmental elements, which together generate multiple returns.20

What Is Triple Bottom Line?

According to Mercer, the triple bottom line is a holistic approach to measuring a compa—ny’s performance on environmental, social, and economic issues. It focuses companies not just on the economic value they add but also on the environmental and social value they add or destroy.21

What Is The Global Impact Investing Network (GIIN)?

The Global Impact Investing Network (GIIN) is a global group of investors and intermediaries who put capital to work at scale to generate social and environmental value in addition to financial return. The GIIN is a platform for leaders of the emerging impact investing industry to incubate the activities and institutions that can accelerate the impact investing industry’s maturation, and ultimately drive substantial capital to solve previously intractable social and environmental challenges.22

What Is Social Impact Measurement?

Social impact measurement is the measurement and assessment of the effect of implemented activities on the social fabric of communities and the quality of life of individuals and families within communities. This can be used to assess the effectiveness of an investment against its aims and objectives and as a tool for implementing organizations to review, assess and adapt their models and programs according to feedback and lessons learnt.

What Are The Impact Reporting And Investment Standards (IRIS)?

The Rockefeller Foundation, Acumen Fund, and B Lab initiated the Impact Reporting and Investment Standards (IRIS) effort to create a common framework for defining, tracking, and reporting the performance of impact capital. Significant progress has already been made in sectors like microfinance measures and data aggregation, and rating tools have been developed.

The IRIS initiative will build on these sector-specific efforts to create a common language that will allow comparison and communication across the breadth of organizations that have social or environmental impact as a primary driver. IRIS is an essential element in the evolution and maturity of the social and environmental impact investing market. A common language for measuring and reporting performance forms a basis for enabling infrastructure and leads to transparency and credibility. (Further reading on the IRIS standards is available at http://iris-standards.org .)

What Is Corporate Social Responsibility?

Corporate social responsibility (CSR) is the idea that businesses should not function amorally but instead should contribute to the welfare of their communities.

Other definitions of CSR include the following:

• CSR is about how companies manage the business processes to produce an overall positive impact on society.23

• Corporate social responsibility is the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large.24

• Corporate social responsibility is a concept whereby companies decide voluntarily to contribute to a better society and a cleaner environment. CSR is a concept whereby companies integrate social and environmental concerns in their business operations and in their interaction with their stakeholders on a voluntary basis.25

What Is Global Sustainable Impact Investing?

A rapidly growing supply of capital is seeking placement in impact investments across geographies, sectors, and asset classes, with a wide range of return expectations. The glue that binds those who operate in the impact investing industry is the shared conviction that creative investments can play a crucial part in addressing social and environmental challenges. This investment interest is sparking the emergence of a new industry that operates in the largely uncharted area between philanthropy and a singular focus on profit-maximization.26

The Global Social Investment Exchange (GSIX) initiative, lead by GreaterGood South Africa and SASIX, emerged out of the experience, learnings, and success of the SASIX initiative coupled by numerous requests for support around its replication in other developing countries and strengthened by extensive global research over the past decade.

The concept of a global social investment/stock exchange and a related governing Federation of Social Investment/Stock Exchanges was elaborated during a meeting in early 2009 organized and hosted by GreaterGood South Africa Trust with the support of The

Rockefeller Foundation and its Bellagio Conference Centre.

A preparatory concept paper outlined a framework for a single global exchange that could more efficiently move capital, meet a set of high and comparable standards, demystify the opportunities to attract more investors and capital sources, and better connect developing world enterprises to markets and capital. It considered the need for the existence of a single standard or, if there were to be multiple social exchanges and multiple standards, consideration of the nature and role that a federation structure and inter-relationship, similar to that provided by the World Federation of Exchanges, could bring. For more information visit the GSIX website at www.gsix.com .

Notes

1. Primer on Social Innovation: A Compendium of Definitions Developed by Organizations Around the World was first published at www.sigeneration.ca/primer .

This primer is a living document. Collaboration is encouraged. To contribute further definitions or suggest changes, send Geraldine an email: geraldine@sigeneration.ca .

2. Robert Peck Christen, Richard Rosenberg & Veena Jayadeva. (2004, July). Financial institutions with a double-bottom line: implications for the future of microfinance. CGAP Occasional Paper, pp. 2-3.

3. The World Bank, Microfinance at a glance: http://go.worldbank.org/XZS4R3M2S0 [April, 2010].

4. United Nations Peace and Security Section of the Department of Public Information in cooperation with the Public Affairs Unit of the Department of Peacekeeping Operations and the Department of Field Support, Peacekeeping, (2010).

URL: http://www.un.org/en/peacekeeping .

5. Brough, David. (2008, January 10). Briton finds ethical jewellery good as gold. Reuters Canada.

6. Young Foundation. (2005-2010). URL: http://www.youngfoundation.org .

7. The Social Innovation eXchange (SIX) and the Young Foundation for the Bureau of

European Policy Advisors. (2010). Study on Social Innovation Report, pp. 17-18.

8. James A. Phills Jr., Kriss Deiglmeier, & Dale T. Miller. (2008, Fall). Rediscovering

Social Innovation. Social Innovation Review.

9. Centre for Social Innovation, Toronto.

URL: http://socialinnovation.ca/about/social-innovation .

10. Centre for Social Innovation, New Zealand. URL: http://www.nzcsi.org .

11. Peterson, G. (2009). Ten conclusions from the resilience project. URL: http:// www.geog.mcgill.ca/faculty/peterson/susfut/rNetFindings.html .

12. Noga Leviner, Leslie R. Crutchfield, & Diana Wells. (2007). Understanding the impact of social entrepreneurs: Ashoka’s answer to the challenge of measuring effectiveness. In Rachel Mosher-Williams (Ed.)., Research on Social Entrepreneurship: Understanding and Contributing to an Emerging Field. URL: http://www.ashoka.org/ printroom . [October, 2010].

13. David Bornstein. (2004). How to change the world. Oxford University Press.

14. Roger L. Martin & Sally Osberg. (2007, Spring). Social Entrepreneurship: The case for definition, Stanford Social Innovation Review.

15. The Skoll Foundation, Allianz, IDEO, & Sustainability (2008, April). The social intrapreneur: A field guide for corporate changemakers. SustainAbility Ltd.

16. For more information see: URL: http://www.enterprisingnonprofits.ca/about_

17. The American Heritage Dictionary, 4th Edition. (2000).

18. Emerson, Jed. (2009, September 29). Steady returns with social impact. Forbes.com.

19. Further reading: URL: http://www.socialinvestment.ca/French/SRIdefinition.htm .

20.Further reading: URL: http://www.blendedvalue.org .

21. Further reading: URL: http://www.mercer.com/ridictionary .

22. Reference: http://www.globalimpactinvestingnetwork.org/cgi-bin/iowa/aboutus/index.html .

23. Mallen Baker, Corporate Social Responsibility: What does it mean? http://www.mallenbaker.net/csr/index.php

24. Lord Holme & Richard Watts. (2000, January 1). Making Good Business Sense, The World Business Council for Sustainable Development.

25. Commission of the European Communities. (2006, March). Implementing the Partnership for Growth and Jobs: Making Europe a pole of excellence on corporate social responsibility. Brussels.

26. Global Impact Investing Network. (2009). What is Impact Investing? URL: http://www.globalimpactinvestingnetwork.org/cgi-bin/iowa/investing/index.html .

Geraldine Cahill is Communications Coordinator at Social Innovation Generation. Email: geraldine@ sigeneration.ca .